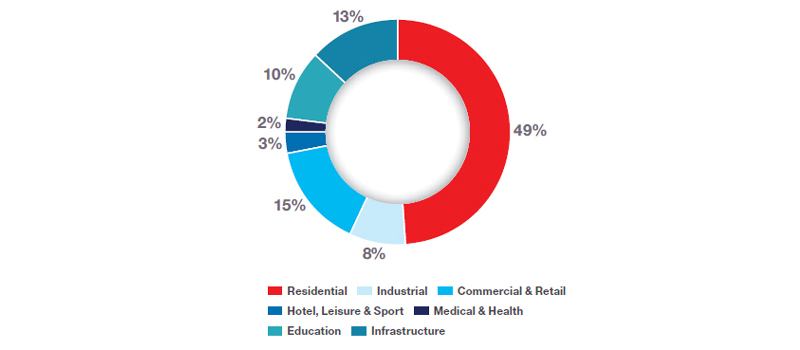

The residential sector showed major signs of a return in October with 49% of all construction contract values, totalling £3.7 billion, according to the latest Economic & Construction Market Review from industry analysts Barbour ABI.

Higher residential activity levels will be warmly welcomed by the industry after lagging behind an infrastructure dominated few months. To put the sector’s supremacy in October into perspective, commercial and retail construction was the second highest sector for contracts awarded by value, but only made up 15% of the market, compared with residential at 49%.

Overall for October, the value of residential projects is the highest since Barbour ABI started tracking the series, helped significantly by a number of projects within private housing, which accounted for 81% of all residential contract values.

Major construction projects in October that fuelled the residential revival were spread right across the United Kingdom, from the City North Development in London’s Finsbury Park valued at £120 million, to the Oakfield Road project in Altrincham that is set to deliver 59 apartments with a total construction value of £70 million.

Commenting on the figures, Michael Dall, lead economist at Barbour ABI, said: “After a slower Q3 for construction activity it was vital for the industry as a whole that residential bounced back to help regain momentum. It was also encouraging to see the spread of contract values right across the UK, with no region dominating.

“Although the residential contract value figure increased in October, the number of units awarded increased by only 2.8%, suggesting that recent schemes are more focused on high value rather than high density, which does not necessarily bode well for those calling to increase housing figures. However, October’s total residential value was the highest for over three years and dominated by private housing, which has to be seen as a positive for the industry, economy and investors.”

Barbour ABI’s latest Economic & Construction Market Review is available to read here.