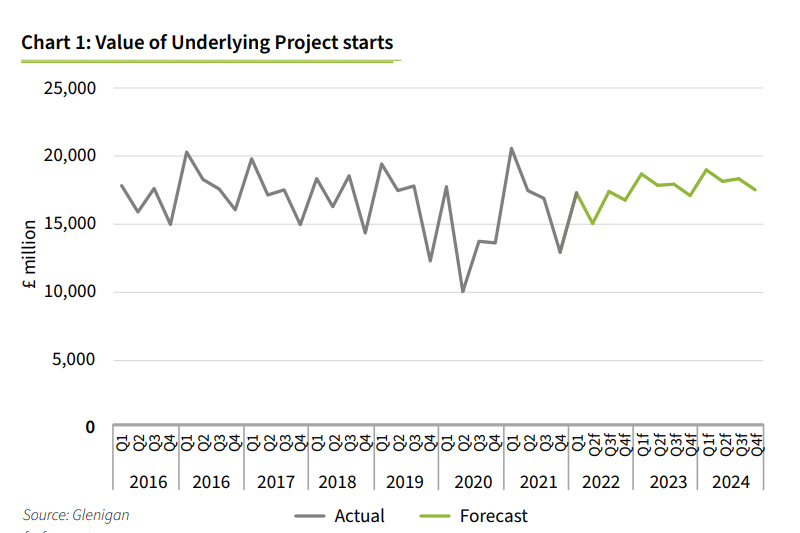

Glenigan’s recently-released UK Construction Industry Forecast 2022-2024 indicates that the “current tough circumstances will give way to a return to growth in the next three years”.

