PBM offers a round-up of industry comment in relation to George Osborne’s 2015 Summer Budget:

John Newcomb, Managing Director of the Builders Merchants Federation (BMF):

“Apprenticeships are the life blood of our economy. We have been urging the Chancellor to ensure the future funding provision for apprenticeships is sufficiently attractive to encourage employers to invest in developing new talent and training. The apprenticeship levy is a welcome and much needed boost to this. It means there is a real incentive to take on apprentices.

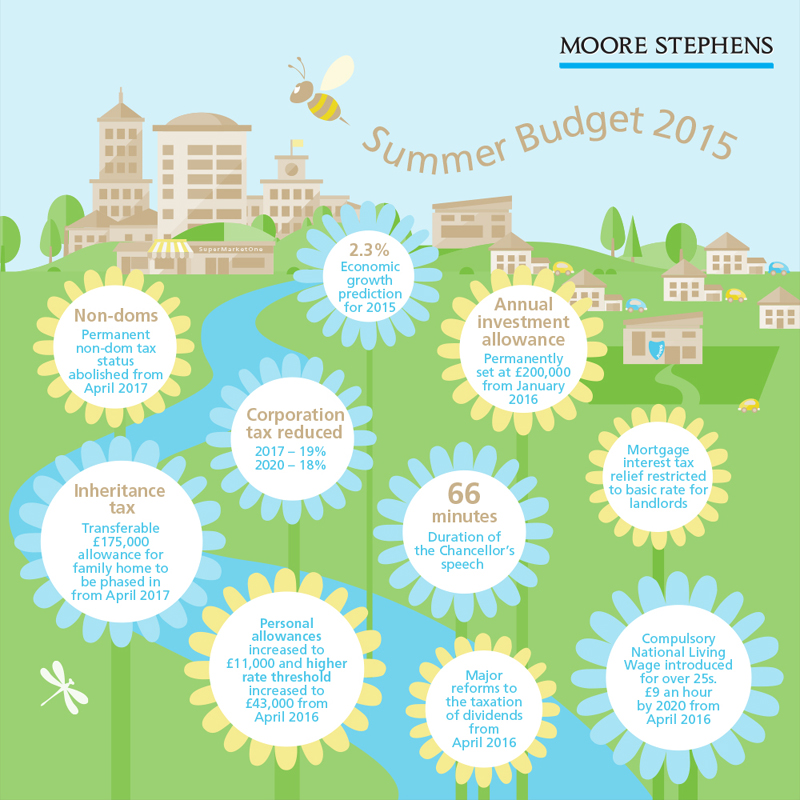

“The setting of the level of the Annual Investment Allowance to £200,000 by January and raising the Employment Allowance by £1,000 to £3,000 by April next year will help our SME members, in particular.

“The freezing of fuel is also good news but and will be offset by the higher wage bills due to the rise in the Living Wage. Members will be squeezed by this in the short term especially as the fall in corporation tax to 18% will not take full effect until 2020.”

Dr Diana Montgomery, Chief Executive of the Construction Products Association:

“We were pleased by plans — that were in line with our recommendations — of the permanent setting of the annual investment allowance of £200,000 from January 2016. This will offer industry confidence in the long-term to invest in new innovative plant and machinery equipment which will impact positively on productivity.

We are encouraged by the announcement that government will be bold in in the delivery of infrastructure especially in terms of roads. The Chancellor’s commitment to the £15 billion road spending plan and his recognition of a long-term road investment programme offers certainty to industry.

Finally, we are pleased to hear that the main rate of Corporation Tax which had already been cut from 28% in 2010 to 20%, will now fall further, from 20% to 19% in 2017, and then to 18% in 2020.

“However, what was starkly missing was any indication of policies to incentivise energy efficiency of existing housing. We continue to press the government to recognise the tremendous potential for improving the housing and commercial building stock and improve the cost of living for home owners.”

Brian Berry, Chief Executive of the Federation of Master Builders:

“The construction industry is at a loss as to why the Government is ignoring the need to improve our current housing stock. By refusing to acknowledge the importance of these improvements, the Government is exacerbating problems such as high household fuel bills, carbon emissions and the national housing shortage.

“First and foremost, the Government has a legally binding target to reduce the UK’s carbon emissions by 80% by 2050 and our existing homes account for 27% of our current emissions. Simple logic suggests that if they do not address 27% of the issue, that target will not be met. Climate change is an issue that concerns the majority of the population, but without tackling the energy inefficiency of our housing stock, the Government is not taking cutting carbon emissions seriously. This is rather surprising when you consider that not long ago, the Prime Minister wanted his Conservative-led Coalition to be the “greenest Government ever.”

“What’s more, the issue goes to the heart of household finances. By improving energy efficiency in our homes, the Government will reduce fuel bills and put more money back in the pocket of the consumer. The benefits of taking action in this area are clear and the Government is aware of this but seems determined to sit on its hands. Making our existing homes a national infrastructure priority, re-directing carbon taxes, putting an energy efficiency financing framework in place and reducing VAT on housing renovation and repair work from 20% to 5% are all effective and implementable measures. We urge the Government to wise up on energy efficiency — we want to work with Ministers to find a sustainable solution.”

Iain McIlwee, Chief Executive of the British Woodworking Federation:

“This is a complex Budget for businesses in our sector, the true impact of which probably won’t be known for a while. There was a very positive announcement earlier this week about the Housing Growth Partnership initiative to bring in added support for small builders. The Government’s continued commitment in this Budget to new home building and infrastructure is also very welcome.

“But our concern is that it may, on closer scrutiny, turn out to be a Budget of indirect and hidden costs to the construction industry, the very engine of growth the Chancellor is depending on most.

“Like others, we have serious concerns about the future security of income for housing associations and their likely ability to maintain their development or refurbishment programmes. Affordable housing is already on its knees. Planning reforms will need to reduce development costs significantly to give us any chance of a sustainable social housing sector in the future.

“And looking at the direct impact on SMEs in the construction supply chain, while an increase in the minimum wage for the lowest paid is welcome, we cannot ignore the fact that such increases have a knock-on effect throughout a business, creating inflation in a firm’s total wage bill. Our latest State of Trade survey among Britain’s joinery manufacturing firms already reveals that 73% of respondents had seen a sharp increase in labour costs, and this is fast becoming a constraint on business. Wage inflation and other increases in the cost of doing business, such as the IPT increase, will need to be properly offset by the cuts in Corporation Tax and increases in employment allowances.”

Mike Quinton, Chief Executive of NHBC:

“NHBC registered 145,174 new homes for development in 2014 across the UK, up 9% on 2013, but with research showing that 245,000 homes are needed every year to meet demand, there is still some way to go.

“We welcome the launch of The Housing Growth Partnership earlier this week, which gives vital financial support to small and medium sized housebuilders. It also helps to increase the supply of new homes that our country so desperately needs.

“Small housebuilders and developers have contributed to UK housing output throughout history. However, in recent years the number of smaller builders have not returned to the market at the same rate following other recoveries. Research by NHBC last year found that access to finance is one of the biggest barriers preventing smaller housebuilders.”

The following infographic from Moore Stephens outlines a number of the key points made in the Budget: