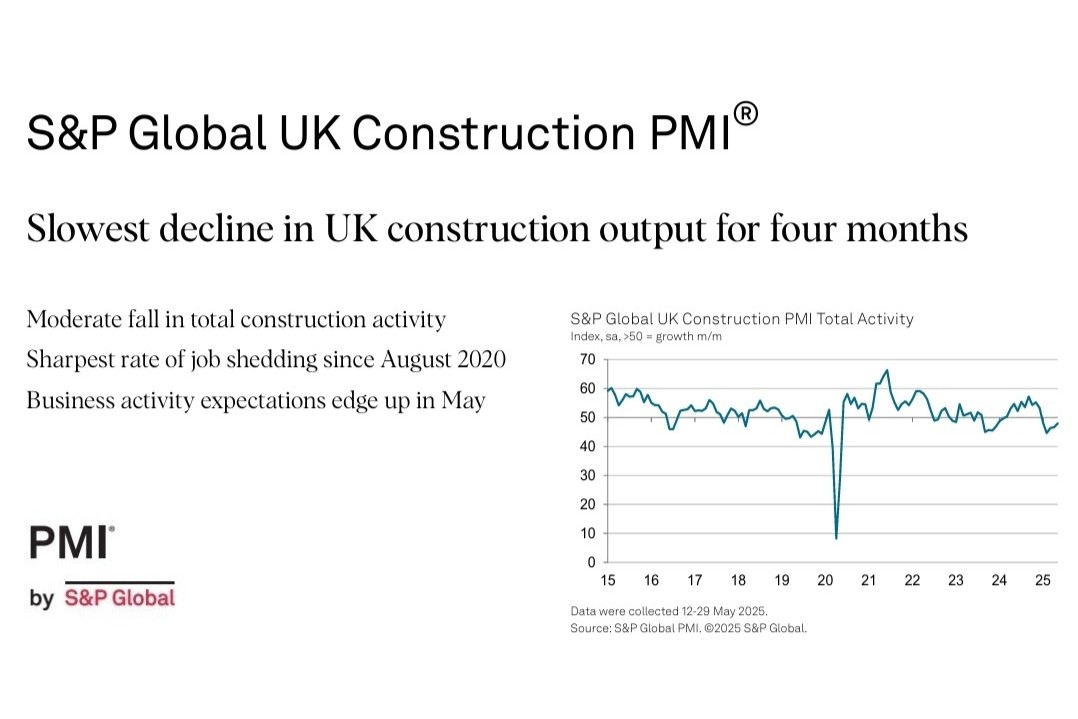

The latest UK Construction PMI report from S&P Global revealed that “the downturn in the UK construction sector showed signs of easing in May.”

The Output and new orders both fell at the slowest pace since January, while growth projections for the year ahead improved again. Employment remained a weak spot, with job shedding accelerating to its fastest since August 2020.

The headline S&P Global UK Construction Purchasing Managers’ Index™ (PMI®) – a seasonally adjusted index tracking changes in total industry activity – posted 47.9 in May, up from 46.6 in April, to signal the slowest reduction in output volumes since January. Lower business activity has been recorded throughout 2025 to date, but the latest fall was only modest.

House building was the weakest-performing segment in May (index at 45.1). Moreover, the downturn in residential construction work accelerated since April amid ongoing reports of subdued demand conditions.

Civil engineering also decreased at a solid pace in May (45.9), which extended the current period of contraction to five months. Meanwhile, commercial work (49.5) fell only marginally and the rate of decline was the slowest since the downturn began in January.

Total new work received by UK construction companies decreased to the least marked extent for four months in May. Survey respondents attributed reduced order intakes to delayed decision-making among clients and cutbacks to capital spending budgets.

May data indicated that construction firms remained reluctant to backfill vacancies amid a lack of new work to replace completed projects and pressure on margins from rising payroll costs. Employment numbers fell at the fastest pace for nearly five years. Moreover, subcontractor usage decreased to the greatest extent since May 2020.

Purchasing activity was reduced in response to lower workloads. Input buying has now fallen for six months running. This resulted in fewer pressures on supplier capacity and a subsequent improvement in delivery times during May.

The latest improvement in vendor performance was the fastest since September 2024, despite persistent reports of international shipping delays. A strong rate of input price inflation continued in May.

However, overall cost pressures continued to drift down from the 26-month high seen in March. Construction companies widely noted efforts by suppliers to pass on higher payroll costs. Aggregates, concrete, insulation and timber were commonly reported as up in price, while a number of firms noted that fuel costs had decreased.

Meanwhile, business activity expectations for the year ahead edged up to the highest since December 2024. Around 39% of the survey panel forecast a rise in output levels, while 16% predict a decline.

Positive projections were attributed to hopes of a turnaround in housing market conditions, greater

infrastructure work, and the impact of lower borrowing costs on client demand. This was balanced against concerns about the general UK economic outlook and the negative impact of rising business uncertainty on sales pipelines.

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

“The construction sector continued to adjust to weaker order books in May, which led to sustained reductions in output, staff hiring and purchasing. However, the worst phase of spending cutbacks may have passed as total new work fell at a much slower pace than the near five-year record in February.

“Housing activity was the weakest-performing segment in May as demand remained constrained by elevated borrowing costs and subdued confidence. Commercial work was close to stabilisation after a marked decline in April, suggesting that fears about domestic economic prospects have abated after the initial shock of US tariff announcements.

“Output growth expectations across the UK construction sector recovered to the highest so far in 2025. Survey respondents mostly cited a general improvement in sales projections as well as a potential tailwind from falling interest rates over the year ahead.

“On the inflation front, stubbornly high input price pressures were recorded in May, although the overall rise in purchasing costs was the least marked for four months. Many firms noted that suppliers continued to pass through greater payroll costs.

“Rising wages, squeezed margins and subdued demand weighed on construction employment, despite a brighter outlook for business activity. Job shedding was the steepest since August 2020, while subcontractor usage decreased to the greatest extent for five years.”