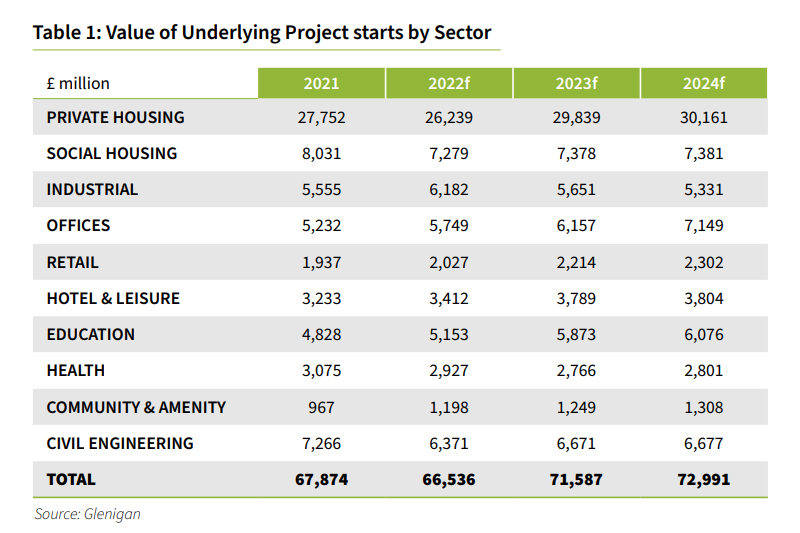

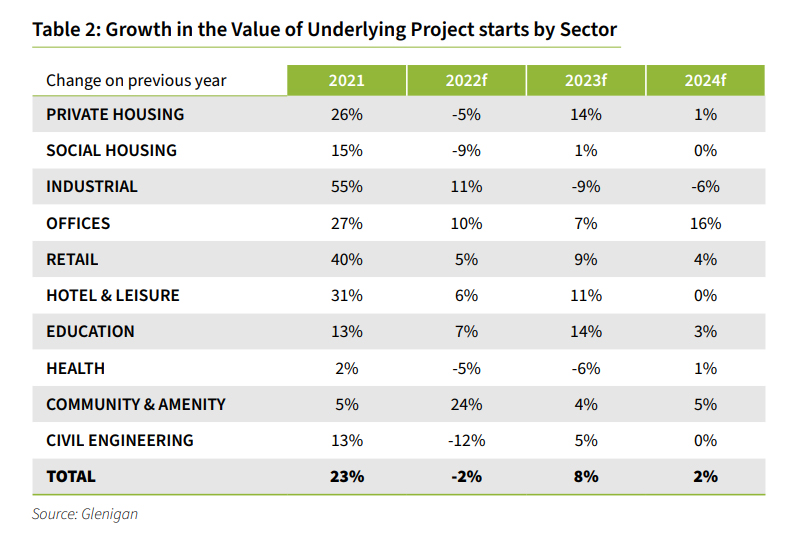

Predominantly focused on underlying starts (< £100m in value), the Forecast indicates that whilst growth will be stifled in 2022 (-2%), 2023 is predicted to see a modest 8% increase and a smaller 2% lift in 2024, representing an average rise of 2.6% over the Forecast period.

Significant disruption stifles short-term growth

Containing a comprehensive overview of the sector, the report outlines how the next few years will be challenging for the construction industry as a whole. The war in the Ukraine is creating considerable economic uncertainty which is having a direct, current effect on output, derailing post-COVID recovery. As a result, overall project starts are forecast to slip back 2%.

Aside from this ongoing conflict, current inflation spikes, higher taxes and rising mortgage costs are expected to constrain activity in consumer-related areas, such as private housing, retail and hotel & leisure.

In contrast, “a firm development pipeline is predicted to lift industrial and office starts in 2022, as well as Government-funded areas such as education, health and community & amenity”. Furthermore, it contends that the value of project starts is expected to rise in 2023 as the UK economy stabilises and short-term supply chain pressure ease. However, “the lingering impact of higher construction, material and energy costs means this growth will be significantly lower than predicted in previous forecasts”.

Housing Starts Depressed

Although a buoyant housing marked helped to lift new housebuilding activity in 2021, with starts rising 26%, “this recent surge is fading”. Predicted to drop 5% in 2022, following the removal of temporary Stamp Duty relief and dwindling homebuyer confidence, higher taxes and mortgage costs, “housebuilders are expected to moderate project starts and focus on building out developments already on-site”.

According to the the report though, this slowdown “appears temporary, with a renewed build-for-sale starts recovery anticipated in the second half of the Forecast period, rising 14% in 2023 and 1% in 2024, as household financial positions and UK economic prospects improve”. In addition, a strong development pipeline has also be registered for Build-to-Rent starts, following a productive 12 months in 2021.

Bright spots for non-residential work

The report considers the market for industrial starts, including warehousing, retail, leisure and hospitality. Office starts, for example, “bounced back sharply” last year (+27%) and are predicted to benefit over the forecast period (av. +11%). This potential growth can be attributed to a rise in refurbishment projects as tenants and landlords adapt premises to accommodate changing working practices.

New build office projects will likely be slower to recover as tenants and developers assess the effects of the shift towards remote and hybrid working on the long-term demand for office accommodation.

Public Sector Pick-Up

Public sector investment is set to be an important driver for construction activity over the Forecast period, although the latest Spending Review revealed only modest growth in capital funding for a handful of central Government departments over the next three years.

Whilst the value of social housing starts is set to dip almost 10% this year, following a 15% surge in 2021, the vertical is “predicted to rally for the remainder of the Forecast period, helped by a strong pipeline of already approved projects commencing on site”.

Commenting on the Forecast, Glenigan’s economic director Allan Wilen said: “Circumstances have changed significantly since the November 2021 Forecast and, whilst the short-term picture appears challenging, we should adopt a sanguine approach for the next few years. Markets sent into turmoil by the Russia-Ukraine War are starting to stabilise as new supply chain solutions are developed and established.

“Of course, in the near future construction and building product costs will remain high. However this situation will no doubt encourage a burst of imagination and innovation which will see the sector weather the current storm and progress to, if not sunny uplands, then at least towards a trajectory of upward growth.”

To find out more about Glenigan, its expert insight and leading market analysis, click here.