Travis Perkins plc has announced its half year results for the six months to 30 June 2025.

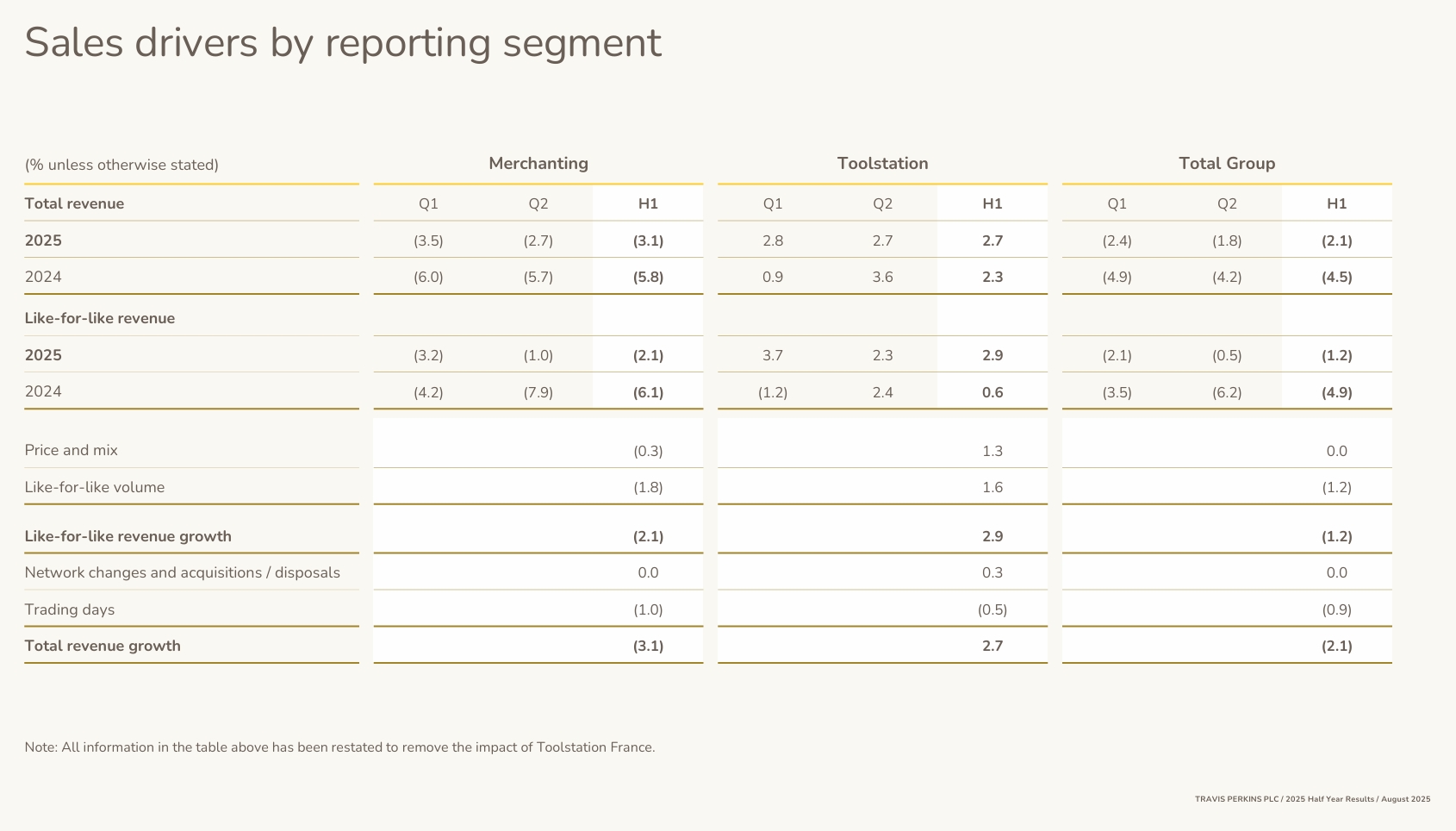

With the accompanying reporting from the firm outlining its “focus on stabilising business performance,” Group revenue was shown to have declined by (2.1)% ”driven primarily by operational challenges in the early part of the year.” However, actions to drive volume in Merchanting are said to be taking effect, with Merchanting like-for-like sales (1.0)% in Q2 (versus (3.2)% in Q1) and “market share decline arrested.”

The proactive management of overheads has been undertaken to mitigate cost inflation and increased employer national insurance contributions, whilst further progress has been seen in Toolstation UK with operating profit increasing 50% to £21m.

