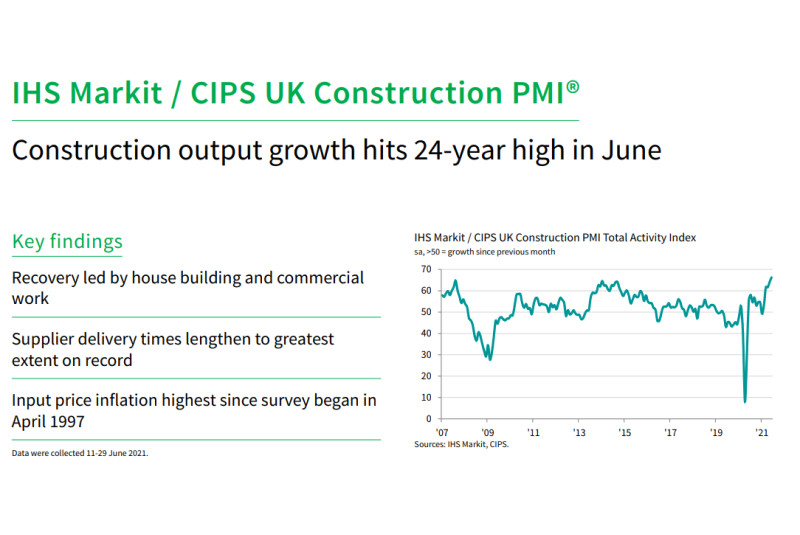

The recovery in UK construction output gained further momentum during June, according to the latest PMI data with overall construction activity expanding at the fastest pace since June 1997, supported by another sharp rise in new orders.

This is tempered by suppliers’ delivery times reportedly lengthening to the greatest extent since the survey began just over 24 years ago, surpassing the previous record seen in April 2020. Severe shortages of construction products and materials further resulted in a survey-record rise in purchasing prices in June.

At 66.3 in June, up from 64.2 in May, the seasonally adjusted IHS Markit/CIPS UK Construction PMI Total Activity Index signalled the strongest rate of output growth for exactly 24 years. Sharp increases in business activity were seen across all three main areas of the construction sector monitored by the survey.

Construction work in the house building sub-category (index at 68.2) increased at the fastest pace since November 2003. The second-best performing area was commercial work (66.9), with output rising at the strongest rate since March 1998. Meanwhile, civil engineering activity rose sharply in June (60.7), but the speed of growth eased to a three-month low.

Survey respondents widely commented on a rapid turnaround in demand for new construction work, especially residential building and commercial projects related to the reopening of the UK economy. Total new orders have increased in each of the past 13 months, although the latest expansion was slower than May’s survey-record high.

Construction companies indicated another month of sharply rising employment numbers, reflecting efforts to boost capacity and meet incoming new orders. The rate of job creation moderated since May but remained among the fastest seen over the past seven years. Moreover, sub-contractor usage increased at the steepest pace since the survey began in April 1997.

Around 77% of the survey panel reported longer lead times among suppliers in June. The seasonally adjusted index pointed to the worst month for supplier delays since the survey began just over 24 years ago. Construction companies overwhelmingly cited stock shortages among vendors, reflecting severe delays with shipping and haulage, especially for products sourced from the EU.

In terms of building materials, panel members commented on short supply across the board, particularly cement, concrete, plaster, steel, timber and roof tiles.

Imbalanced demand and supply resulted in rapid cost inflation across the construction sector in June. Average prices paid for products and materials increased at survey-record pace. Adding to cost pressures in June was the steepest rise in rates charged by sub-contractors since the survey began.

Construction companies remain optimistic about growth prospects for the next 12 months. That said, the degree of confidence eased to its lowest since January, in part reflecting concerns about labour availability and the sustainability of the recent surge in demand.

Tim Moore, Economics Director at IHS Markit, which compiles the survey, said:

“June data signalled another rapid increase in UK construction output as housing, commercial and civil engineering activity all expanded at a brisk pace. The headline index signalled the fastest rise in business activity across the construction sector for 24 years. Total new orders expanded at one of the strongest rates since the summer of 2007, mostly reflecting robust demand for residential projects and a boost to commercial work from the reopening UK economy.

Supply chains once again struggled to keep up with demand for construction products and materials, with lead times lengthening to the greatest extent since the survey began in April 1997. Survey respondents widely reported relays due to low stocks of building materials, shortages of transport capacity and long wait times for items sourced from abroad. Purchasing prices and sub-contractor charges both increased at a survey-record pace in June, fuelled by supply shortages across the construction sector.

Escalating cost pressures and concerns about labour availability appear to have constrained business optimism at some building firms. The degree of positive sentiment towards the year ahead showed growth outlook remaining high, but eased to its lowest since the start of 2021.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, added:

“A wave of new orders overwhelmed supply chains again this month where stock levels could not keep up with building work accelerating at the fastest rate since June 1997. The meagre availability of raw materials placed obstacles in the path of stronger workflows, where supplier delivery times extended into record-breaking territory once again and surpassed the height of disruption when the pandemic first hit.

A lack of delivery drivers and logistics difficulties for EU imports left stock undelivered or unavailable, and construction companies waited while costs mounted. Construction’s heavy load remains inflation rising to its highest rate since April 1997 as a staggering 86% of respondents reported paying more for their goods in June.

These malfunctions in supply chain performance may be a global issue, but this doesn’t help UK builders who are ready but unable to return fully to projects which was reflected in the lowest optimism since January. This surge in activity will lose momentum while labour availability along with key materials remain elusive.”

Amongst a number of responses, the Federation of Master Builders (FMB) outlined its concern that “the fastest rise in construction activity since 1997 risks being undermined by price increases and a shortage of building materials”. Brian Berry, FMB Chief Executive, said: “The building materials shortage is disproportionately affecting small builders and threatening their recovery from the pandemic despite strong growth in the construction sector. The materials shortage is proving a serious detriment to both businesses throughout the supply chain and consumers. As the country reopens for business, it’s imperative that building firms have better access to the materials they need to build.”

He added: “It’s very encouraging that activity in the construction sector is increasing at its fastest rate in over twenty years, but given that confidence is rapidly dropping away, the lack of materials needs addressing before jobs and business continuity start to be compromised. Small firms form over 90% of the construction industry, and they are experiencing the most difficulties as a result of these shortages.”

Related News:

UK Construction PMI for May 2021

UK Construction PMI for April 2021