Conducted in August, the latest survey showed a market continuing to recover from lockdown but still confident of further recovery.

The most recent data show sales expectations and confidence varying by merchant size, region and type. Merchants, however, are cautious — the prospect of mass unemployment when Government support is withdrawn and the consequences for the economy are significant concerns.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 3rd and 7th August. Because of the unusual circumstances, we continued with the extra questions we added in April to get a better picture of the market through the lockdown.

Impact of COVID-19

Merchants are getting back to normal, with no branch closures or non-responses in this month’s survey. All merchants interviewed have implemented new safety measures in accordance with new government guidelines. One of the main restrictions in place is limiting people in the branch or yard.

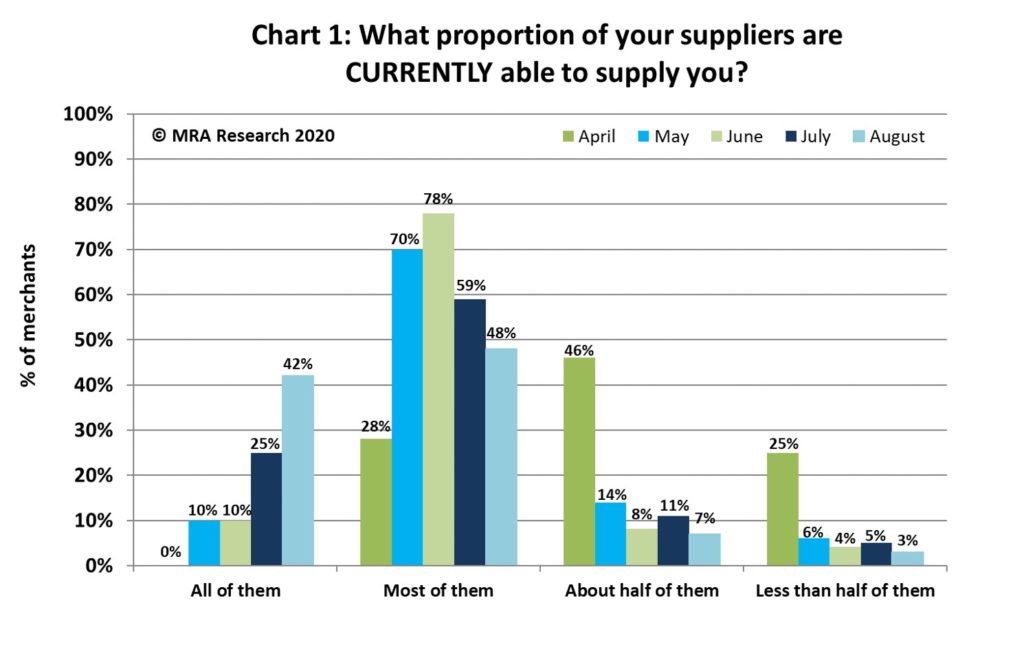

While availability of supply continued to improve in August — see Chart 1 — extended lead times remain an issue.

