David Hopkins, CEO of the Timber Trade Federation, looks at the links between reputation, value and selling timber products.

This year marks 45 years since Benny Andersson and Björn Ulvaeus produced the ABBA song ‘Money, Money, Money’. The “rich man’s world” of the 21st century still depends to a certain extent on downright wealth, but in our world of trading in timber products, generating long-term value is about maintaining a reputation for reliability and knowledge, coupled with legendary customer service.

Reputation is a valuable financial asset, albeit an ‘intangible’ one. Indeed, the 2021 Reputation Dividend report reveals that £1 in every £3 of FTSE 350 company market value can be traced back to corporate reputation. And in the top ten listed companies, corporate reputation contributed to 49% of those companies’ market capitalisations.

If reputation is that big an asset, it serves everyone in business to guard their reputations well. The safeguarding of reputation through delivering accurate product information, provided by provably-competent people, is one of the central tenets behind the Code for Construction Product Information, or CCPI.

Many of us will remember the old TV campaign about advertising being ‘legal, decent, honest and truthful’. It’s only right that the same should apply to the information about timber products that we all share with each other across the supply chain, and with customers at the end of it.

The CCPI underlines the need for product claims to be verifiable, and information provided to customers to pass five ‘acid tests’ — of being clear, accurate, unambiguous, up to date, and accessible.

So what has all this got to do with timber products? Merchants sell timber and wood products based on a combination of knowledge and customer service. Your reputation is balanced between your ability to offer the right product for the job and your ability to supply product or offer suitable alternatives.

So what has all this got to do with timber products? Merchants sell timber and wood products based on a combination of knowledge and customer service. Your reputation is balanced between your ability to offer the right product for the job and your ability to supply product or offer suitable alternatives.

But what if those products are not correctly described? Post-Grenfell, the accuracy of product descriptions matters across the board as the construction sector seeks to re-establish its wider reputation.

Customers automatically view you, the merchant, as the expert. If you say a product is suitable for use in ground contact, such as a ‘sleeper’ for example, customers don’t normally have the expertise to question your judgement. It’s only when the product doesn’t last, or worse in the case of structural plywoods, fails in use causing an accident on site, that there is any come-back.

Avoiding potential problems in the first instance by providing correct information about the level of preservative timber treatment in the product, or the correct grade and glue bond in the case of plywood, has to be the better business option. It reinforces your local reputation and drives recommendations, potentially expanding your customer-base and your future sales.

As the CCPI begins to roll out across the construction products sector, all of us should take another look at how we describe, market and sell wood products. Can we justify calling something ‘eco-friendly’? If so what data is there to back up that claim? Can we say that something is ‘recyclable at the end of its life’? Have we done our due diligence to make sure that is the case, for example with composite wood-plastic products? And when was the information we’re giving last updated? Did someone knowledgably-senior sign off the use of that information? Do we have systems in place to check that?

As the CCPI begins to roll out across the construction products sector, all of us should take another look at how we describe, market and sell wood products. Can we justify calling something ‘eco-friendly’? If so what data is there to back up that claim? Can we say that something is ‘recyclable at the end of its life’? Have we done our due diligence to make sure that is the case, for example with composite wood-plastic products? And when was the information we’re giving last updated? Did someone knowledgably-senior sign off the use of that information? Do we have systems in place to check that?

If we offer a guarantee or warranty, for example on preservative-treated timber decking, CCPI suggests that we should be able to back up that guarantee with further information on what is included or excluded, the conditions under which the guarantee is valid, and visibly signpost how to claim against that guarantee.

Are we, for example, using the correct terminology when we sell preservative-treated softwoods — grouping the applications into the right Use Classes, not simply stating that the treatment is ‘green’ or ‘brown’…?

At TTF we are encouraging all members to check the information they provide to colleagues in the merchant sector, and to document the competence of the people delivering that information to you. Without going, as ABBA did in the song, to ‘Las Vegas or Monaco’, we can ensure the riches of our trade are passed on in the form of value-generating ‘timber you can trust’.

