At its first physical event with Partners and Suppliers since the beginning of the pandemic, held in November at the Belfry Hotel & Resort, National Buying Group (NBG) revealed its market report results for 2021.

The report asked NBG Partners to reflect on business operations during the pandemic and look to the future, predicting sales projections for the next two years. Partners were encouraged to be candid about their greatest threats, opportunities and areas for business improvement going into 2022 and beyond. A total of 73 Partner Principals responded to the survey.

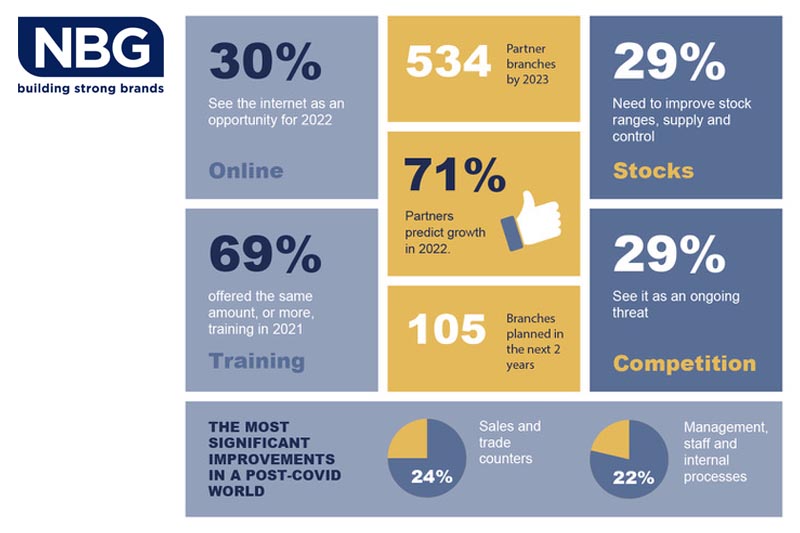

In an exciting result, the survey revealed that Partners are planning to open new branches in the next few years, with an estimated 10% (44 branches) to open in 2022 and a further 14% (61 branches) in 2023. This projection would bring NBG Partners to a collective total of over 500 branches.

The report also revealed that sales projections are looking strong for the next 12 months, with 71% of Partners predicting either a small or strong growth. Of the remaining 29%, half said they were unsure in which direction their sales were going to move in the next year.

Following the boom in construction from 2020-21, the independent builders’ merchant industry is appearing lucrative. The survey showed that overall, NBG Partners have a positive outlook for 2022, with three quarters of Partners’ sales predicted to continue growing over the next 12 months.

The majority of Partners surveyed said that they have made significant business improvements during Covid, which is something they intend to remain focused on next year. Of the Partners that participated in the survey, 65% have made internal improvements to their business, including working on sales and trade counters, boosting staff morale, streamlining internal communications and improving customer relationships, to name a few.

When asked what improvements need to be made to businesses post-Covid, 29% of Partners revealed that stock is still a major area requiring improvement. Other main priorities were websites and IT systems and investment in new sites and branches, demonstrating that Partners are still planning to operate out of brick-and-mortar premises.

The report also shows that in the last 18 months, Partners have been focusing their efforts inwards to concentrate on keeping their doors open. Principals have had no choice but to spend more time on the frontline alongside staff, which has offered an insight into what needed to be changed.

In 2022, Partners will concentrate on facing outwards to seize market opportunities and negotiate future threats. 30% of Partners said they would utilise the internet and online sales to maximise business opportunities, given the continued rise of online shopping due to the pandemic.

NBG states it has already been working on a solution to help Partners and Suppliers do this, creating the first ever Product Information Management (PIM) system for independent builders’ merchants. This will allow Partners to sell more efficiently online, through access to real-time product and pricing data.

The survey also found that Partners see additional product ranges as an opportunity for business growth, particularly in the renewables sector. This has become a priority for Partners in recent months, given the rising global need to reduce carbon footprints.

18% of Partners also perceived competition from nationals and other local independent merchants as a threat, with 11% also voting for internet competitors. These threats will be navigated well by Partners who are embracing digitalisation.

During Covid, 50% of Partners maintained the same level of staff training, 30% reported a reduction. Positively, 69% offered the same amount of training or more in 2021. And when asked what the most beneficial training for their staff was, 37% of Partners surveyed believe that it was sales training, including product knowledge, customer service and Supplier interaction. 13% prefer in-house training from experienced staff with another 16% saying that skills-based training in areas such as health and safety and HGV driving were also useful.

This split in training preferences shows that although business growth continues to be a large focus, post-Covid priorities have shifted to a bigger emphasis on looking after staff and their well-being.

Nick Oates, Managing Director at NBG, said: “The results revealed in this year’s market report are extremely encouraging. We know that our Partners and Suppliers have had to navigate major challenges this year, but to hear that Partners are planning to expand so significantly and open new branches in the next couple of years is fantastic. We can’t wait to start 2022 with a renewed focus and at NBG, we’re looking forward to supporting all of our Partners and Suppliers through an exciting period of growth.”

For more information, visit www.nationalbuyinggroup.com