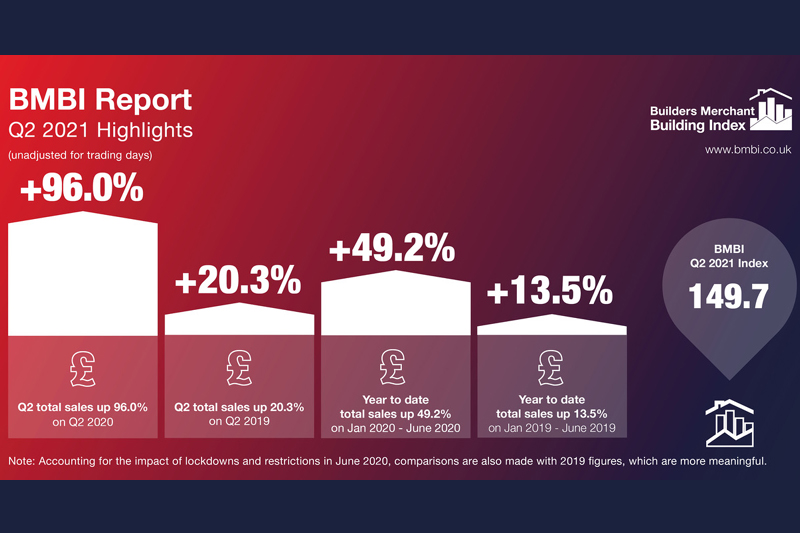

The latest report from the BMF’s Builders Merchants Building Index (BMBI) confirms Q2 2021 as the best performing quarter on record for sales through GB builders’ merchants.

Total builders’ merchant sales in Q2 2021 increased by +96.0% over Q2 2020. While this reflects the severe adverse impact of the initial Covid lockdown, looking further back the BMBI figures show Q2 2021 merchant sales increasing by +20.3% against Q2 2019.

All categories sold more in Q2 2021 compared with the same period in both of last two years.

Confirming the strength of the market, 2021 quarter on quarter sales also showed significant growth. Sales in Q2 2021 were 24.1% higher than in Q1, with two less trading days in Q2. Average sales a day in Q2 were 28.1% higher than in Q1.

Q2 2021 vs Q2 2020 – Year on Year

Two of the strongest performers in Q2 2021 were the weakest in Q2 2020; Tools increased by +151.4% and Kitchens & Bathrooms by +141.3%. In addition, four categories had their best-ever quarterly sales since the BMBI started in July 2014 – Timber & Joinery Products (+134.6%), Ironmongery (+105.9%), Heavy Building Materials (+81.4%) and Landscaping (+71.1%).

Q2 2021 vs Q2 2019 – Year on 2 Year

Comparing Q2 2021 with the same quarter two years ago, it is clear that the two strongest performers, Landscaping (+48.3%) and Timber & Joinery Products (+41.3%), drove the overall increase. Sales increases were recorded in all categories, with the largest product category, Heavy Building Materials, up by +11.8%. Other categories recorded smaller increases, including Plumbing Heating & Electrical (+3.2%), Decorating (+1.7%) and Kitchens & Bathrooms (+1.5%).

Q2 2021 vs Q1 2021 – Quarter on Quarter

Ten of the 12 product categories sold more in Q2 than Q1. Once again Landscaping (+67.8%) was strongest, followed by Timber & Joinery Products (+29.3%) and Heavy Building Materials (+20.5%), with Decorating (+11%) and Kitchens & Bathrooms (+8.6%) amongst the others showing growth. Only Plumbing, Heating & Electrical (-3.5%) and Workwear & Safetywear (-11.4%) sold less.

John Newcomb, CEO of the Builders Merchants Federation, said: “This quarter’s results reflect both the strength of the current market and the vital role of builders’ merchants in the supply chain. With high global demand and UK workloads continuing at extremely high levels, merchants have done a fantastic job managing product demand and supply. The challenges faced in the first half of the year are likely to continue and the building materials supply chain will be working closely with customers to keep projects on track.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK, added: “At the end of Q2 2020 the builders’ merchant sector was coming to terms with the initial fallout of the global pandemic and had just started to reopen. Fast forward twelve months and last year’s ‘lost’ quarter has been replaced by the best performing quarter on record. The well documented surge in house building and buying has played a key role, while the stock shortages experienced across the UK hasn’t slowed down market performance.

“The second half of the year is difficult to predict but will be fascinating to track.”

Click here to download the BMBI Q2 2021 report

The Builders Merchant Building Index (BMBI) report contains data from GfK’s ground-breaking Builders Merchants Panel, which analyses data from over 80% of generalist builders’ merchants’ sales throughout Great Britain. The BMBI, a brand of the BMF, is produced and managed by MRA Research.

GfK’s Builders’ Merchant Point of Sale Tracking Data is said to set a gold standard in reliable market trends. Unlike data from sources based on estimates, or sales from suppliers to the supply chain, this up-to-date data is based on actual sales from merchants to builders and other trades.

More information can be found at www.bmbi.co.uk