Working together we’ll achieve dividends whilst satisfying the aspirations of the CCPI.

For more information from the Timber Trade Federation, go to: https://ttf.co.uk/ttf-guides-members-on-the-code-of-construction-product-information-ccpi/

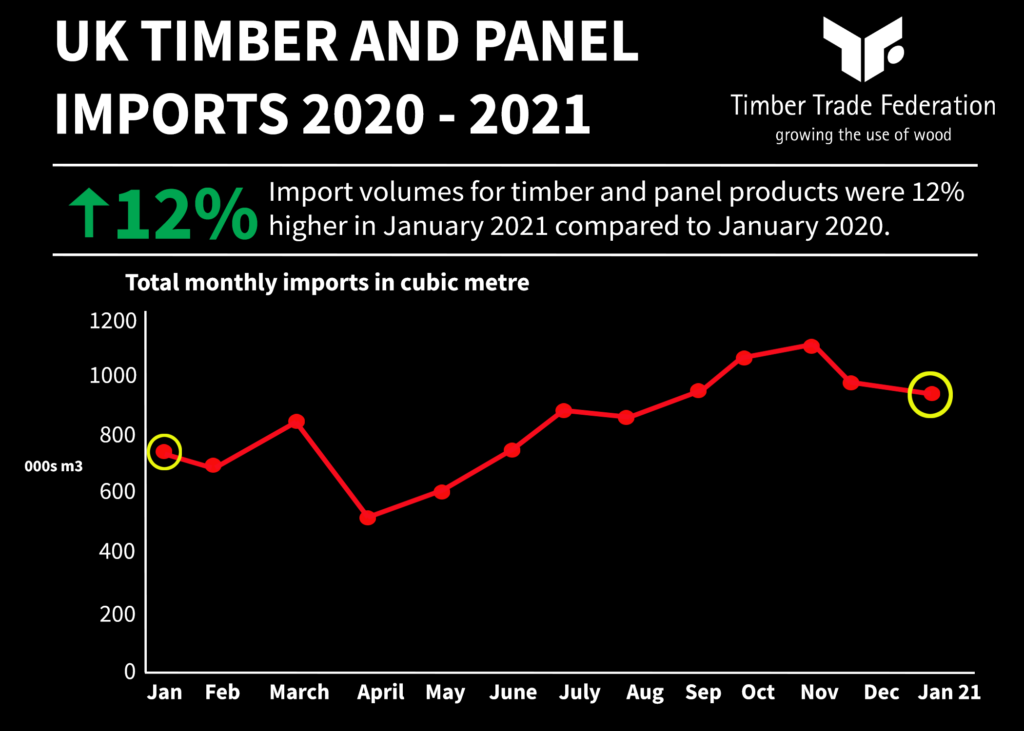

The Timber Trade Federation reports that the recovery in import volume seen in the second half of 2020 continued in January 2021 with timber and panel imports 12% higher than in January 2020. For example, the volume of solid timber and panel products imported in January 2021 totalled 895,000m3, a 100,000m3 rise from January 2020’s total imports of 795,000m3. When comparing January 2021 with January 2020 the statistics revealed that among the individual product categories: The increase in import volumes comes amidst a resurgent housing market, with housing starts up by 26% in England in Q4 2020 as compared to Q4 2019. Exclusively to TTF members, the full monthly report highlights the stories behind these statistics, including a focus on panel product imports over the last five years. David Hopkins, TTF CEO, said: “Our latest statistics reflect the determination of our members to match supply to demand, with a growth in overall wood product imports amidst a competitive international market which is keeping supply tight the world over, and a surge in construction in the UK. “This growth is being supported by a buoyant housing market, a government eager to invest, and consumers choosing to spend money saved during the pandemic on home improvements, with some £160 billion saved during the last year.”