Writing in PBM’s April 2022 issue, editor Paul Davies reflected upon the many mergers and acquisitions that have affected the composition of the latest ‘Top 20’ merchant league table and considers the broader impact on the wider merchant market.

As you will see from our annual pull-out supplement which details the trading performance of the sector’s largest businesses throughout 2021, the merchant industry continues to evolve in quite dramatic ways. Significantly, despite a number of common underlying trends, the transformation is moving in a number of different directions — for some, the last twelve months have been a time of ‘strategic focus’ as companies such as Travis Perkins plc and Saint-Gobain Building Distribution UK dispose of their plumbing & heating brands to pinpoint ‘general merchanting’ core as a foundation for success.

And this targeted approach extends beyond product categories. TP, for instance, also divested its Wickes retail arm whilst Grafton’s sale of its ‘traditional merchanting’ operations of Buildbase et al allows it to invest in, and further expand, its extremely successful Selco proposition.

Conversely, for many others, diversification is key — witness the Independent Builders Merchant Group’s growth being fuelled in part by the expansion of its electrical division in addition to the acquisition of a number of plumbing & heating specialists to supplement its existing strength in heavyside.

Private equity funding very much remains a factor behind the sector’s ‘readjustment’, and scale is also a central issue. It wasn’t all that long ago three or perhaps four firms dominated ‘at the top’ — now, the Top 10 and beyond have either already achieved or are well on the way to what was once loosely termed ‘supermerchant status’.

“Delving into the year-end reports and reading the submissions we have received in compiling our countdown, the post-pandemic recovery continues apace for streamlined operations in a booming market.”

The broader implications have the potential to be far reaching, for competition on a local level to affecting the ‘influence’ of the buying groups, but the general direction of travel seems set for now at least.

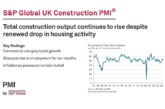

Indeed, the merchant sector is clearly an attractive place to be at present. Delving into the year-end reports and reading the submissions we have received in compiling our countdown, the post-pandemic recovery continues apace for streamlined operations in a booming market.

However, behind the numbers there are plenty of references to the commonly understood underlying problems. Sustainability and environmental issues, ecommerce and omnichannel trading, and ‘people’ — from the recruitment and retention of staff, to the skills shortage and an aging customer profile — are all predominant themes in need of industry-wide solutions.

Concerns over supply chain disruption and material price increases also remain high. And, as if Brexit uncertainty and a global pandemic weren’t enough to contend with over the last five years, the harrowing situation in Ukraine — though it seems crass to discuss anything other than the plight of those still in or fleeing the besieged country — is already impacting upon the global economy.

Even before the invasion, a cost of living crisis was building within the UK and the impact on the sector of even higher energy bills and rising inflation cannot be underestimated — in terms of both the disposable income of end customers and on increased business costs alike.

Yet in a time of great uncertainty across the world, it is worth reflecting once again on the resilience of the merchant sector. The numbers and comments we present in this issue highlight its ability to adapt and thrive in the face of significant challenge, whilst the shockwaves of recent years ensure it is in a robust shape to navigate whatever comes next.