Sales expectations

Sales expectations

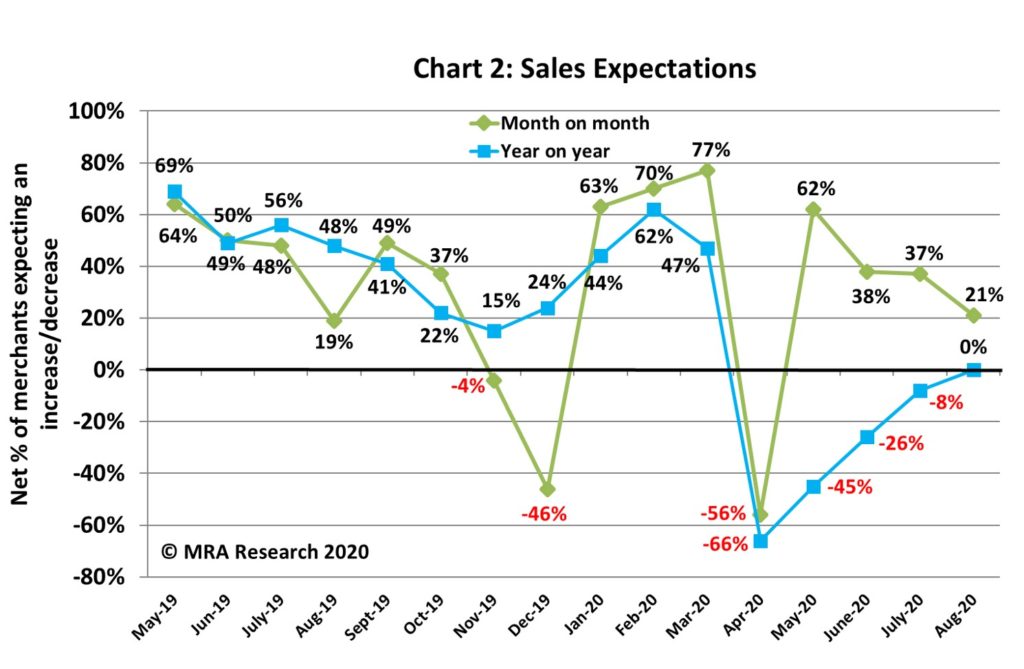

A net 21% of merchants expected sales to improve in August compared to July — see Chart 2. More small (net +29%) and mid-sized branches (+20%) forecasted better month-on-month sales than large outlets (+6%).

Merchants in the Midlands (+46%) and Scotland (+38%) were confident of better sales, but only 13% in the South expected growth. In the North, a net -5% of merchants expected sales to drop over the period.

Continuing the recovery, on balance, merchants now expect no change year-on-year — also Chart 2. While a net +17% of large outlets expect sales to improve, small (-5%) and mid-sized branches (-3%) forecast a drop.

Merchants’ outlook for quarter-on-quarter sales softens in August with a net +32% forecasting an improvement over the period. This compares with 52% in the previous month’s survey. Expectations are strongest among merchants in Scotland (net +44%) and among Nationals (+51%).

