With lockdown continuing to ease in June, more builders’ merchants’ branches have reopened fully. And while some branches continue to operate with restrictions, fewer complete closures were reported. As featured in the July/August issue of PBM, the latest edition of The Pulse reflects on how the Covid-19 crisis continues to challenge the sector.

As demand increased in June, branches working with skeleton staff were ‘rushed off their feet’. The outlook for the next three and six months is positive, but merchants are cautious — unsure whether the surge in sales is indicative of a V-shaped recovery, or just customers catching up on lost time.

Impact of Covid-19

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. In June, we spoke to 95% of branches from the 146 interviews, with only three closures and four non-responses.

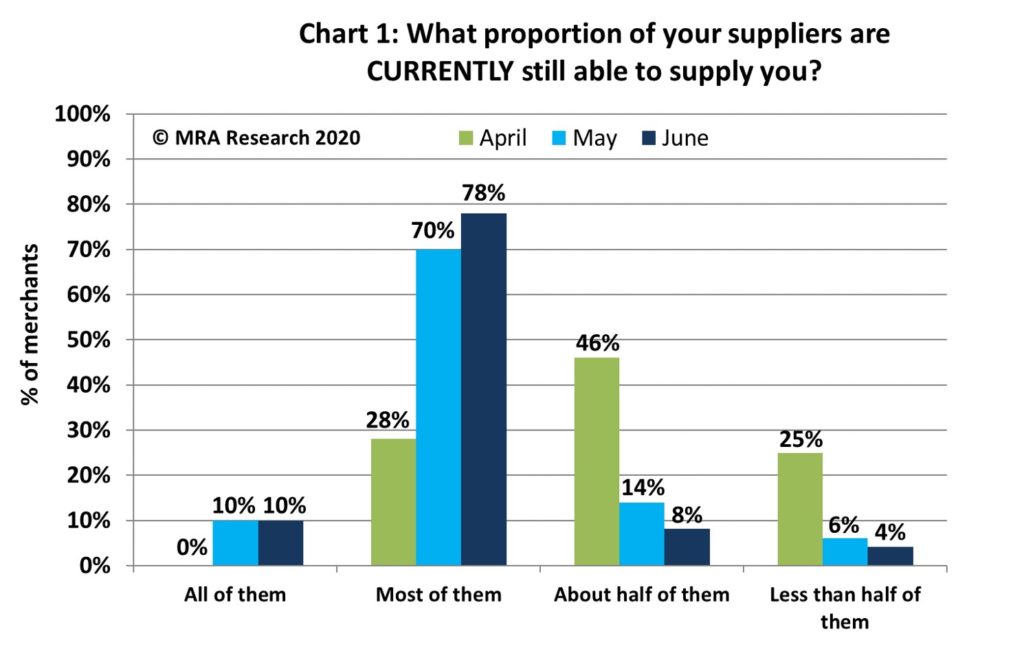

Because of the ongoing nature of these unprecedented circumstances, the extra questions added in the last survey (published in PBM’s June edition) continued into June to get a better picture of the market through the lockdown. For example, while respondents reported a significant improvement in material supply compared to April (see Chart 1), extended lead times are an issue.

