As published in PBM’s February 2022 edition, the latest installment of The Pulse reveals that merchants were feeling optimistic about their prospects for the months ahead.

Lead times have lengthened, and the supply chain is stretched, but merchants are positive and their confidence in the market has strengthened. Indeed, merchants’ sales expectations for the next six months (December 2021 to May 2022) are robust, as they expect high demand to continue as the UK avoids another national lockdown.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 1st and 8th December 2021.

Materials supply

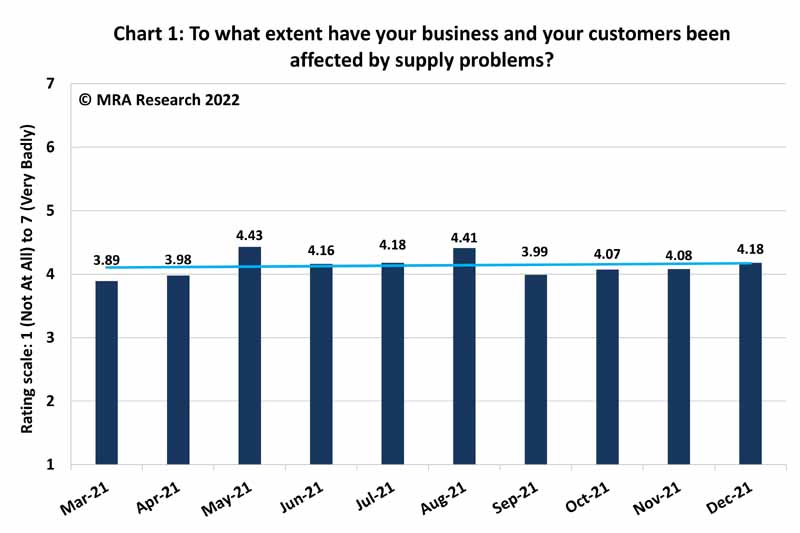

Merchants were asked on a scale of 1 (not at all) to 7 (very badly) to what extent their business and customers have been affected by supply problems. An average score of 4.18 in December indicates supply problems had worsened slightly in December — Chart 1. Supply issues, extended lead times and price increases are impacting merchants

Sales expectations

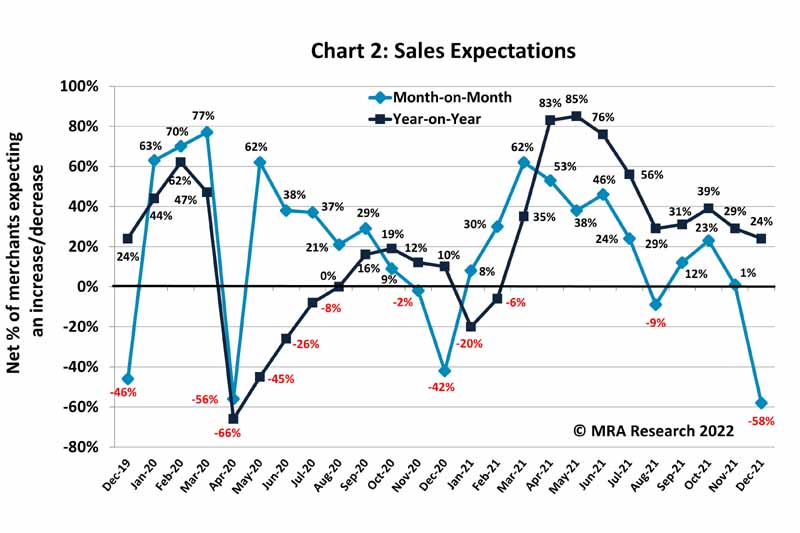

A net -58% of merchants expected sales to drop in December compared to November, reflecting seasonal factors and a shorter trading month — Chart 2. Expectations were particularly weak among large branches (-72%), the Midlands (-75%) and North (-82%) and Independent outlets (-77%).

Among merchants expecting sales to drop in December, 21% expected sales to slip by up to 9% compared with November, and 28% expected sales to drop by 10-20%. Just under half expected sales to fall by more than 20%.

Compared with December 2020, sales expectations weakened slightly in the final month of 2021 but remain positive (net +24%) — also Chart 2. More Small and Large branches (+32%) expected sales to improve than Mid-sized outlets (+13%).

Among those expecting growth in December compared to the same month in 2020, 38% expected growth of up to 9%. A further 49% expected sales to improve 10-20%.

On balance, a net +2% of merchants expect sales to improve in the three months December 2021-February 2022 compared to the previous three months (September-November 2021). Regional (-12%) and Independent branches (-18%) anticipate a decrease in sales, but National merchants (+30%) expect sales to increase over the period.

Among merchants expecting sales growth over the next quarter, nearly two thirds expect sales to increase by 10% or more.