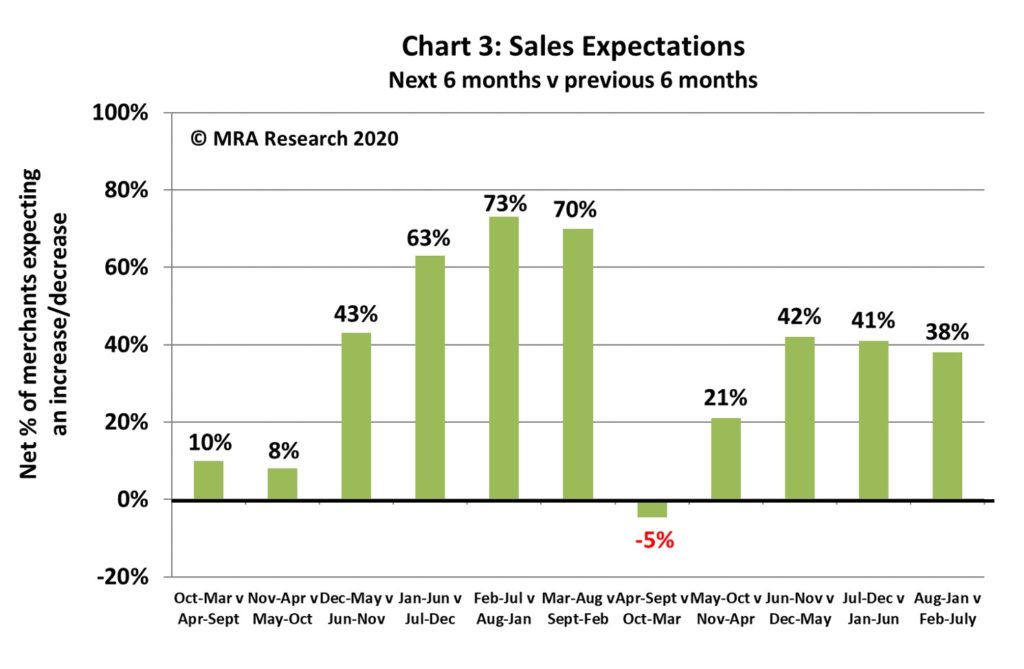

Merchants are positive about the next six months, but prospects are behind the expectations pre-Covid — see Chart 3. Large (net +50%) and mid-sized outlets (+42%) are more confident than small branches (+29%). Nationals (+63%) are significantly more bullish than Regionals (+28%) or Independents (+16%).

Confidence in the market

Confidence in the market softened compared to June and July, but is still positive month-on-month (net +24%). Merchants in the Midlands (+42%) were most confident.

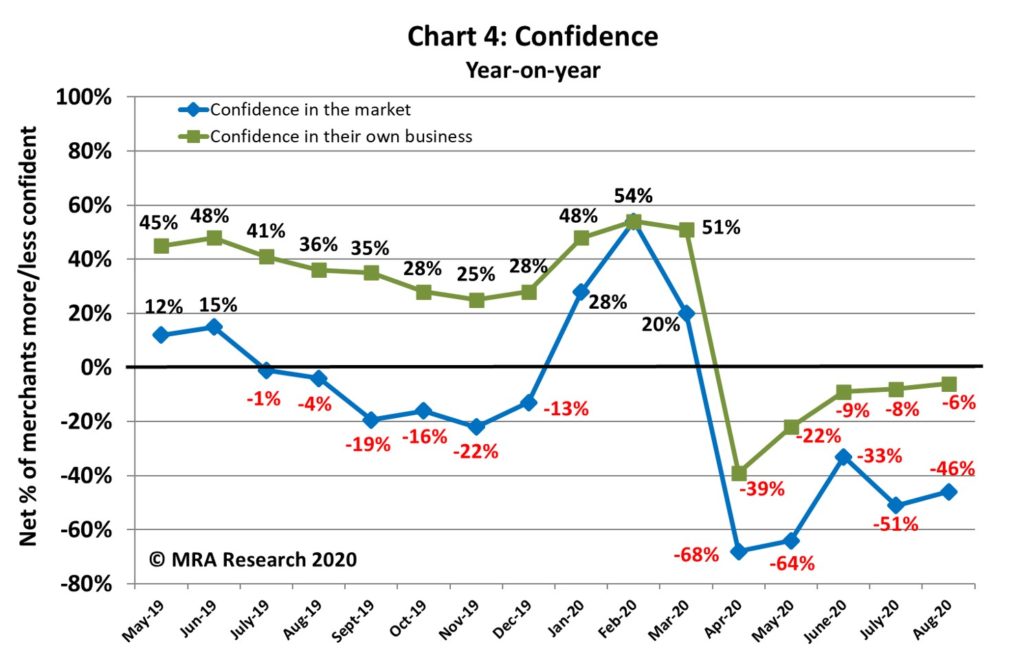

Compared to last year, confidence in the market is low but it’s recovering slowly after the lockdown — Chart 4. Mid-sized and large merchant branches are least confident (net -54% and -50% respectively). Merchants in Scotland were much less confident (-63%) than other parts of the UK.

Confidence in their business

Merchants’ confidence in their own business remains strong, with a net +47% of merchants more confident in August compared to July.

Compared to last year, merchants are recovering confidence in their own business — also Chart 4. Branches in the North (+14%) and Midlands (+4%), Independents (+5%) and small outlets (+2%) were more confident.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 16th in the series, with interviews conducted by MRA Research between 3rd and 7th August 2020. Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The full report can be downloaded from www.mra-research.co.uk/the-pulse or call Lucia Di Stazio at MRA Research on 01453 521621.