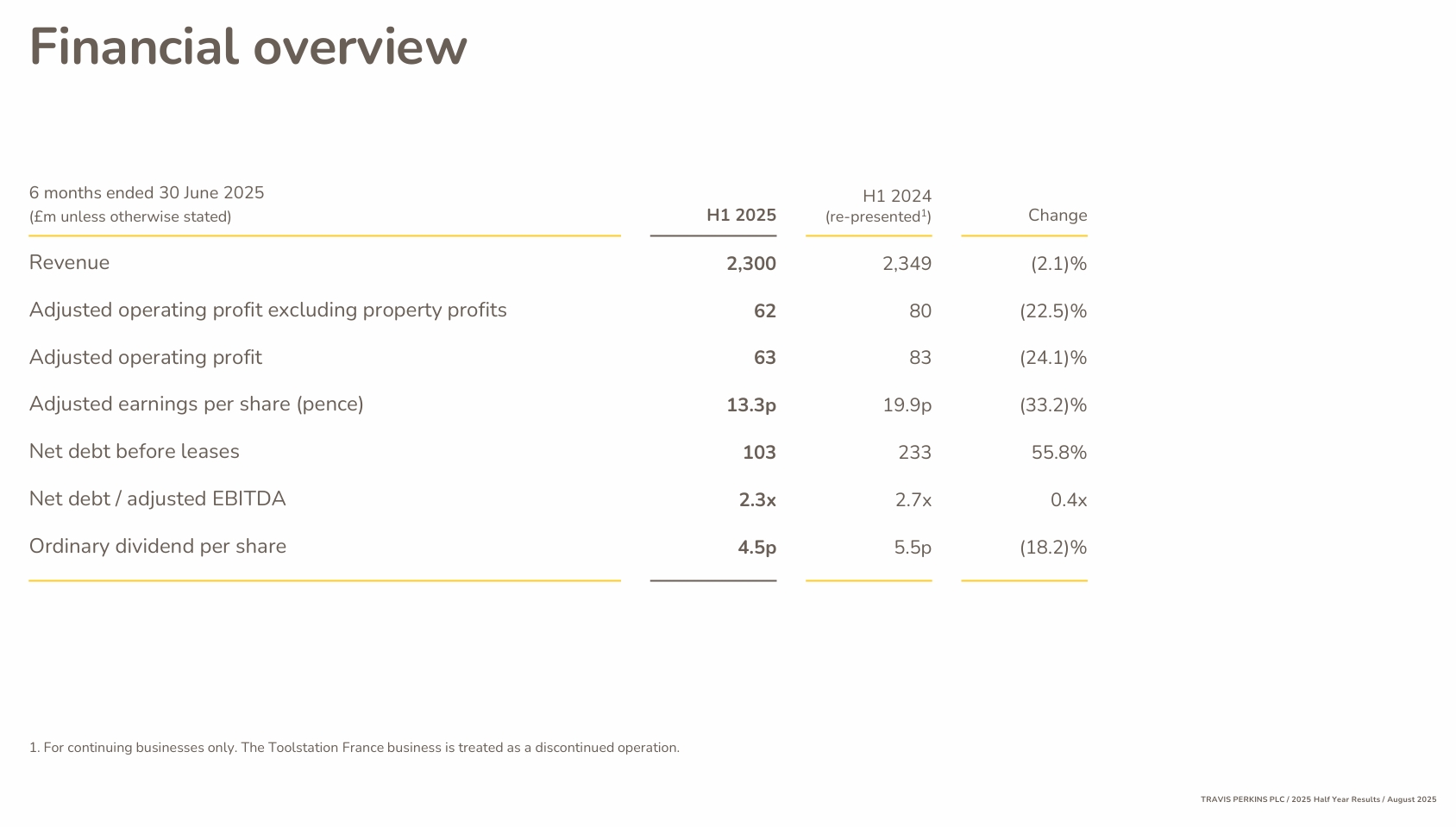

Overall, “lower volumes in Merchanting resulted in adjusted operating profit of £63m (2024: £83m)” with Statutory operating profit of £59m (2024: £48m). The Group says it expects to deliver a full year adjusted operating profit (including £8m of property profits) broadly in line with current market expectations.

The report further emphasises the implementation of new leadership structures, for example with highly experienced CEO Gavin Slark set to join the Group on 1 Jan 2026 following the departure of Pete Redfern in March 2025. In addition, the Group has also implemented a new operating structure for the Specialist Merchant businesses – BSS, CCF, Keyline and TF Solutions – which now all report into a Specialist Merchant Managing Director, sitting on the Group Leadership Team, with Catherine Gibson appointed to the role.

Managing Directors have also now been appointed in all of the Specialist businesses. Meanwhile in Toolstation UK, Lakhvir Sanghera has been appointed as Managing Director following the upcoming retirement of Angela Rushforth, while Richard Lavin has taken up the role as Managing Director of Travis Perkins General Merchant.

Catherine, Lakhvir and Richard have extensive industry experience, having all been with the Group for over a decade.

Chair Geoff Drabble, commented: “The first quarter was difficult with a continued trend of market share loss and revenue decline in Merchanting. However, I was encouraged by the response of the business to management actions to drive a more customer-focused approach. In the second quarter we delivered improved revenue performance and stabilised Merchanting market share and these trends have continued into July.

“We will build on this momentum in the second half as we deploy further system enhancements that put the difficult Oracle implementation behind us. The strong performance of Toolstation UK, which operates in similar markets to the Group’s other businesses, demonstrates our potential without internal distractions.

“Whilst the market outlook for the second half remains uncertain, the Board anticipates that the Group will deliver a full year result broadly in line with current market expectations.”