July PMI data compiled by IHS Markit and the Chartered Institute of Procurement & Supply (CIPS) highlighted that the recovery in UK construction output has lost momentum since June, with slower growth seen in all three main categories of work.

Survey respondents often cited difficulties keeping pace with the recent surge in demand for construction projects, especially due to raw material supply shortages and shrinking sub-contractor availability. With demand for construction materials continuing to outstrip supply, the latest data signalled another steep increase in purchasing prices.

Around 81% of the survey panel reported a rise in their average cost burdens during July, while only 1% signalled a decline.

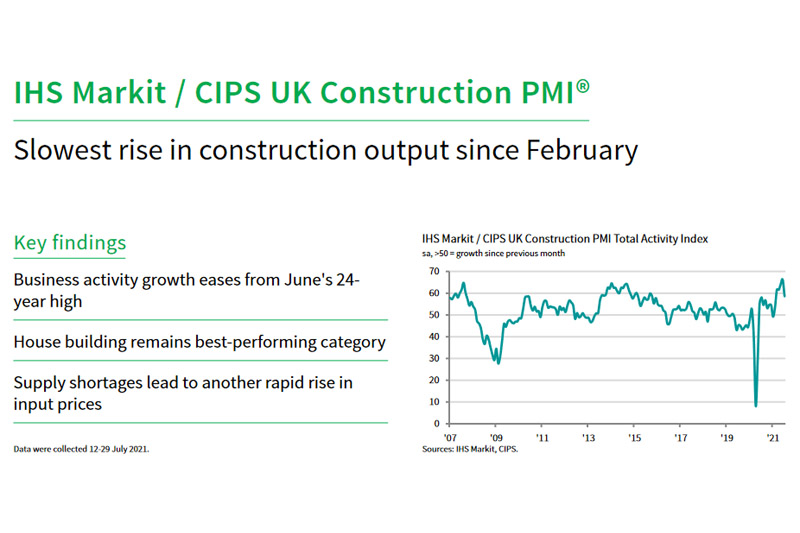

The headline seasonally adjusted IHS Markit/CIPS UK Construction PMI Total Activity Index registered 58.7 in July, down sharply from June’s 24-year high of 66.3 but still well above the crucial 50.0 no-change threshold. However, the latest reading signalled the slowest overall increase in construction output since February.

House building was the best-performing category in July (index at 60.3), followed closely by commercial building (59.2). In both cases, the rate of expansion was the weakest since February. This mostly reflected stretched business capacity and growth constraints due to supply issues, but some firms noted that the post-lockdown spike in customer demand had started to wane.

Civil engineering activity (55.0) followed the momentum seen elsewhere in the construction sector during July, with growth easing sharply since June and the lowest for five months.

Total order books continued to improve in July, but the latest rise in new work was the weakest since March. Similarly, input buying expanded at the slowest pace since April amid a softer recovery in demand. Construction companies also noted that reduced materials availability had acted as a brake on purchasing volumes in July.

Around 66% of the survey panel reported longer wait times for supplier deliveries in July, while only 2% signalled an improvement in vendor performance. The resulting index signalled widespread supply chain delays, although the latest reading was up from June’s record low and the highest for three months. Survey respondents noted that supply imbalances were amplified by a lack of transport availability, port congestion, and Brexit trade frictions.

A rapid pace of input cost inflation continued in July, fuelled by supply shortages and robust demand for construction items. Higher charges among sub-contractors and difficulties filling staff vacancies also added to price pressures. Indeed, the latest decline in sub-contractor availability was the second-fastest since the survey began in 1997, exceeded only by that seen during the lockdown in April 2020.

Finally, construction firms continued to hire staff at a strong pace, reflecting rising orders and confidence regarding the near-term outlook. While optimism toward future output growth remained historically high, the index drifted down to its lowest for six months in July.

Tim Moore, Economics Director at IHS Markit which compiles the survey, said:

“July data marked the first real slowdown in the construction recovery since the lockdown at the start of this year. It was unsurprising that UK construction companies were unable to maintain output growth at the 24-year high seen in June, especially with widespread supply shortages and constrained capacity to take on additional orders.

The loss of momentum spanned all major categories of construction work and was most pronounced in the house building sector. Long lead times for materials and shrinking sub-contractor availability were cited as factors holding back work on site.

Around two-thirds of the survey panel experienced longer wait times for supplier deliveries in July, while just 2% reported an improvement since the previous month.

Another rapid increase in purchasing costs was linked to global supply and demand imbalances, but many firms also noted that local issues had amplified inflationary pressures. These included a severe lack of haulage availability, continued reports of Brexit trade frictions, and greater shortages of contractors due to exceptionally strong demand.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said:

“The pace of growth in the construction sector slowed sharply in July as all three PMI surveys showed slower growth in the UK economy. The pervasive weaknesses in supply chains along with a lack of staff and contractor availability were laid bare as construction lost some of its get-up-and-go.

The rampant rise in prices for raw materials and transportation continued to be the construction’s heavy load along with historically long delivery times. Though there was a slight improvement in supplier performance from June’s record low, it was partly as a result of frustrated supply chain managers reining back on purchases that were unlikely to arrive when needed.

Businesses were also unable to expand on staff capacity, where even the most prolific hiring periods since 2014 was insufficient for builders’ ability to complete work in hand.

Faced with transport disruptions, shortages of essentials and Brexit delays, the initial spurt of activity this year is fast hitting the rocks. Building optimism was dampened to the lowest since January as it is difficult to foresee when all these challenges are likely to subside.”

Related News:

UK Construction PMI for June 2021

UK Construction PMI for May 2021

UK Construction PMI for April 2021