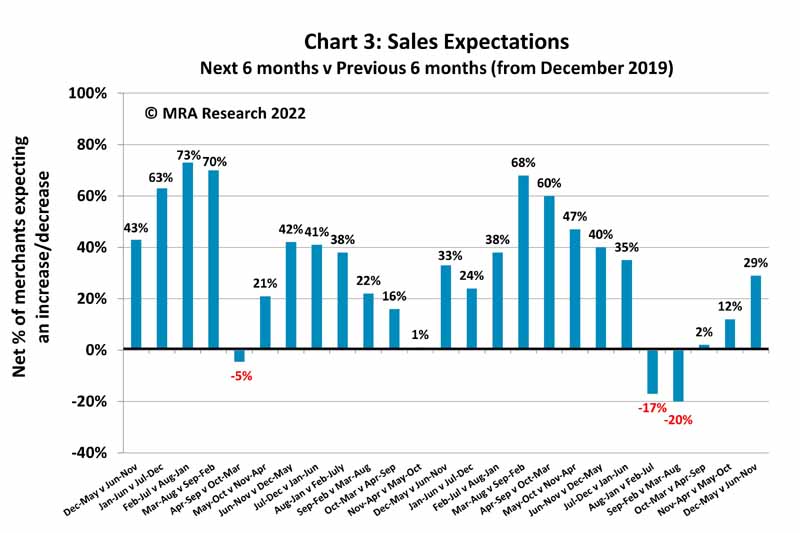

A net +29% of merchants expect their sales to grow over the next six months (December 2021-May 2022) compared with the last six months (June-November 2021) — Chart 3. Large outlets (+50%) and National merchants (+41%) are most bullish.

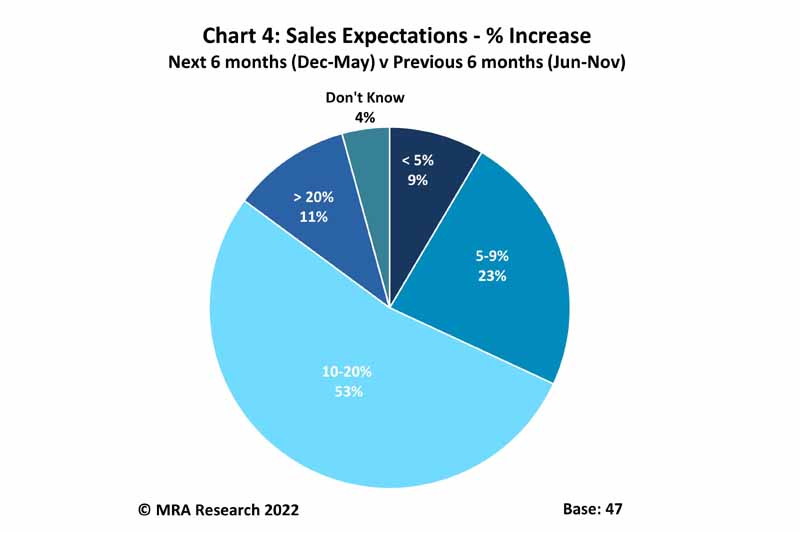

Just under a third of merchants expecting sales to increase in the next six months compared to the last six, expect growth of up to 9%. Over half of the merchants expecting growth, expect sales to increase by 10-20%. A further 11% expect to grow by more than 20% — Chart 4.

Confidence in the market

Compared with November’s survey, confidence in the market improved in December 2021 with a net +19% of merchants more confident than the previous month. Confidence is strongest among Small outlets and merchants in Scotland (+31%), and Regional branches (+34%).

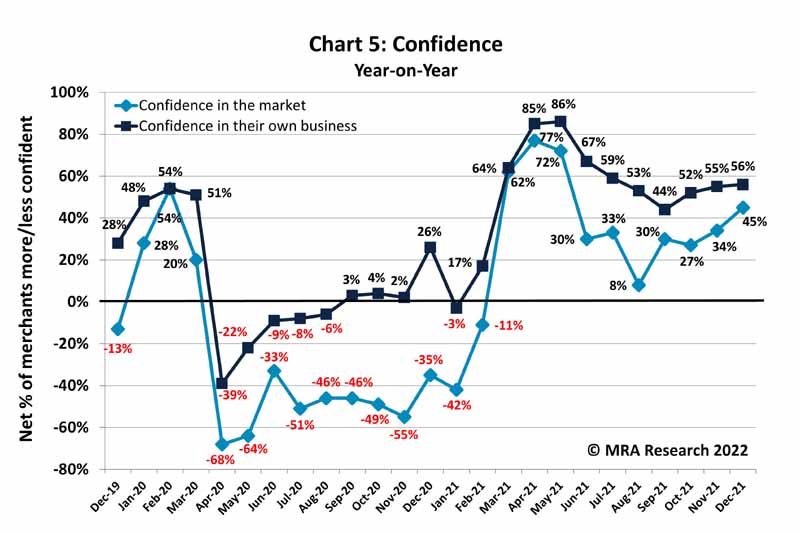

Year-on-year, confidence in the market also improved with a net +45% of merchants more confident in December than the same month in 2020 — Chart 5. Confidence levels are similar across merchants of all sizes and type, and across all regions.

Confidence in their business

Merchants’ month-on-month confidence in their own business jumped up in December (net +41%) compared to November’s survey (+30%). Confidence levels are strong across the board, and particularly among Merchants in the South (+55%) and Scotland (+63%).

Compared to December 2020, merchants’ confidence in their own business is holding strong (net +56%) — also Chart 5. Merchants in the South and Scotland (+63%) and National branches (+65%) are most confident.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 32nd in the series, with interviews conducted by MRA Research between 1st and 8th December 2021. Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Ralph Sutcliffe at MRA Research on 01453 521621.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.