August data pointed to a setback for the recovery in UK construction output, with growth easing from the near five-year high seen during July, according to the latest UK Construction PMI from IHS Markit/CIPS.

Survey respondents mostly suggested that a lack of new work to replace completed contracts had acted as a brake on the speed of expansion.

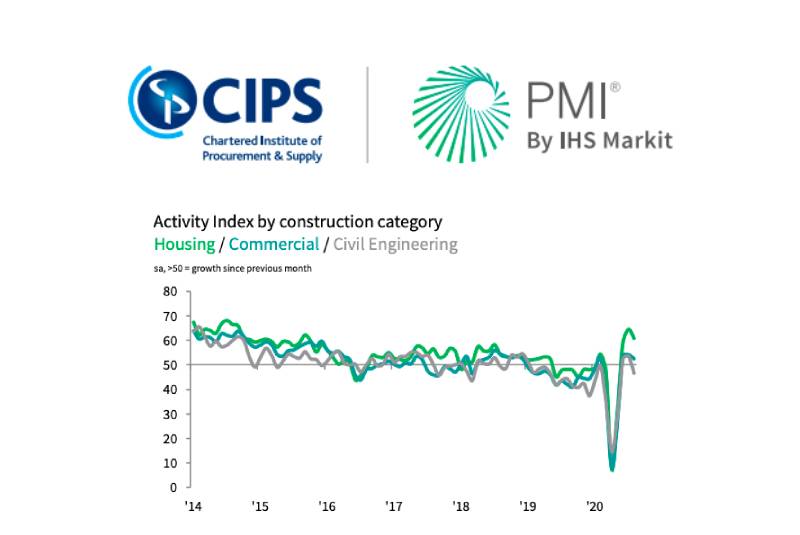

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index registered 54.6 in August, down from 58.1 in July. Any figure above 50.0 indicates growth of total construction output. Higher levels of activity have been recorded in each of the past three months, but the latest expansion was the weakest over this period. All three broad categories of construction provided a weaker contribution to the headline index in comparison to those seen in July.

House building has registered the strongest rebound since the stoppages of work on site in late-March due to the coronavirus disease 2019 (COVID-19) pandemic. This trend continued in August, with the seasonally adjusted Housing Activity Index posting well inside expansion territory (60.7). The equivalent figures for commercial work (52.5) and civil engineering activity (46.6) were notably weaker than the headline index in August.

Total new business volumes increased for the third month running during August, but the rate of expansion remained only modest and slowed since July. Construction companies noted that economic uncertainty and a wait-and-see approach among clients had limited their opportunities to secure new work. However, there were again a wide range of comments from survey respondents in relation to the strength of their order books, which largely mirrored the multi-speed recovery experienced across different sectors of the UK economy.

Supply chain disruption persisted across the construction sector, which led to another sharp downturn in vendor performance. Stock shortages and an imbalance of supply and demand for construction inputs contributed to higher purchasing costs. The overall rate of input price inflation was the highest since April 2019.

Despite reporting subdued new business intakes since the start of the pandemic, construction companies reported an improvement in their business expectations for the year ahead. More than twice as many survey respondents (43%) expect a rise in construction output over the next 12 months as those that anticipate a fall (19%). This was often linked to hopes of a boost from major infrastructure projects and resilient public sector construction spending.

However, an expected rise in business activity could not prevent a further drop in staffing numbers. The rate of job shedding eased only slightly since July and remained among the fastest seen over the past decade.

Tim Moore, Economics Director at IHS Markit:

“The latest PMI data signalled a setback for the UK construction sector as the speed of recovery lost momentum for the first time since the reopening phase began in May. House building remained the bestperforming area of construction activity, with strong growth helping to offset some of the weakness seen in commercial work and civil engineering activity. The main reason for the slowdown in total construction output growth was a reduced degree of catch-up on delayed projects and subsequent shortages of new work to replace completed contracts in August. “Another month of widespread job shedding highlighted the ongoing difficulties faced by UK construction companies, with order books often depleted due to a slump in demand from sectors of the economy that have experienced the greatest impact from the pandemic. “More positively for the employment outlook, business expectations climbed to a six-month high in August as construction firms turned their hopes towards a boost from major infrastructure work and reorienting their sales focus on new areas of growth in the coming 12 months.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply:

“The momentum in the sector’s recovery hit a bump in the road in August with a sudden slowdown in output growth and tender opportunities, while employment trends remained the most fragile in a decade. “This stalled progress was not a surprise given the warning signs last month that any hard-won progress could start to fizzle out. As new order gains slowed across all sectors, continuing COVID-19 anxiety amongst clients meant many projects still remained on ice. Though residential building remained the strongest, it too was showing signs of strain. “In addition, there were ongoing difficulties in supply chains which hampered the sourcing of raw materials. Delivery times lengthened in August as a result of stock shortages at suppliers and cost increases were the highest since April 2019. “Even with all these obstacles, builders were at their most optimistic since the beginning of the year. This glass half full attitude will have to carry companies into the autumn as the UK economy remains delicate and susceptible to more turbulence.”

Related News: