Lords Group Trading plc has provided a trading update for the year ended 31 December 2023 ahead of publication of its FY23 Final Results in May 2024.

During the period the Group’s trading is shown to have “again demonstrated Lords’ resilience and capability to deliver its growth strategy amidst the continuing subdued trading conditions. In the face of these conditions, Lords has made steady operational progress across both Merchanting and Plumbing & Heating divisions.”

Furthermore, seven additional sites across the UK have been added through acquisitive and organic growth which the company says will be “generating an expected £25 million of annualised revenues at maturity.”

As a result, the Group expects to report, subject to audit, FY23 revenue of £463 million (FY22: £450 million) and FY23 adjusted EBITDA of approximately £26.6 million (FY22: £30.0 million), in line with current market expectations, and adjusted profit before tax of approximately £11.0 million (FY22: £17.4 million).

Segmental Trading

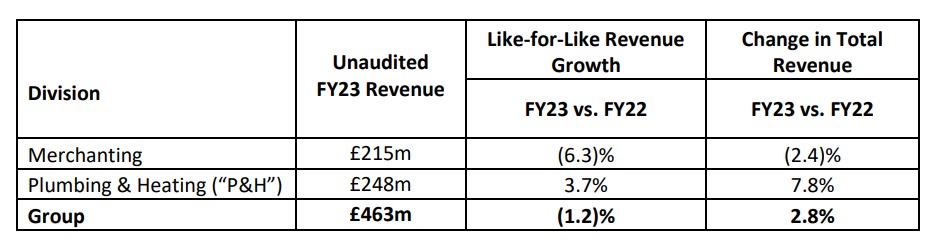

The table below shows total revenue growth and like-for-like for FY23:

Overall, the Group says it has “experienced further resilient trading across the business, despite wider market headwinds, resulting in total sales growth of 2.8%.” And in addition to organic growth, the Group “successfully executes a unique M&A strategy that is focused on creating market share gains, enhanced profitability and further diversifying revenue streams.”

The update notes that “Lords targets specialist, independent businesses that broaden product range or geographic reach in order to do this. The Merchanting and P&H markets remain highly fragmented, offering significant opportunity given Lords’ reputation as being an acquirer of choice in the market.”

Accordingly, the Group notes that it “continues to maintain a prudent and considered approach to inorganic growth and, whilst a pipeline of acquisition opportunities remains live, in the current environment the Group is committed to balance sheet discipline which will remain in FY24.”

Renewables product range extension

A key focus in recent years for the business has been on “product range extension in the renewables space… with strong growth drivers and market dynamics complementing Lords position in the supply chain.”

The report references that, in Q4 2023, the Government confirmed that the widely consulted Clean Heat Market Mechanism will commence in Q2 2024. The CHMM is designed to incentivise boiler manufacturers and homeowners to accelerate the transition towards renewable energy sources across the UK housing stock, increasing demand for renewable products including air source heat pumps.

Lords states that it is “well placed to benefit from a shift in demand towards air source heat pumps, enjoying successful and growing trading relationships with six air source heat pump manufacturers and achieving 60% revenue growth across its wider renewables range (incorporating air source heat pumps, controls, underfloor heating, air con and electric boilers) in FY23.”

Current Trading and Outlook

Throughout FY23 Lords says it “has demonstrated resilient organic growth, in a sector which has seen a challenging period… The Group continues to successfully apply a number of steps to manage costs and reduce debt.”

In addition, it noted: “The markets in which we operate in are expected to remain subdued into FY24 and, whilst there are signs of improvement in customer demand, these signals remain intermittent and price deflation persists. This has led the Group to continue to take a prudent approach to FY24 in order to give the market dynamics appropriate time to recalibrate as economic volatility reduces.”

Shanker Patel, Chief Executive Officer of Lords, commented: “Like many of our peers it has been a challenging year but the fundamentals of our business have underpinned a resilient performance that I’m incredibly proud of.

“Our scale and profitability in both Merchanting and Plumbing & Heating have benefitted from our organic growth levers as we build our geographic footprint, extend our product range and build our digital sales expertise. We maintain an ongoing ability to execute earnings enhancing M&A, but balance sheet discipline remains a core consideration. In that regard it is pleasing to report net debt reduction ahead of market expectations. As market conditions improve we are confident that we are exceptionally well positioned for growth.”

Lords operates through the two divisions of Merchanting and Plumbing & Heating. In the Merchanting division, it operates both in lightside and heavyside through 31 locations in the UK. In Plumbing and Heating, the business operates as a specialist products distributor to a

network of independent merchants, installers and the general public via both a multi-channel offering and from 17 physical locations.

Lords was established over 35 years ago as a family business with its first retail unit in Gerrards Cross, Buckinghamshire. Its stated aim is to become a £500 million turnover building materials distributor group by 2024 as it grows its national presence, whilst the business was admitted to trading on AIM in July 2021 with the ticker LORD.L.