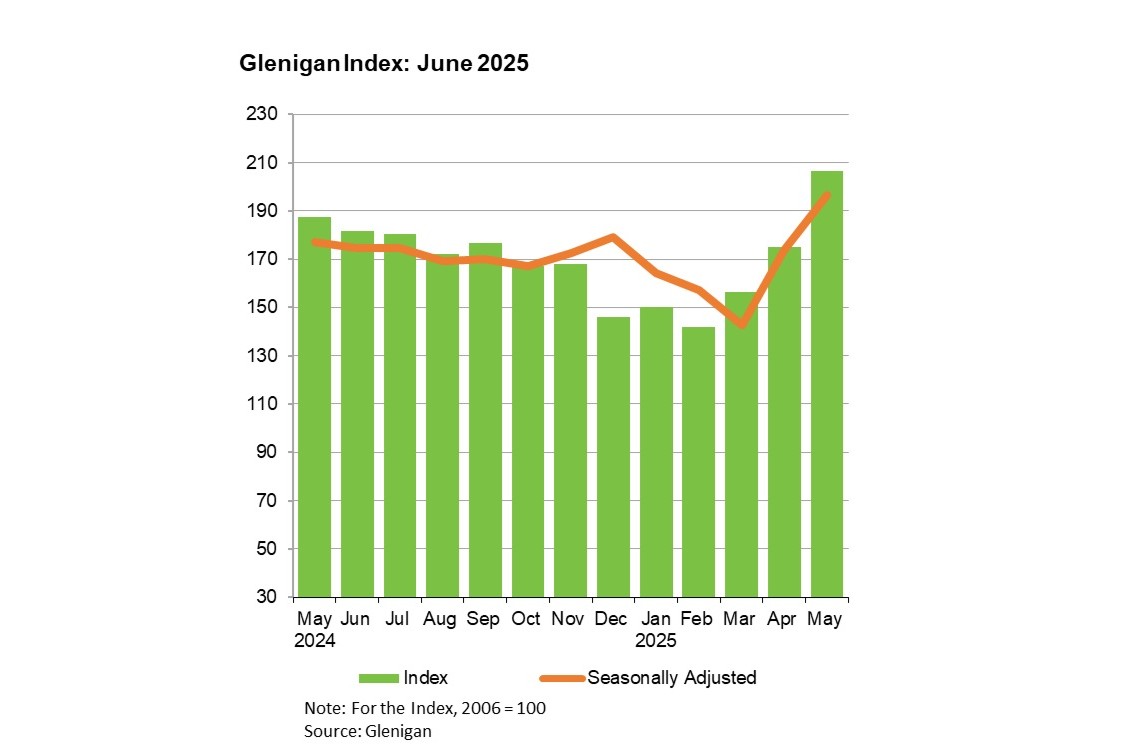

The June 2025 edition of the Glenigan Construction Index reports that the sector’s “underlying performance is on the rise during Q.2 2025.”

Providing a detailed and comprehensive analysis of year-on-year construction data, the latest Index focuses on the three months to the end of May 2025 and covers all underlying projects with a total value of £100m or less (unless otherwise indicated), with figures seasonally adjusted.

Continuing the upward trend of the previous editions of the Index (specifically April and May 2025), June “paints an increasingly optimistic picture of an industry that is finally bouncing back following years of uncertainty.”

According to Glenigan, these encouraging signals are borne out by a 25% uptick in projects starting on site in the three months to the end of May, whilst they also held firm against 2024 figures, posting a 10% increase. Once again, performance was buoyed by the residential construction market which rocketed 49% on the preceding three months to finish an impressive 45% higher than last year.

Whilst the non-residential sector was shown to have fallen by almost a fifth (-18%) compared to 2024 numbers, it “held its own in the face of still-challenging socioeconomic conditions, breaking even when performance was measured against the three months to the end of May.”

The decline in civils, which Glenigan describes as having been “so severe” over the past few Indexes, softened. Despite dropping by a third (-33%) compared to last year, “it only went down by a modest 2% during the core measurement period.”

Allan Wilen, Glenigan’s Economics Director, commented: “The industry will welcome these results as, despite the downturn in major projects (Construction projects valued at >£100m) recently shown in the May Review, the underlying market, which represents the majority of work across the sector, appears to be on the up.

“Perhaps a higher degree of ‘relatively’ good news business stories coming from Downing Street is giving many investors that boost they so desperately needed to get building. Certainly, if the very strong figures in the residential vertical are anything to go by, we’ll likely see the curve continue to rise into H.2 2025.”

Allan continued: “Of course, the much-anticipate Spending Review is revealed this month and should have an interesting effect on industry confidence. Coming out just shy of our own Spring/Summer Forecast these two documents should offer a fascinating indicator of the future direction of activity across UK construction.”

To find out more about Glenigan and its construction intelligence services click here.

Sector Analysis – Residential

Residential construction was the standout performer in the June Index, where starts increased 49% on the preceding three months and rose 45% against 2024 figures. Drilling deeper, private housing construction-starts increased by 55% against the preceding three months, experiencing a 56% increase on the year before.

Likewise, Social Housing increased 29% against the preceding three months to stand 13% up on the previous year.

Sector Analysis – Non-Residential

Results were slightly less spectacular in non-residential verticals. Offices experienced a mixed period, rising 8% against the preceding three months but remaining 6% below the previous year. Hotel & Leisure followed a similar trend, rising 10% against the preceding three months but remaining 4% below the previous year.

Retail declined 14% against the preceding three months to stand 26% down against the previous year. Education also fared poorly, decreasing 10% against the preceding three months and decreasing 52% against the previous year.

Community and amenity project-starts declined 6% against the preceding three months and the previous year. Health followed a similar trend, declining 15% against the preceding three months to stand 11% lower than the previous year.

Civils work starting on-site declined 2% against the preceding three months and decreased 33% against the previous year. Breaking this down further, infrastructure work starting on-site decreased 1% against the preceding three months and decreased by 28% on the previous year. Utilities starts also experienced poor performance, declining 2% against the preceding three months to stand 38% down against the previous year.

Regional Outlook

The South West experienced a strong performance, increasing 27% against the preceding three months to stand 24% up against the previous year. The North West performed similarly, rising 58% against the preceding three months and rising 1% against the previous year.

The South East experienced a mixed results, rising 30% against the preceding three months to stand 2% down against the previous year. The Capital rose 30% against the preceding three months to stand 2% up against the previous year.

The North East experienced a strong performance, increasing 21% against the preceding three months to stand 10% up against the previous year. The West Midlands increased 34% against the preceding three months to stand 11% up against the previous year.