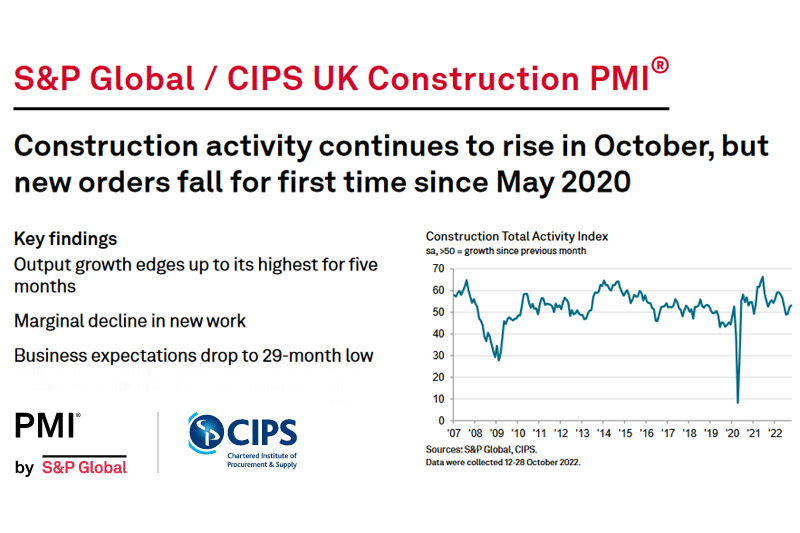

The latest S&P Global / CIPS UK Construction PMI report for October 2022 “indicated that the UK construction sector gained momentum, with total industry activity rising at the fastest pace since May”.

Despite signalling a solid recovery in business activity from the downturn seen this summer, construction companies indicated that growth expectations for the year ahead remained very subdued. The degree of optimism fell sharply since September and was the lowest for almost two-and-a-half years, reflecting falling volumes of new work and worries about the longer-term UK economic outlook.

The headline seasonally adjusted S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) – which measures month-on-month changes in total industry activity – posted 53.2 in October, up from 52.3 in September and the highest reading since May. Moreover, the index continued to pick up from the 26-month low seen in July (48.9). Higher levels of business activity were attributed to a combination of new project starts and strong pipelines of unfinished work.

Commercial building was the best-performing category in October (index at 54.5), with output growth reaching a five-month high. Residential work also expanded (51.2), but at a softer pace than in September. Meanwhile, civil engineering activity decreased for the fourth month running (48.5).

Total new orders decreased slightly in October, which ended a 28-month period of sustained expansion. Construction companies noted weaker confidence among clients, alongside headwinds from rising input prices and higher borrowing costs. Some firms also reported a drop in new work due to heightened political uncertainty.

Rising construction output contributed to increases in input buying and staff hiring during October. However, survey respondents noted that weaker demand contributed to a slowdown in the rate of job creation since September.

There were some positive signals for supply chain performance in October as instances of longer delivery times were the fewest since February 2020. Moreover, the seasonally adjusted Suppliers’ Delivery Times Index was above its pre-pandemic average, which suggested that supply shortages and transport delays have eased considerably in comparison to the low point seen last year.

Despite a turnaround in supply chain pressures, latest data signalled another steep increase in average cost burdens across the construction sector. Higher purchasing prices were overwhelmingly linked to greater energy costs, fuel bills and the pass through of rising wages. This was partly offset by softer commodity price pressures. Measured overall, the rate of input cost inflation eased slightly since September and was the lowest for 20 months.

Looking ahead, construction firms are relatively downbeat about their growth projections for the year ahead. Around 33% of the survey panel anticipate a rise in business activity, while 26% predict a decline. The resulting index signalled the lowest degree of optimism since May 2020.

Many companies commented on recession worries and a drop in UK economic prospects due to rising political uncertainty. Meanwhile, those reporting positive sentiment in October often cited tender opportunities in niche markets or opportunities related to infrastructure spending (especially green energy projects).

Tim Moore, Economics Director at S&P Global Market Intelligence, which compiles the survey said:

“Construction output has staged a modest recovery after the downturn seen through much of this summer, with growth hitting a five-month high in October. Commercial work was the best-performing area of activity as delayed projects moved forward, while increased house building also provided a positive contribution to overall workloads.

“However, the forward-looking survey indicators highlight that growth will be harder to achieve in the coming months as rising borrowing costs, economic uncertainty and cost constraints all had a negative influence on order books in October. The reduction in total new work was the first since May 2020 and this fuelled increased concerns about longer-term tender opportunities.

“Business optimism regarding the year ahead slumped in October and was by far the weakest since the early pandemic months. Construction firms cited concerns about a broad-based decline in client demand due to cutbacks on non-essential spending among clients, although some noted that growth linked to green energy projects, planned infrastructure spending and success in niche markets could help to offset the UK economic headwinds.”

Dr John Glen, Chief Economist at the Chartered Institute of Procurement & Supply, said:

“The construction sector offered a small improvement in output compared to September, maintaining its place in growth territory and rising at the fastest rate for almost six months. However, this positive result offered little in terms of comfort even though purchasing activity also rose and supply chain performance returned to near-normal levels, the sector remained under pressure from all sides.

“New business levels dropped for the first time since May 2020 so this momentum in output levels mostly came from projects in hand or those delayed rather than fresh assignments. Job creation was maintained so builders were able to complete unfinished work, but salary demands along with higher energy costs stripped away margins with inflationary pressures still high.

“The housing sector lost some of its momentum creeping closer to the no-change mark and sitting in a precarious position as the recent interest rate rise will impact on affordability rates for new homes in the months ahead. The UK is entering a recession and higher borrowing costs are intensifying these challenges, which combined to drag down builder optimism about the year ahead to its lowest level since May 2020.”

Related News

S&P Global / CIPS UK Construction PMI September data

S&P Global / CIPS UK Construction PMI August data

“Fall in new construction orders is a worry”, says FMB

The fall in new construction orders for the first time since May 2020, as reported by S&P Global / CIPS UK Construction PMI, is a worry and a reflection of growing nervousness in the building industry about future workloads, says the Federation of Master Builders (FMB).

Brian Berry, Chief Executive of the FMB, said: “It is encouraging that the recent data shows a steady, but modest improvement in output in the construction sector. While there has been a modest level of growth, the data highlights that the next few months will continue to be hard on the industry, with expectations of a fall in volumes of new work and concerns around the longer-term UK economic outlook.”

He continued: “The data is a key indication on how the current economic climate is impacting the industry on a wider scale, which is why the FMB is calling on the Government to prioritise investment in energy efficiency improvements, via a UK-wide national retrofit strategy, which would help create thousands of new jobs, boost regional economies, reduce energy bills, and help secure the UK’s energy supply. As an immediate boost, the removal of VAT on repair, maintenance and improvement work would immediately save consumers money and incentivise them to carry our more work which will reinvest into the industry.”