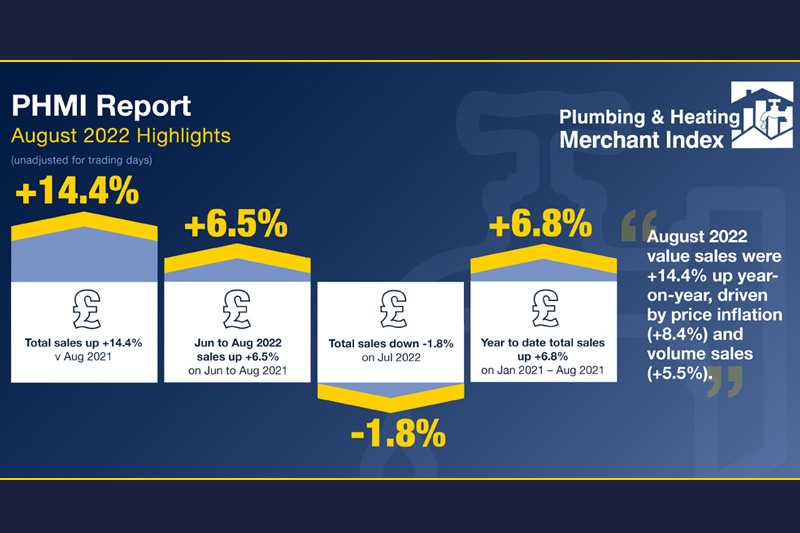

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for August 2022 through specialist plumbing and heating merchants were +14.4% higher than August 2021. Growth was driven by a combination of price inflation (+8.4%) and volume (+5.5%).

Taking into account the difference in trading days, like-for-like sales were +9.2% higher in August this year, which benefited from one extra trading day.

Month-on-month August value sales were -1.8% lower than July 2022. Volume sales were virtually flat (+0.3%) and prices were down (-2.1%), and with an extra trading day in the month, like-for-like sales were down -6.2%.

Year to date value sales in the period January-August 2022 were +6.8% higher than the same period in 2021. Price inflation was up +8.8%, but volume sales were down -2.2%. With one less trading day this year, like-for-like sales were +7.4% higher.

Plumbing & Heating merchants’ value sales in the last 12 months (September 2021 to August 2022) showed marginal growth (+1.5%) compared to the previous twelve months, September 2020 to August 2021. However, volume was down -5.9% while price was up +7.8%. With one less trading day in the most recent period, like-for-like sales were +1.9% higher.

The PHMI index for August was 95.5, with one additional trading day.

Mike Rigby, CEO of MRA Research which produces the report, commented: “The August sales data offers some positive reading for Plumbing & Heating specialist merchants, with double digit value and volume growth. A slight dip against July sales is perhaps to be expected as August saw the return of a proper holiday season with overseas travel undoubtedly causing some delays to homeowner projects and affecting the availability of labour.

“Looking ahead, it is potentially quite a mixed bag for merchants. While new build has been one of the stars of the last couple of years, national housebuilders are now feeling the effects of gravity as a cost of living crisis combines with a political crisis. But underlying demand is strong and a stalled property market is likely to see a return to the ‘improve don’t move’ mentality, which will boost RMI sales. As with the last two and half years, it’s a case of expect the unexpected and stay agile to deal with the challenges as they come along.”

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands. It is produced by MRA Research for the Builders Merchants Federation. There is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.

To download the latest report, visit www.phmi.co.uk.