With interviews taking place during the week before the second lockdown (in England), merchants expressed caution about their prospects for the near future but anticipated better times ahead.

Set against the backdrop of further restrictions for the country in the run up to Christmas, merchants participating in the latest survey were realistic about the potential impact on both their businesses and the market of the imminent restrictions. However, they were still optimistic about the mid-to longer term prospects.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 2nd and 5th November.

Impact of COVID-19

The gradual shift towards operating normally continues with 7 out of 10 merchants nationally being fully open in November, rising to as many as 9 out 10 in the South.

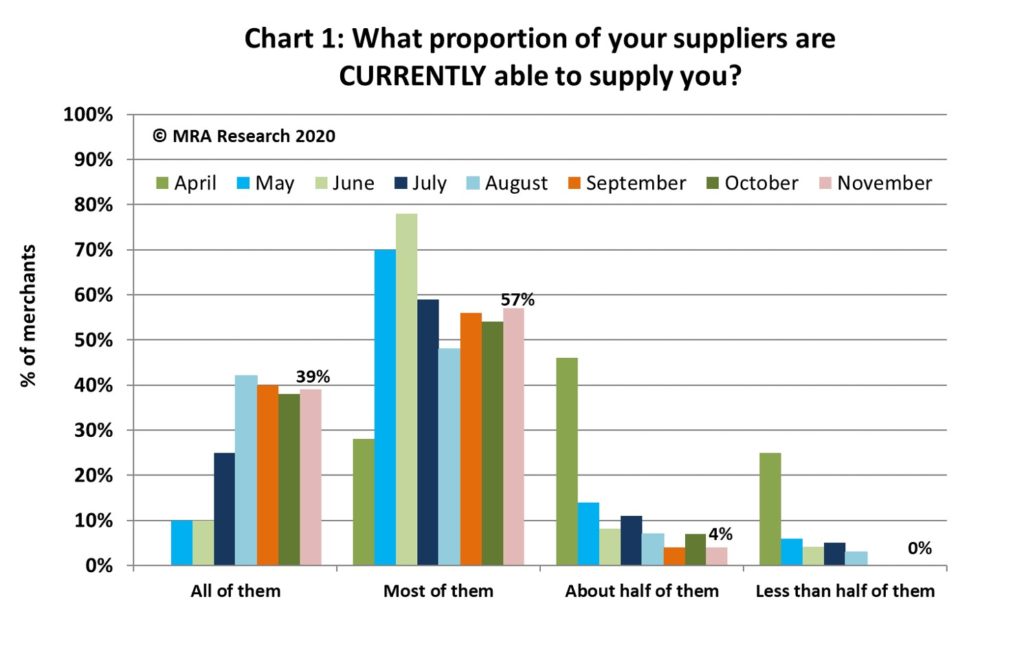

96% of merchants say all or most of their suppliers are currently able to supply them (Chart 1). However, extended lead times and stock availability continue to be cited as problems by many merchants.

