The latest IHS Markit/CIPS UK construction PMI data (covering May 2020) shows an easing of the construction sector downturn following the unprecedented slump in April, and reflects upon the impact throughout the supply chain of the Covid-19 cirisis.

Whilst UK construction companies continued to indicate a sustained downturn in business activity during May, the latest survey highlighted a softer pace of decline than the record slump seen in the previous month, largely reflecting a gradual reopening of construction sites as lockdown measures were eased in England.

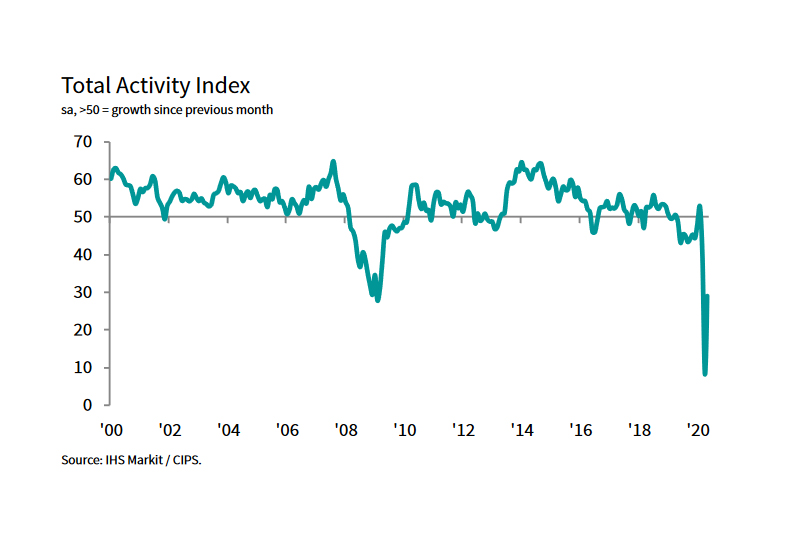

At 28.9 in May, the headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index picked up from 8.2 in April, but was the second-lowest since February 2009. Any figure below 50.0 indicates an overall decline in output.

With data collected between 12-28 May, around 64% of the survey panel reported a drop in construction activity during the month, while only 21% signalled an expansion. Where growth was reported, this was mostly attributed to a limited return to work on site following shutdowns in April.

Supply chain disruptions were frequently reported by survey respondents in May, with lead times for construction products and materials continuing to lengthen at a rapid pace. A number of firms commented that a lack of capacity for deliveries and ongoing business closures had resulted in the need to source alternative suppliers, which had also pushed up costs.

Construction companies recording a drop in activity during May often cited furloughed staff across the supply chain, as well as prolonged business closures in other parts of the economy and disruptions from social distancing measures on existing projects.

Residential work was the most resilient category in May (index at 30.9), followed by civil engineering (28.6). Commercial building also fell at a slower pace during the latest survey period, but was the worst performing broad area of construction (26.2).

May data also indicated a rapid drop in new orders received by UK construction companies, which was almost exclusively attributed to the coronavirus disease 2019 (COVID-19) pandemic. Survey respondents commented on a sharp decline in demand for new construction projects, although some noted that the reopening of sites had helped to alleviate the scale of the downturn in order books.

Mirroring the trend for workloads, latest data indicated that cuts to staffing numbers moderated since April. However, there were again widespread reports that redundancies would have been far more severe without the use of the government’s jobs retention scheme.

Supply chain disruptions were frequently reported by survey respondents in May, with lead times for construction products and materials continuing to lengthen at a rapid pace. A number of firms commented that a lack of capacity for deliveries and ongoing business closures had resulted in the need to source alternative suppliers, which had also pushed up costs.

Looking ahead, construction companies remain downbeat about their prospects for the next 12 months, with sentiment holding close to April’s low. Recession worries and fears of postponements to new projects were commonly reported in May.

Tim Moore, Economics Director at IHS Markit, said: “A gradual restart of work on site helped to alleviate the downturn in total UK construction output during May, but the latest survey highlighted that ongoing business closures and disruptions across the supply chain held back the extent of recovery.

“It seems likely that construction activity will rebound in the near-term, as adaptations to social distancing measures become more widespread and the staggered return to work takes effect. However, latest PMI data pointed to another steep reduction in new orders received by UK construction companies, with the pace of decline exceeding the equivalent measures seen in the manufacturing and service sectors.

“Survey respondents often commented on the cancellation of new projects and cited concerns that clients would scale back spending through the second half of 2020, especially in areas most exposed to a prolonged economic downturn.

“With construction firms anticipating a reduced pipeline of work and fewer tender opportunities, business expectations for the next 12 months remained negative in May. Since the start of the lockdown period in March, business sentiment has remained more downbeat than at any time since October 2008.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, added: “The construction sector suffered one of its worst results in May since the PMI surveys began as building work was grounded by the pandemic and lockdown measures.

“Spending was slashed as clients continued to stonewall building firms and put new projects on hold. With furloughed staff across the supply chain, companies saw their capacity leak away and the construction sector now faces the most challenging environment for generations. Building materials were in constrained supply as vendors gradually reopened in May, while items such as personal safety equipment were difficult to source.

“As the sector staggers back to work, and builders put their heads above the parapet, they face a number of obstacles. New safer working practices will ensure operations can continue but client confidence to place new orders is harder to predict. As the furlough scheme is unravelled towards the end of the summer, the floodgates preventing redundancies may also fly open and job losses will follow without a strong pipeline of work waiting in the wings. It will take a long time for the sector to build strength from the ruins of COVID-19.”