Sales expectations

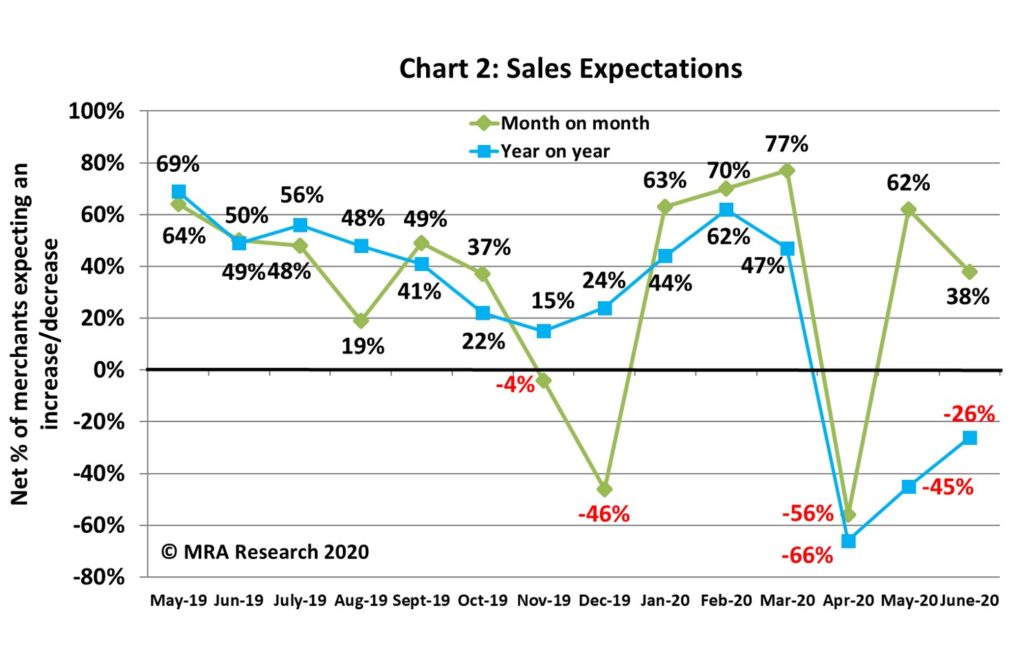

A net +38% of merchants expected sales to improve in June compared to May, although expectations have weakened since the last survey — see Chart 2. Small (net +51%) and mid-sized outlets (+39%) anticipated a rise, while large branches forecasted a drop (-8%).

Year-on-year, expectations continue to improve — up a net +19% from May’s survey — also Chart 2. The outlook varied by size of branch. Regionally, Scotland (-46%) and the Midlands (-42%) were more cautious than the North (-29%) and South (-6%).

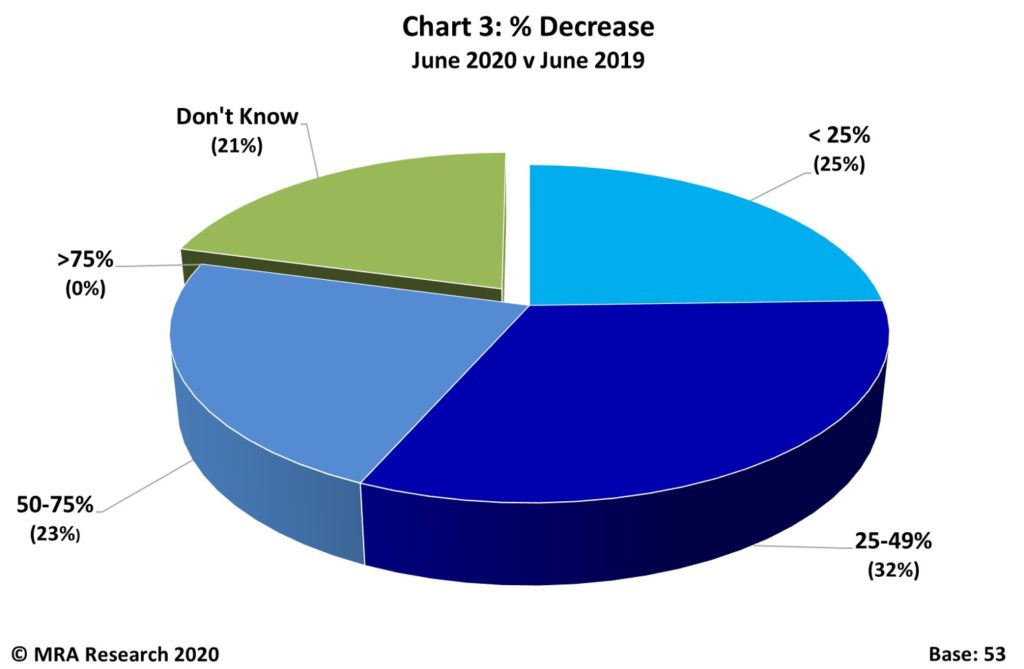

Of those forecasting lower sales, 55% of respondents anticipated a drop of 25% to 75%. See Chart 3.

Of those forecasting lower sales, 55% of respondents anticipated a drop of 25% to 75%. See Chart 3.

Looking to the next three months (June to August), a net +44% expect stronger sales than the previous three months (March to May). Small branches (net +58%), those in the South (+69%) and nationals (+64%) are most positive.