Sales expectations

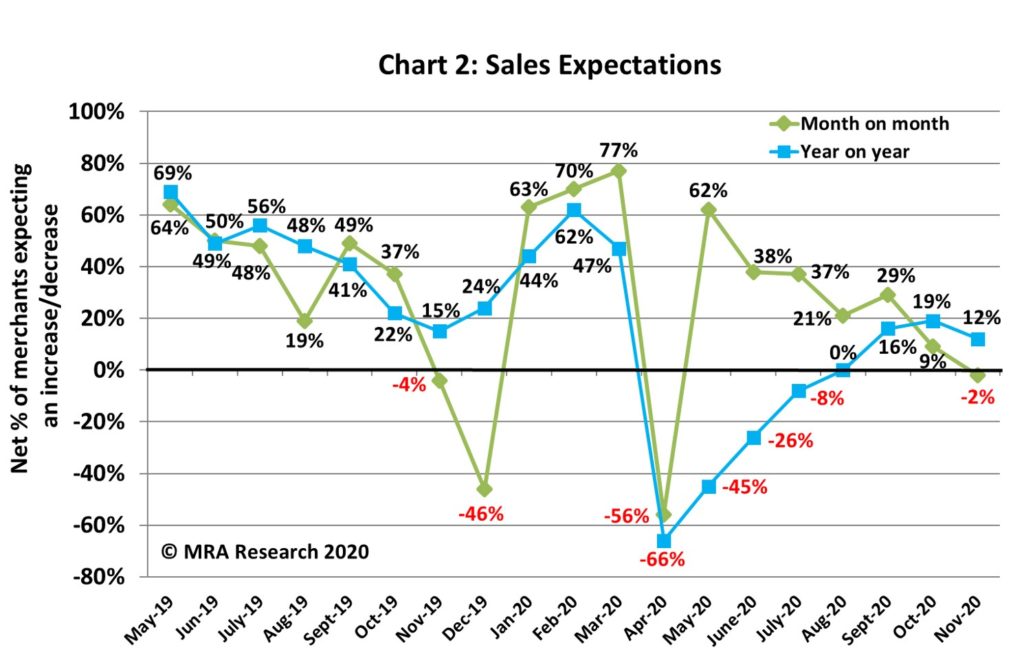

Sales expectations month-on-month were weaker in November compared to October. A net -2% of merchants expected sales to increase (Chart 2). Small branches (net +10%) and merchants in the South and in Scotland (+18) were most bullish.

Year-on-year, merchants’ expectations are still positive with a net +12% forecasting better sales (also Chart 2). Merchants in the South (+29%) anticipated improved sales in November, while merchants in the North expected sales to drop (net -9%). Regional merchants predicted better sales over the period (net +28%), while National merchants forecasted a decline (-14%).

The outlook for the quarter ahead (November 2020-January 2021) weakened significantly with a net -41% of merchants predicting lower sales compared to the previous quarter, August-October. Independent branches (-65%), those in the North (-62%) and large merchants (-50%) were most pessimistic.

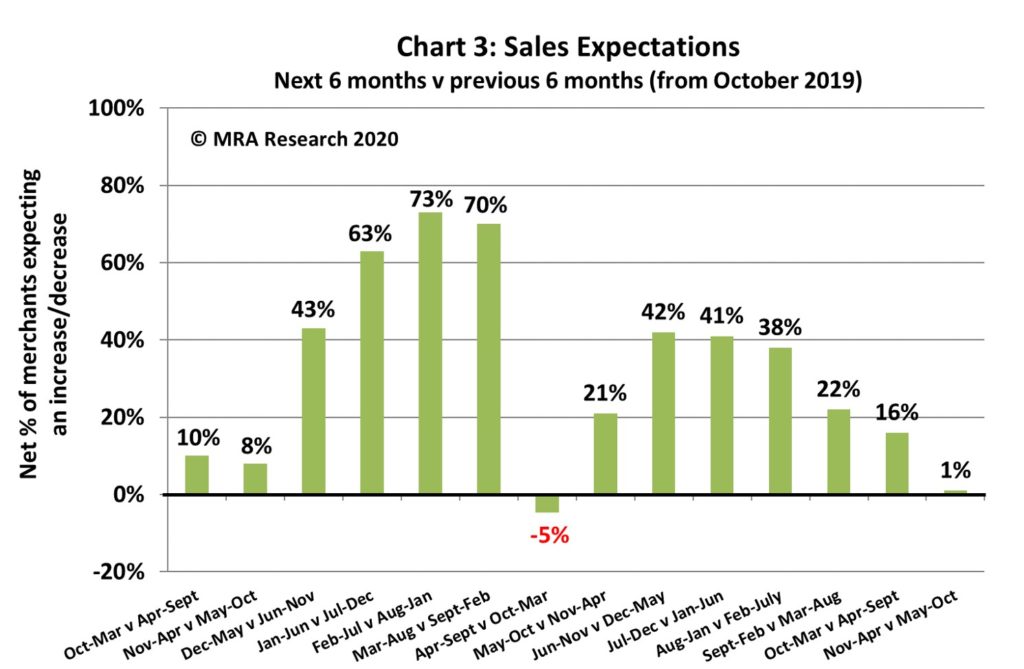

Merchants’ expectations for the six months ahead also weakened with just a net +1% of merchants forecasting improved sales in November 2020 to April 2021 compared to May to October 2020 (Chart 3). Expectations vary. Merchants in Scotland (net +18%), Nationals (+14%) and large outlets (+11%) are most positive.

