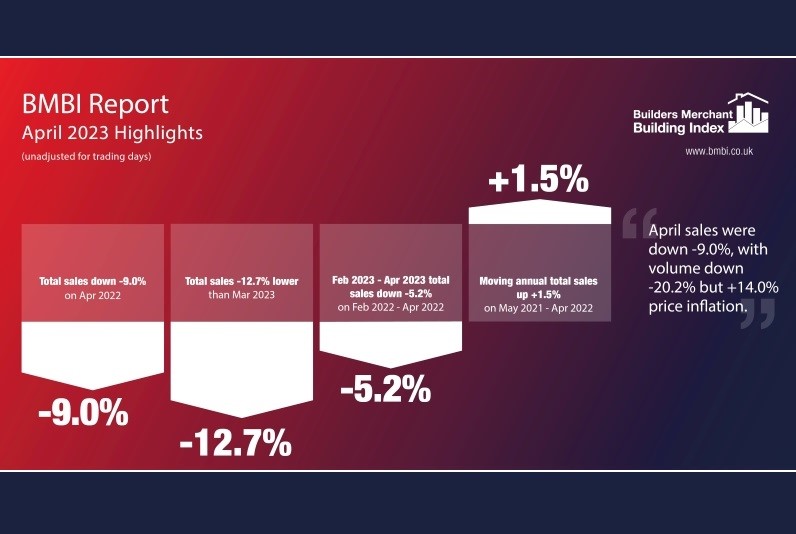

The latest Builders Merchant Building Index report (published 21 June 2023) shows builders’ merchants’ value sales down by -9.0% in April compared to the same month in 2022. Volume fell -20.2% with price inflation of +14.0%.

Taking trading day differences into account, like-for-like sales were -4.0% lower as April 2023 had one less trading day than the same month in the previous year. Seven of the twelve categories sold more this year than in April 2022 with Renewables & Water Saving (+55.4%) the strongest performing category by some margin followed by Decorating (+8.3%) and Plumbing, Heating & Electrical (+5.3%). Timber & Joinery Products (-20.6%) and Landscaping (-23.3%) were the weakest.

Month-on-month, total merchant sales were down -12.7% in April compared to March 2023. Volume sales were down -11.9% with prices registering a small decline (-0.9%). But with five less trading days in April compared to March, like-for-like value sales were up +11.6%. Landscaping (+3.3%) was the only category to sell more, while Plumbing, Heating & Electrical (-22.6%) and Workwear and Safetywear (-26.7%) were the worst performing categories.

Total merchant sales in the twelve months from May 2022 to April 2023 were +1.5% higher than the same period a year ago. Volumes fell -12.5% with price inflation of +16.0%. With two less trading days in the most recent period, like-for-like sales were +2.4% higher. Ten of the twelve categories sold more with Renewables & Water Saving (+39.9%) well ahead of Plumbing, Heating & Electrical (+13.6%), Kitchens & Bathrooms (+13.3%), Decorating (+12.2%) and Heavy Building Materials (+7.7%). Landscaping (-8.5%) and Timber & Joinery Products (-11.6%) both sold less.

Mike Rigby, CEO of MRA Research which produces this report, said: “The latest BMBI figures – which show a significant decrease in value sales and an even sharper decline in volume – reflect the continuing national slowdown in housing activity, both newbuild and repair, maintain and improve.

“Unfortunately, despite what is now widely recognised as a UK housing crisis, there is no quick fix. The UK requires a major step up in the numbers of homes being built each year – think 400,000 a year, not the Government’s nominal target of 300,000 nor the far smaller numbers actually built – and a massive upgrade in the energy efficiency of the housing stock. But we will likely have to wait on a new government, with a change in priorities, and an increase in housebuilding and installation capacity for this much needed growth.”

Mike continued: “In the meantime, high and rising interest rates and ongoing economic uncertainty are putting buyers off. In April, mortgage approvals hit their lowest level since records began. However, GfK’s long-running Consumer Confidence Index improved three-points in May, the fourth monthly increase in a row from January’s low of -45. How people view their personal finances in the next 12 months also improved with a five-point jump to -8.

“This is an important measure as it underpins our ability to spend on the goods and services that drive the economy. But the headline score of -27 means we’re still deep in negative territory and some way from recovery.”

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

April’s BMBI report, published in June, is available to download at www.bmbi.co.uk.