As featured in the June edition of PBM, the latest instalment of The Pulse brings the market challenges into sharper focus.

Merchants’ sales expectations remain at historically high levels for the month, quarter and six months ahead but confidence in the market has tumbled as the sector considers the combined effects on demand of price increases, supply difficulties, fuel rises, the cost of living and the Ukraine conflict. However, merchants’ confidence in their own businesses remains high.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 1st and 11th April 2022.

Sales expectations

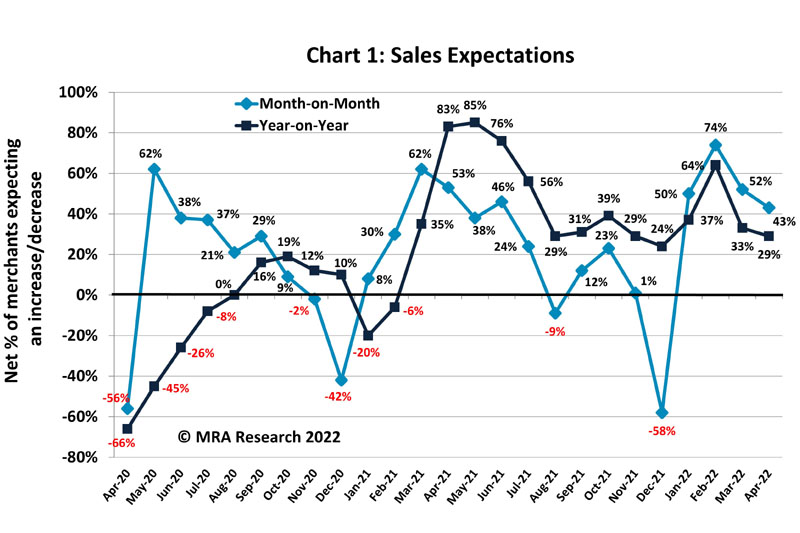

Merchants’ sales expectations slipped again in April compared to March but remain at historically high levels (net +43%) — Chart 1. Expectations were strongest among Large merchants (+67%). Small outlets had lower, but still strong, expectations (+28%).

Of those expecting sales to increase in April compared to March, just under two in five merchants expected sales to grow by up to 9%. Over half expected sales to increase by 10-20%.

Year-on-year, sales expectations slipped to net +29% — Chart 1. Expectations were strongest among merchants in the Midlands (+50%) and Nationals (+49%), and weaker in the North (+9%).

Of those expecting sales to increase in April compared to the same month in 2021, 42% expected growth of up to 9% and a further 47% expected growth of 10-20%. Eleven per cent expected sales to increase by more than 20%.

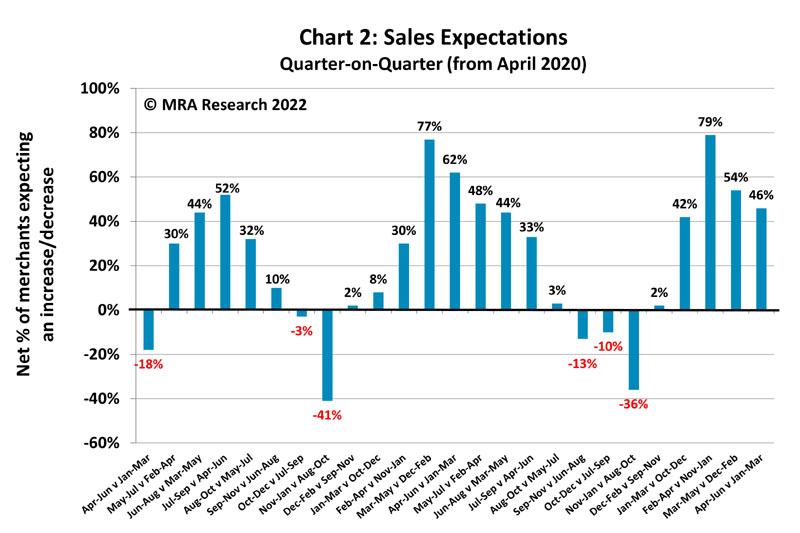

Although quarter-on-quarter expectations have weakened, they are very strong at net +46% — Chart 2. Expectations are particularly strong among Independents (+68%), Large outlets (+61%) and merchants in the Midlands (+58%).

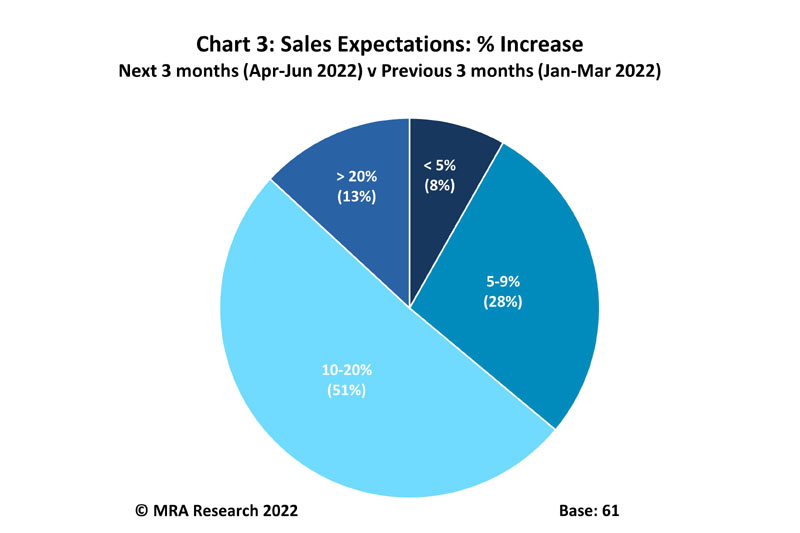

Among merchants expecting sales to grow over the next three months (April-June) compared to the previous three months (January-March), 36% expect sales to increase by up to 9%. Over half expect sales to grow by 10-20%, and a further 13% expect even stronger growth — Chart 3.

