The latest BMF Builders Merchant Building Index (BMBI) reveal that sales at builders’ merchants have shown a positive start to the year, “largely due to a significant upturn in March which saw value sales increase by +7.2% compared to the same month last year.”

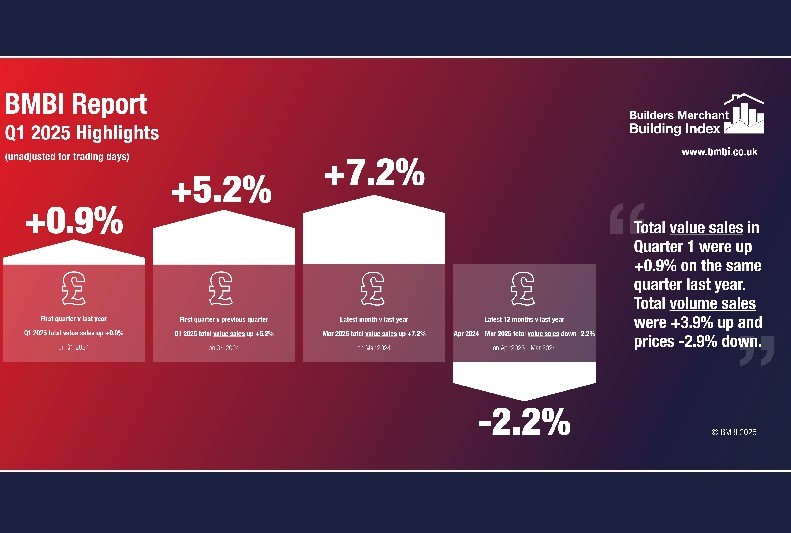

Quarter 1 2025 v Quarter 1 2024: Looking at the Quarter as a whole, year-on-year total value sales in Q1 2025 grew by +0.9% on the same period in 2024. Total volume sales increased by +3.9%, while prices fell -2.9%.

Sales increased in eight of 12 product categories. This included a strong performance by the largest category, Heavy Building Materials, led by Blocks and Aggregates followed by Bricks and Roofing tiles, which saw value growth of +2.0%, volume growth of +5.8% and a price decline of -3.6%. Other categories outperforming the total market for value growth included Services (+5.3%), Tools (+2.9%) and Landscaping (+2.6%).

However, total value sales for Timber & Joinery Products, the second largest category, underperformed the overall market, with Q1 2025 sales value down -1.4% against Q1 2024. Volume increased by +2.9%, with price down by -4.2%, with Sheet Materials the main driver behind this decline.

Workwear and Safetywear (-3.3%), Decorating (-3.2%) and Kitchens & Bathrooms (-2.7%) were the other categories experiencing year-on-year value decline against Q1 2024.

Quarter 1 2025 v Quarter 4 2024

A comparison of value growth in Q1 2025 with Q4 2024 shows total value sales in the latest three months were +5.2% higher than in the previous three months. Total volume sales increased by +5.8%, and prices were down by -0.5%. Eleven of the 12 categories sold more, led by the seasonal category of Landscaping, where value sales increased by +14.1%. Workwear & Safetywear (-0.8%) was the weakest category.

With two more trading days in Q1 2025, like-for-like value sales were +1.9% higher than the previous quarter.

Latest 12 months v last year (April 2024-March 2025 v April 2023-March 2024)

Total value sales in the 12 months April 2024 to March 2025 were -2.2% lower than the previous period. Total volume sales were -1.4% down, with prices down -0.8%. With four more trading days in 2024, like-for-like value sales were -3.8% lower.

Value sales increased in five of 12 categories, led by Tools (+7.2%), Workwear & Safetywear (+6.6%) and Services (+4.3%). Conversely, value sales in Timber & Joinery Products (-4.2%), Kitchens & Bathrooms (-2.9%) and Heavy Building Materials (-2.8%) were weaker than the Total Merchants figure.

John Newcomb, CEO of the BMF, said: “A positive view of the first quarter of 2025 may suggest a market poised on the brink of an upturn, yet the outcome for the rest of the year remains uncertain. While we would like to remain optimistic that the brighter picture emerging in March will continue, much will depend on the return of consumer confidence; with inflation rising again, this may take some time. It is proving a difficult year to forecast with any accuracy.”

Emile van der Ryst, Key Account Manager – Trade & DIY at NiQ GfK said: “The Builders Merchants channel has made a strong start to 2025, taking into account previous years and the various macroeconomic and political concerns, both locally and globally. However, this position may be short-lived, as general expectations for the sector have become more negative compared to views at the beginning of the year.

“The second quarter results will be shaped by the autumn budget and the realities surrounding it, while the US-China trade war adds another significant layer to ongoing global uncertainty, which may affect merchanting sales.”

Mike Rigby, MD of MRA Research which produces this report, added: “To say it’s been a tempestuous start to the year would be a considerable understatement, as the world struggles to adapt to the rapid shifting of its foundations triggered by Trump’s volcanic tariffs onslaught.

“Relief that the UK has agreed a deal with the US has been short-lived as economists agree there’s little substance in it to drive growth. Other world leaders who have yet to sign a deal are contributing to the uncertainty and churn. For now, and the next five years at least, it’s goodbye Davos and know-where-you-stand treaties, and hello to the Godfather and an-offer-you-can’t-refuse.”

Mike continued: “With such monumental geoeconomic headwinds, how will UK construction be affected? Even if the tariff tsunami is resolved quickly, a certain amount of disruption to supply chains and increased production costs is baked in. Given the cumulative impacts on uncertainty, I imagine consumer confidence and its effect on RMI and property will take longer to recover.

“Given the chaotic backdrop, merchant’s year-on-year March sales, and year-on-year Q1 sales are more robust than we could have expected. Admittedly, March 2024 and Q1 2024 were nothing to shout about, but month-on-month and quarter-on-quarter sales are also positive.

He added: “The Construction Products Association reported a mixed start to the year with 15% of heavy side manufacturers reporting quarter-on-quarter decreases for Q1, while 55% of light side manufacturers said sales increased – the strongest result since Q3 2019. Despite the disparity in fortunes, manufacturers remain optimistic about the year ahead.

“Animal spirits are resilient and powerful, but confidence has taken a battering. GfK’s long-running Consumer Confidence Index decreased by four points to -23 in April. All measures were down compared to March, and expectations for the general economic situation over the next 12 months fell to -37, sixteen points worse than April 2024.

Mike concluded: “However, the Major Purchase Index component of the Consumer Confidence Index which correlates with larger domestic purchases and RMI projects is down two points at -19, six points better than April last year, so not all bad! Wages rising faster than prices, and more interest rate cuts to come will also provide relief for consumers.

“In practice, whether consumers postpone big purchases in 2025 or not will depend on a mix of domestic and global factors. The world feels more fragile and uncertain now than at any time since the Berlin Wall came down in 1989.”

The Q1 2025 BMBI report is available to download at www.bmbi.co.uk

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date proxy for Repair, Maintenance, and Improvement (RMI) activity in the UK.

The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 88% of total sales from builders’ merchants throughout Great Britain.

An in-depth review, which includes commentary by sector experts, is produced each quarter.