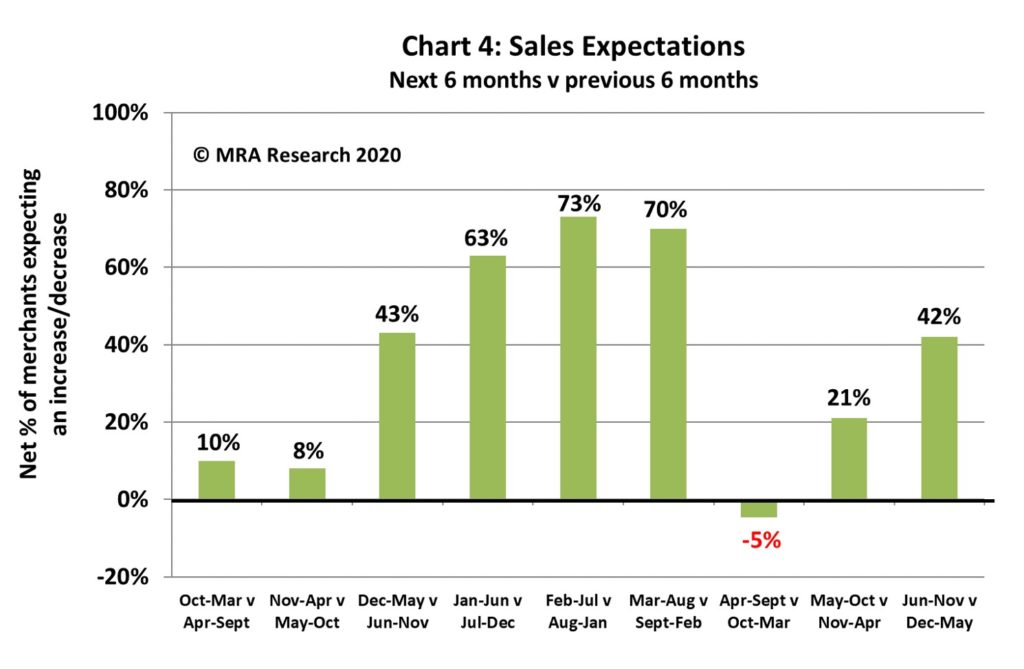

The outlook for the next six months is also robust with a net +42% forecasting better sales in June to November compared with December to May. See Chart 4. Expectations are strong across the board.

Confidence in the market

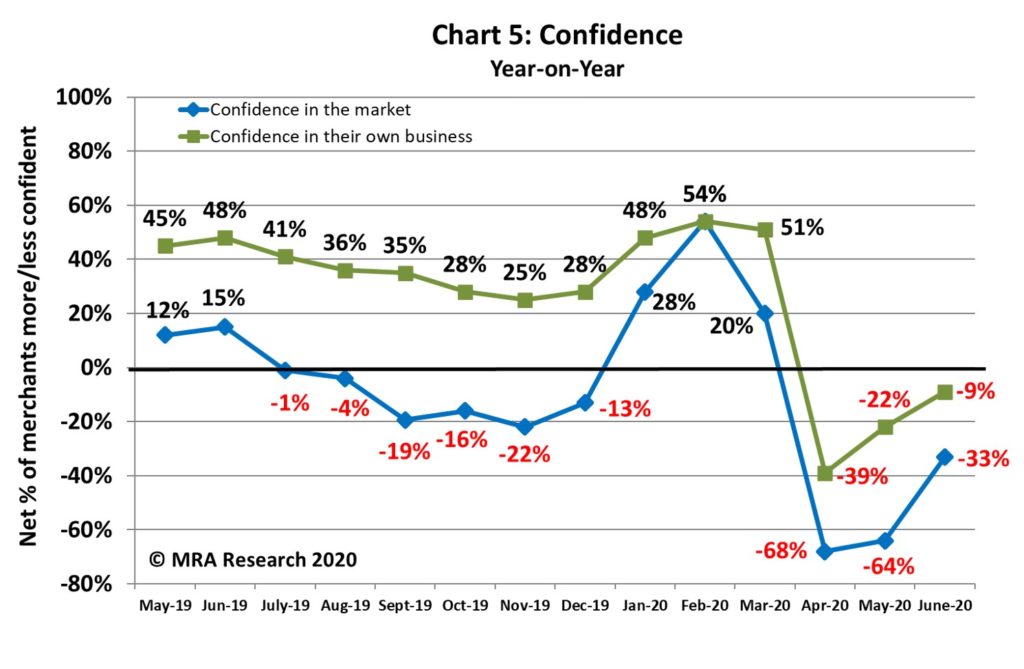

Confidence is improving month-on-month with a net +42% of merchants more confident in June than in May. Year-on-year, confidence is continuing to recover from the deep fall in April, but it is still a very weak net -33%. See Chart 5.

Confidence in their business

Merchants’ confidence in their own business has recovered well, with a net +54% more confident in June than May.

Confidence also improved year-on-year — also Chart 5 — but there were differences. Large outlets (net -38%), merchants in the Midlands (-39%) and those in Scotland (-29%) were least confident. Merchants in the South (+17%) and regional group outlets (+5%) were more confident.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 14th in the series, with interviews conducted by MRA Research between 9th and 16th June 2020. Each month a representative sample of 100 merchants is interviewed. Due to the Coronavirus lockdown and impact on business closures and restrictions, this survey is based on a larger number of contacts (146) to establish the level of closures plus 97 completed interviews, balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The full report can be downloaded from www.mra-research.co.uk/the-pulse or call Lucia Di Stazio at MRA Research on 01453 521621.