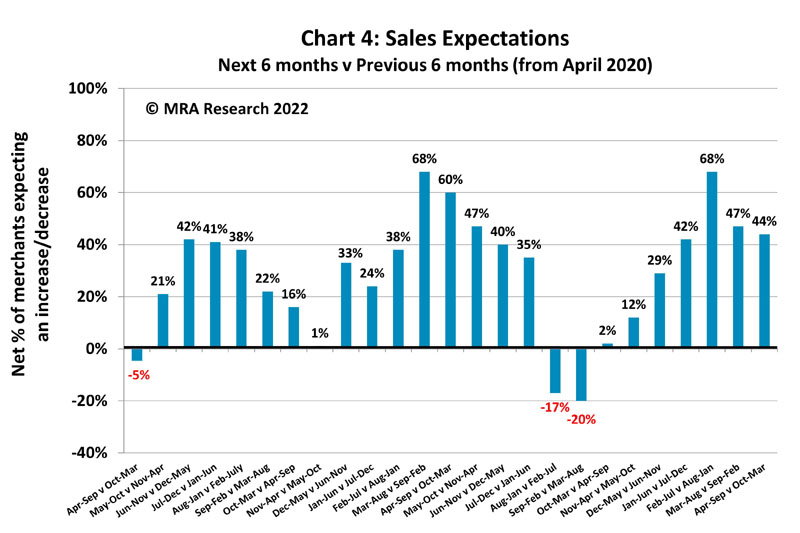

Looking ahead six months, a net +44% of merchants expect sales to grow in April-September compared to the previous six months (October 2021-March 2022) — Chart 4. Expectations are strong across the board, and particularly for merchants in the Midlands and Scotland (+50%) and Independent outlets (+53%).

Just over a third of merchants expecting sales to grow over the next six months, expect sales to increase by up to 9%. A further 44% expect sales to increase by 10% or more. Twenty-one per cent expect sales to grow by more than 20%.

Confidence in the market

Month-on-month, market confidence dropped for a second consecutive month, with a net -9% of merchants less confident in April than in March. Large outlets (-39%) and merchants in the Midlands (-23%) were least confident.

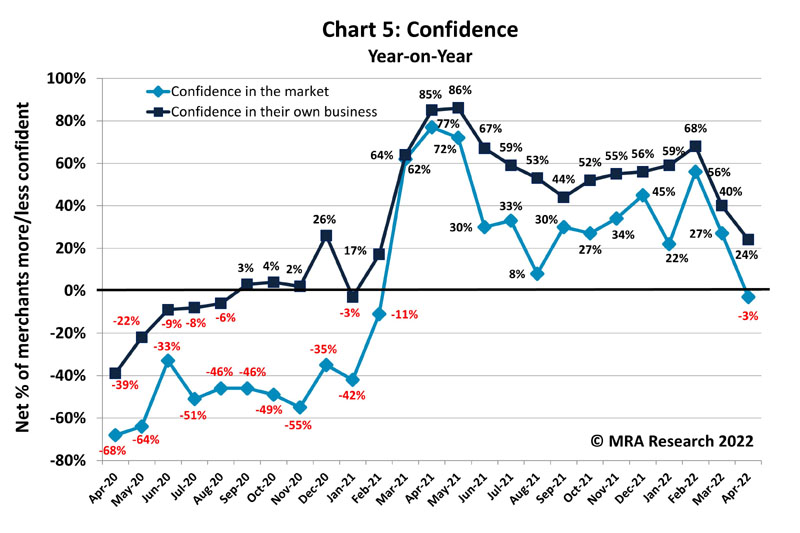

Year-on-year, confidence in the market plunged, with a net -3% of merchants less confident in April than the same month in 2021 — Chart 5. Large outlets (-22%), Regional merchants (-20%) and those in the North (-18%) were least confident.

Confidence in their business

While still at historically high levels, merchants’ month-on-month confidence in their own business dropped in April’s survey to net +31% from +46% in the previous month’s survey. Small (+40%) and Large outlets (+39%) were more confident than Mid-sized branches (+19%). National (+49%) and Independent merchants (+32%) and were more confident in their own business than Regional outlets (+16%).

Year-on-Year, merchants’ confidence in their own business dropped for the second month in succession, with a net +24% of merchants more confident than the same month in 2021 — Chart 5. Small branches (+45%) and National outlets (+51%) were most confident. Independent merchants were least confident (-5%).

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Ralph Sutcliffe at MRA on 01453 521621.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 36th in the series, with interviews conducted by MRA Research between 1st and 11th April 2022. Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.