As the government continues to offer commitments to the construction sector, the latest data reveals an industry fighting its way to recovery but with a setback in August.

Whilst ONS data for Q2 revealed the construction sector has suffered “by far the largest decline in quarterly growth since quarterly records began in Quarter 1 1997”, on a month-by-month basis, construction output grew by a record 23.5% in June — a figure substantially higher than the previous record monthly growth of 7.6% in May 2020 — which demonstrates the rebound effect as construction activity ramped up.

Despite this strong monthly growth, the ONS data acknowledged that construction output in June remained comparatively low at 24.8% below the February 2020 level, which was before the full impact of the coronavirus (Covid-19) pandemic.

And as we await the ONS update for Q3, it is worth considering the monthly UK Construction Total Activity Index from IHS Markit/CIPS. The latest available figures are from August and “pointed to a setback for the recovery in UK construction output, with growth easing from the near five-year high seen during July” as survey respondents “mostly suggested that a lack of new work to replace completed contracts had acted as a brake on the speed of expansion”.

Any figure above 50.0 indicates growth of total construction output and the headline seasonally adjusted index registered 54.6 in August, down from 58.1 in July, with higher levels of activity recorded in each of the past three months.

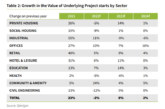

That said, house building has registered the strongest rebound since the stoppages of work on site in late-March due to the coronavirus pandemic and this trend continued in August, with the seasonally adjusted Housing Activity Index posting well inside expansion territory (60.7). The equivalent figures for commercial work (52.5) and civil engineering activity (46.6) were notably weaker than the headline index in August.

Respondents also provided “a wide range of comments in relation to the strength of their order books, which largely mirrored the multi-speed recovery experienced across different sectors of the UK economy”. Furthermore, “stock shortages and an imbalance of supply and demand for construction inputs” were said to have contributed to higher purchasing costs with Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, noting: “There were ongoing difficulties in supply chains which hampered the sourcing of raw materials. Delivery times lengthened in August as a result of stock shortages at suppliers and cost increases were the highest since April 2019.”

More positively, he added: “Even with all these obstacles, builders were at their most optimistic since the beginning of the year. This glass half full attitude will have to carry companies into the autumn as the UK economy remains delicate and susceptible to more turbulence.”

Reflecting the view of many commentators — rather poetic descriptions of the current picture for construction have included “a curious mishmash” and a “faltering foxtrot” — Kate Kirby, Partner in the Construction & Infrastructure practice at global legal business DWF, said: “In a post–pandemic world, there will still be a requirement for more homes, urban regeneration, improved infrastructure, improved offices, retail space and more distribution facilities. We all know from past downturns that a robust construction sector will emerge but how and when, we just do not know.”