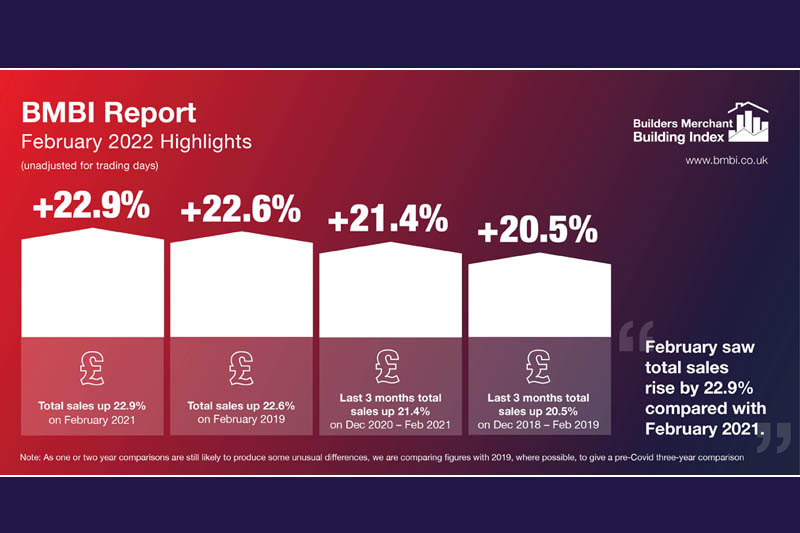

The latest Builders Merchant Building Index (BMBI) report reveals that builders’ merchants’ value sales in February 2022 were 22.9% up on the same month in 2021, continuing January’s solid start to the year. However, this was driven more by price inflation (+13.4%) than volume growth (+8.3%).

According to the report, all categories sold more with Landscaping (+33.7%) performing best. Five categories did better than Merchants overall, including Timber and Joinery Products (+25.6%) and Kitchens & Bathrooms (+25.2%). Plumbing, Heating and Electrical (+15.0%), Decorating (+14.2%), and Tools (+8.8%) grew more slowly. Workwear & Safetywear (+1.0%) was weakest.

Compared to February 2019 (as a pre-pandemic, ‘normal’ year benchmark), total merchant value sales were 22.6% higher. All categories sold more, with overall growth driven by the strength of two categories: Landscaping (+51.1%) and Timber & Joinery Products (+38.3%). Kitchen & Bathrooms (+17.4%), Heavy Building Materials (+16.5%) and Plumbing, Heating & Electrical (+10.4%) were among the categories which grew more slowly.

Month-on-month total merchant sales were 7.5% up in February 2022 compared to January 2022, with no difference in trading days. All bar three categories sold more including Landscaping (+28.6%), Kitchens & Bathrooms (+10.6%) and Heavy Building Materials (+7.7%).

Mike Rigby, CEO of MRA Research who produce this report, said: “February delivered a solid performance for merchants. True, most of the +22.9% headline value growth was driven by price inflation of +13.4%, but in any normal year +8.3% volume growth would be regarded as spectacular. It still is, but we have yet to see the full effects of the uncertainty ushered in by the invasion of Ukraine, a secondary kick to price inflation and shortages that follow from the disruption to supply chains, and the impending energy price increases. It’s impossible to forecast how these factors play out in different markets, but my money is still on this strong demand continuing.”

John Newcomb CEO of the BMF (Builders Merchants Federation) added: “Continued growth is a positive thing to take away for Britain’s builders’ merchants, but with a note of caution around the relative impacts of inflation over volume growth. Current demand is strong and may well continue. However, the rate at which increased energy and raw material costs are driving up prices and the challenges this poses throughout the supply chain down to the end customer remains a concern.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and is regarded as the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK.

The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.

February’s BMBI report, published in April, is available to download at www.bmbi.co.uk.