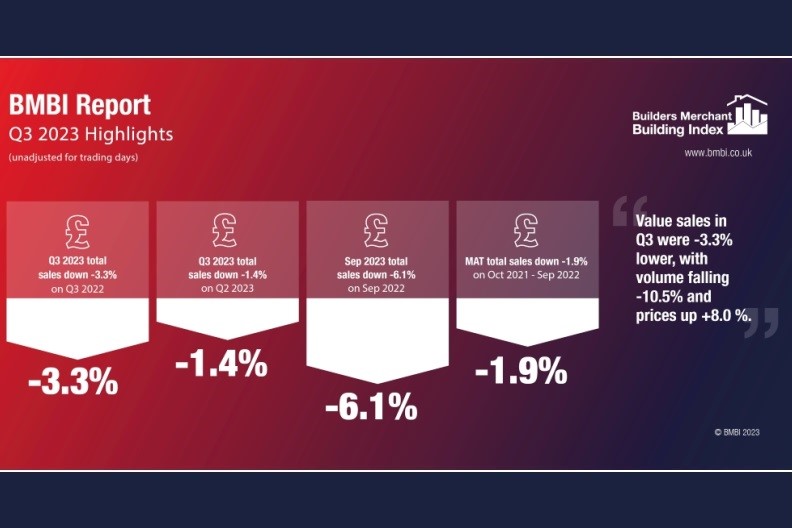

The latest Builders Merchant Building Index (BMBI) figures reveal a reduction in volumes and value sales, however the equivalent Plumbing & Heating Merchant Index (PHMI) report demonstrates a more upbeat showing for lightside specialists.

Compared to the same period in 2022, Q3 2023 total volume sales to builders and trades fell -10.5% from Britain’s builders’ merchants. Value sales were down -3.3%, as prices rose +8.0% over the period, whilst there was no difference in trading days. The three largest categories all sold less: Heavy Building Materials (-1.5%), Landscaping (-7.0%) and Timber & Joinery Products (-13.1%).

Q3 results weren’t helped by September total value sales, which were -6.1% down on September 2022, with no difference in trading days. Volume sales fell -13.0% and prices rose +7.8%. Heavy Building Materials (-5.8%), Landscaping (-6.7%), and Timber & Joinery Products (-13.9%) all sold less.

Quarter-on-quarter, total value sales dipped -1.4% in Q3 2023 compared with April to June 2023. Volume sales dropped -2.1% and prices edged up +0.8%. With four more trading days in the most recent period, like-for-like sales were -7.5% lower in July to September compared to Q2.

Nine of the twelve categories had higher value sales quarter-on-quarter, with Kitchens & Bathrooms (+7.5%) increasing the most. Landscaping (-13.3%) was weakest.

Compared to August, total merchant September value sales were down -3.4%. Volume (-2.7%) and price (-0.7%) were also down. With one less trading day in September, like-for-like sales were +1.2% higher. Only three categories sold more: Workwear & Safetywear (+2.7%), Plumbing, Heating & Electrical (+2.3%) and Kitchens & Bathrooms (+0.8%). Seasonal category Landscaping (-9.2%) contracted the most.

Commentary

John Newcomb, CEO of the Builders Merchants Federation, said: “It has been another challenging quarter for the construction industry, particularly for the housebuilding sector and we can see this reflected in the Q3 BMBI results. Domestic RMI work has held up over the year providing some good news, but with higher interest rates set to remain the norm, it may be some time before the market returns to volume growth.”

Mike Rigby, CEO of MRA Research who produce this report, said: “Quarter 3 was a wash out for the building industry. From the unrelenting rain which put a halt to outdoor work in August and September, sending homeowners abroad in search of the sun, to the drop in housebuilding output which fell to its lowest levels since Covid, not much was happening.

“GfK’s Consumer Confidence Index also fell sharply from -21 to -30 in October defying expectations of continued improvement to -20 as the high cost of living and economic uncertainties weighed on sentiment. But with inflation dropping more than forecast, from 6.7% in September to 4.6% in October, a year after the dismal days of Prime Minister Liz Truss, will the Chancellor’s Autumn Statement lift the national mood and get Britian building, and growing, again?