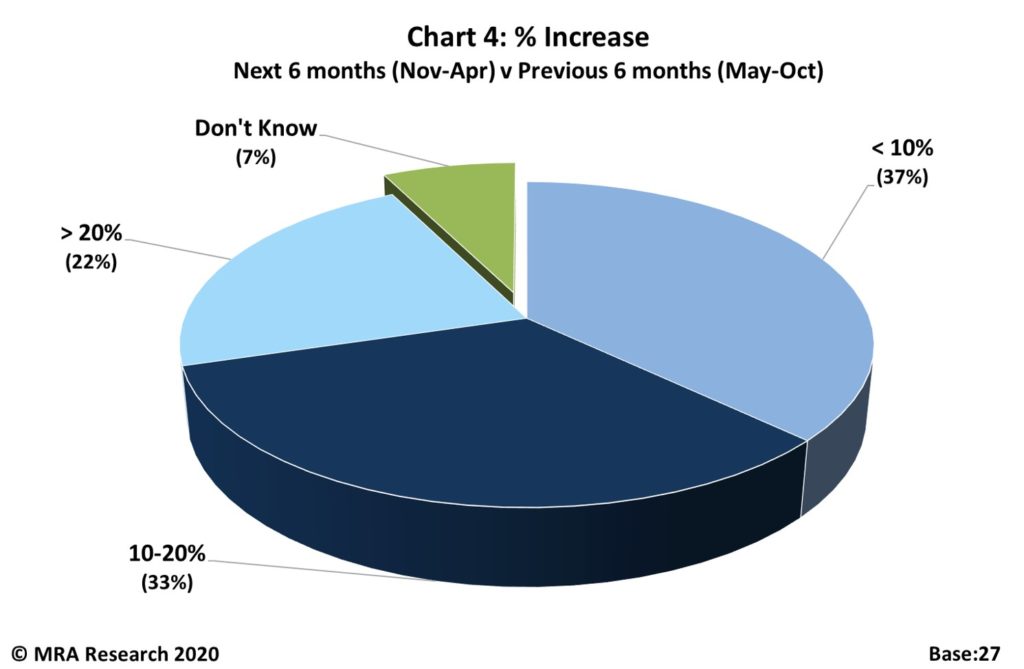

However, seven in 10 of those anticipating an increase in sales expect growth of up to 20%. A further 22% expect sales to improve by more (Chart 4).

Confidence in the market

Month-on-month confidence in the market weakened in November to a net -11%. While confidence is consistent across the country, it varies by type and size of merchant, ranging from a net +29% for Independents to a net -29% for mid-sized branches.

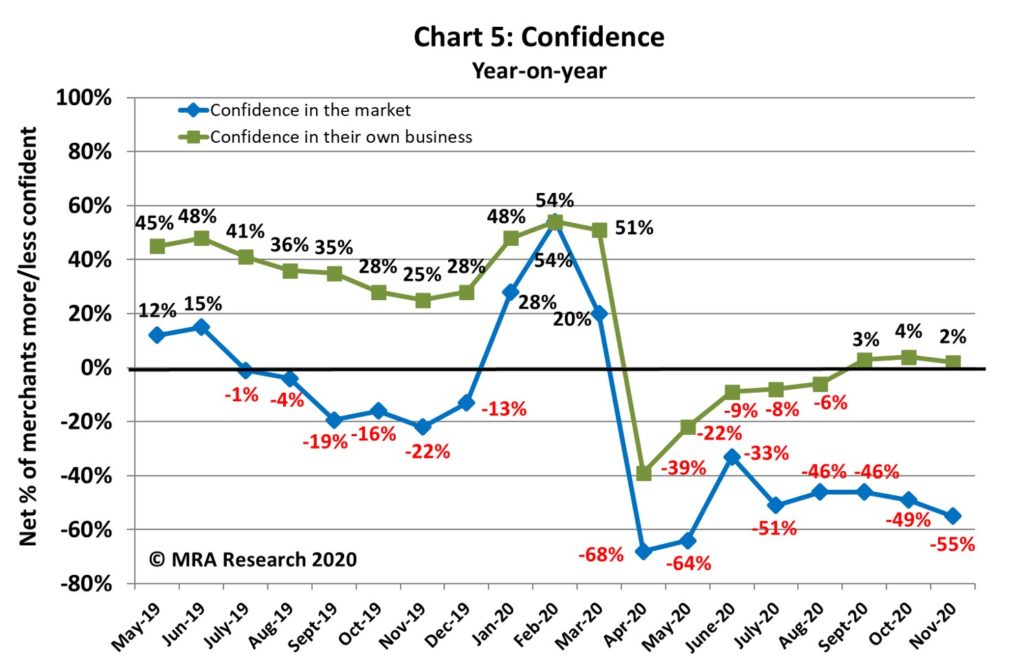

Year-on-year, a net -55% of merchants were less confident in November than the previous month (Chart 5).

Confidence in their business

Merchants’ confidence in their own business, however, remains strong with a net +29% more bullish. Large merchants are most upbeat (+56%) with none of those interviewed less confident.

Year-on-year confidence in their own business is broadly in line with the previous two surveys at a net +2% (Chart 5). Uncertainty over Covid is a major concern as well as the possible impact of unemployment causing money shortages or people spending what money they do have on things other than home improvements.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 19th in the series, with interviews conducted by MRA Research between 2nd and 5th November 2020. Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

Download the full report for free at www.mra-research.co.uk/the-pulse or call Lucia Di Stazio at MRA Research on 01453 521621.