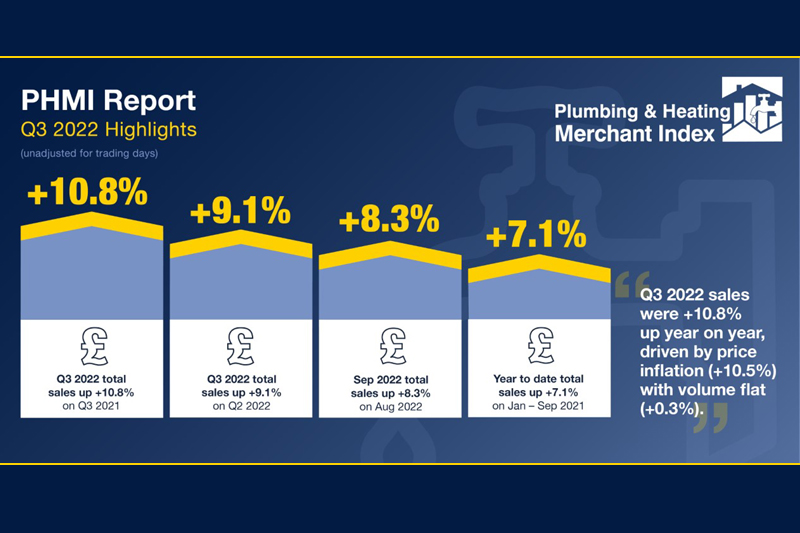

The latest Plumbing & Heating Merchant Index (PHMI) report, published in November, shows total value sales through specialist Plumbing & Heating merchants were up +10.8% in Q3 2022 compared to the same period in 2021.

Following the trend seen throughout the year, this double-digit growth has been driven by price inflation (+10.5%) and not volume sales (+0.3%) which remain flat. With one less trading day this year, like-for-like sales were +12.5 % up.

Quarter-on-quarter, Q3 2022 sales were +9.1% higher than Q2 2022. Both volume sales (+6.8%) and prices (+2.2%) were up. With four additional trading days in the most recent period, like-for-like sales were +2.3% higher.

Year-to-date value sales from January to September 2022 were +7.1% above the same period a year earlier. With two less trading days so far this year, like-for-like sales were up +8.2%.

Plumbing & Heating Merchants sales in the 12 months to September 2022 were +3.0% higher than the same period a year before (October 2020 to September 2021). Volume sales were -4.9% lower while prices were up +8.3%. With two less trading days in the most recent period, like-for-like-sales were up +3.8%.

September 2022 value sales were +9.1% above the same month a year ago, but volume sales were down -3.0% with price inflation of +12.4%. With one less trading day this year, like-for-like sales were up +14.3%.

Month-on-month, total value sales through specialist Plumbing & Heating merchants were +8.3% higher in September compared to August. With one less trading day in the most recent period, like-for-like sales were still +13.5% higher.

The PHMI Index for September 2022 was 103.5 with no difference in trading days.

Mike Rigby, CEO of MRA Research which produces the report, said: “What we are seeing in quarter three seems to mark a return to normal seasonal trends, with the traditional ‘heating season’ giving specialist plumbing and heating merchants a bounce in sales. Double digit growth year-on-year looks remarkable given the country’s economic outlook and record lows in consuming confidence, so it’s no surprise to find that growth is essentially the result of inflation as volumes remain flat.

“That said, on a month-on-month basis Q3 ended more strongly with nominal volume growth in September. A series of downbeat assessments from housebuilders about the prospects for the housing market as higher mortgage rates and a cost of living crisis raise cancellations and people put their dreams on hold have led to lower build forecasts.”

He continued: “RM&I work has been knocked back in the mid to budget sectors as the affordability crisis forces younger and less well-off homeowners to prioritise spending, but mainly older homeowners who have paid off their mortgages or are near to doing so are still spending. And there is still a massive amount of savings to spend that accumulated during the pandemic. Both energy and water saving products are expected to benefit as property owners seek to minimise bills with improved energy efficiency and increasingly, water efficiency too.”

The Plumbing & Heating Merchant Index (PHMI) states it is the first to analyse point of sales data, collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

The PHMI data is from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of Britain’s specialist plumbing & heating merchants’ sales. The PHMI is a brand of the Builders Merchants Federation, and reports are produced by MRA Research. There is no overlap or double counting between PHMI and Builders Merchants Building Index (BMBI) sales data.

To download the latest report visit www.phmi.co.uk.