Mike continued: “There’s a lot of resilience in the private housing repair, maintain and improve sector. If you doubt it, try finding quality trades who are not busy and booked into 2024, for your home improvement project.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK, added: “Price growth understandably remains a key topic and it is worth unpacking this for the largest category, Heavy Building Materials. Over the past year the contribution of Bricks and Blocks which have a lower individual unit price has reduced while the contribution of higher priced items such as Aggregates, Cement, Insulation, Plaster and Plasterboard has increased, pushing up the average price of the category.

“Most prices had peaked by the start of the year, so year on year price comparisons should see a noticeable drop in the coming months.”

The Q3 2023 BMBI report is available to download at www.bmbi.co.uk.

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and reputedly the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain.

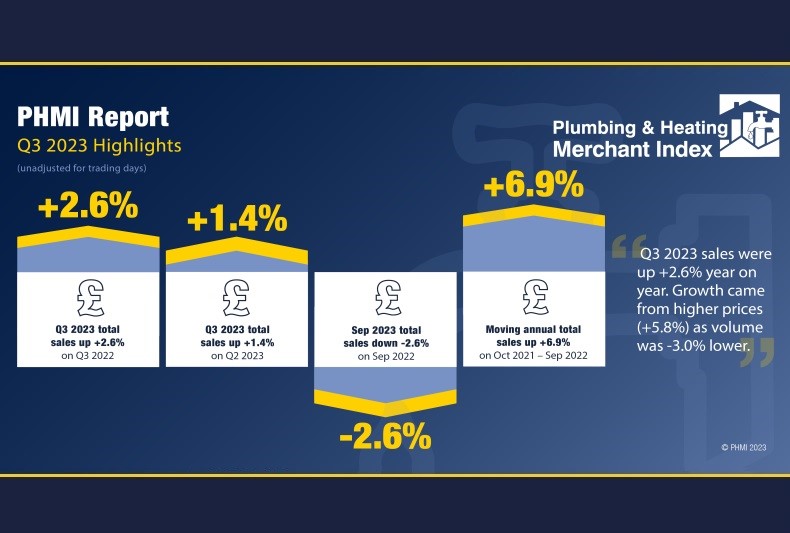

Plumbing & Heating price rises drive +2.6% Q3 value sales growth

The latest Plumbing & Heating Merchant Index (PHMI) report, published in November, shows total value sales through specialist Plumbing & Heating merchants were +2.6% higher in Q3 2023 compared to the same period in 2022 driven by (+5.8%) higher prices. Volumes fell -3.0%. There was no difference in trading days.

Quarter-on-quarter, Q3 2023 value sales were +1.4% ahead of Q2 2023. With four additional trading days in the most recent quarter, like-for-like sales dipped -4.9%. Volume sales edged up +1.6% while prices were marginally down (-0.2%).

Total value sales through specialist Plumbing & Heating merchants for October 2022 to September 2023 increased by +6.9% compared to the same 12-month period in the previous year, but volumes fell -1.2%. Prices increased +8.2%. There was no difference in trading days.

September 2023 value sales were down -2.6% on the same month a year ago. Volumes decreased by -7.0% while prices increased +4.8%.

Month-on-month, September value sales were up +2.6% against August while volume sales dropped -1.2%. With one less trading day in September, like-for-like value sales were +7.5% higher. Prices increased +3.9%.

The PHMI Index for September 2023 was 100.2.

Mike Rigby, CEO of MRA Research which produces the report, comments: “House building has dropped to its lowest levels since Covid, and new home registrations in Q3 fell 53% year-on-year, according to the National House Building Council. While ONS data suggests private housing repair and maintenance picked up in September (+3.0%), it’s still down -0.3% quarter-on-quarter.

“GfK’s UK Consumer Confidence indicator fell sharply to -30 in October 2023 from -21 in September, against expectations of a continuation of the improvements since the depths of September last year. But the high cost of living and economic uncertainties weighed on sentiment.”

To download the latest report visit www.phmi.co.uk.

The Plumbing & Heating Merchant Index (PHMI) is said to be the first to analyse point of sales data collated from specialist plumbing & heating merchants, with combined annual sales of £3bn, to chart their performance month-to-month.

The PHMI data is from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of Britain’s specialist plumbing & heating merchants’ sales. The PHMI is a brand of the Builders Merchants Federation, and reports are produced by MRA Research.

There is no overlap or double counting between PHMI and Builders Merchants Building Index (BMBI) sales data.