The latest installment of The Pulse – as first seen in PBM’s July/August edition – reveals that price rises and availability issues are again presenting a challenge to the sector, but merchants continue to feel optimistic about the prospects of their own businesses.

Just under 90% of builders’ merchants in May were hit by supplier price rises. Over 80% suffered some level of product availability problems too, as the UK deals with global and geopolitical problems. While consumer and business confidence plummets, merchants are more optimistic in their own businesses than in the prospects for the market.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 3rd and 11th May 2022.

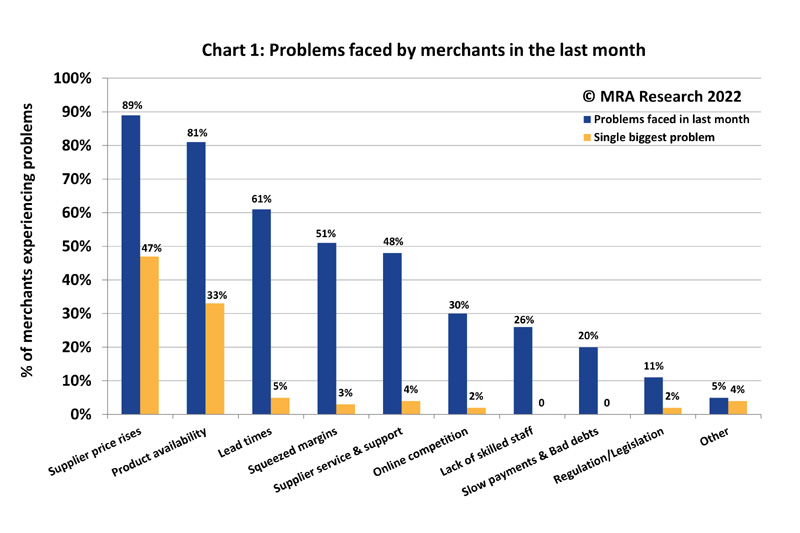

Problems faced by merchants

Merchants were confronted by multiple challenges in a difficult period of supply uncertainty and inflation — Chart 1. Eighty nine percent said supplier price rises were a problem in the last month with almost half saying it was their single biggest problem (47%). Product availability (81%) was the second biggest challenge with one in three deeming it their single biggest challenge.

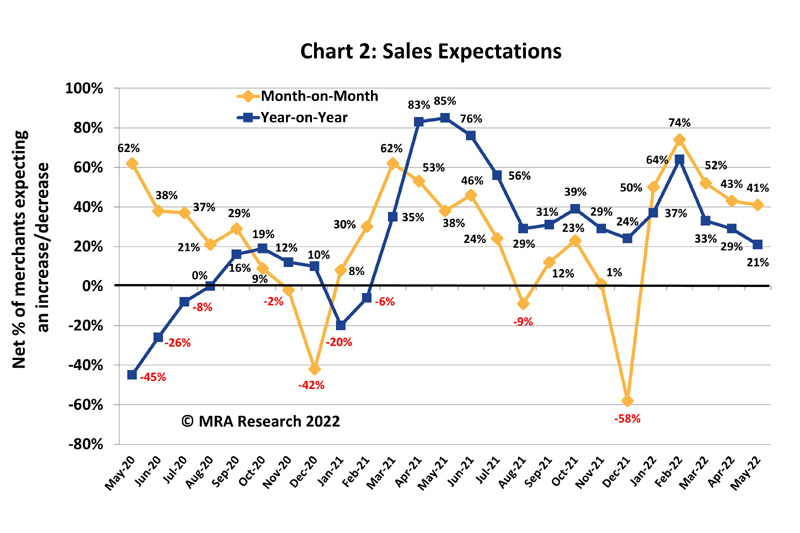

Sales expectations

Merchants’ sales expectations weakened in May compared to April, but expectations remained at historically high levels (net +41%) — Chart 2. Expectations were particularly strong among National merchants (+53%) and Scotland (+69).

Among merchants expecting sales to increase in May, just under two thirds expected sales to grow up to 9% compared with April. Just over a quarter expected sales to increase by 10-20%, and a further 4% expected sales to grow by more than that.

Year-on-year, sales expectations dropped to a net +21% — also Chart 2. Merchants in Scotland (+69%) and the Midlands (+52%) were the most bullish. Expectations were relatively weak in the North and South where a net balance of merchants expected sales to drop over the period (-5%).

Of those expecting sales to increase in May compared to the same month in 2021, 52% expected growth of up to 9% and a further 30% expected growth of 10-20%, while 9% expected sales to increase by more than 20%.

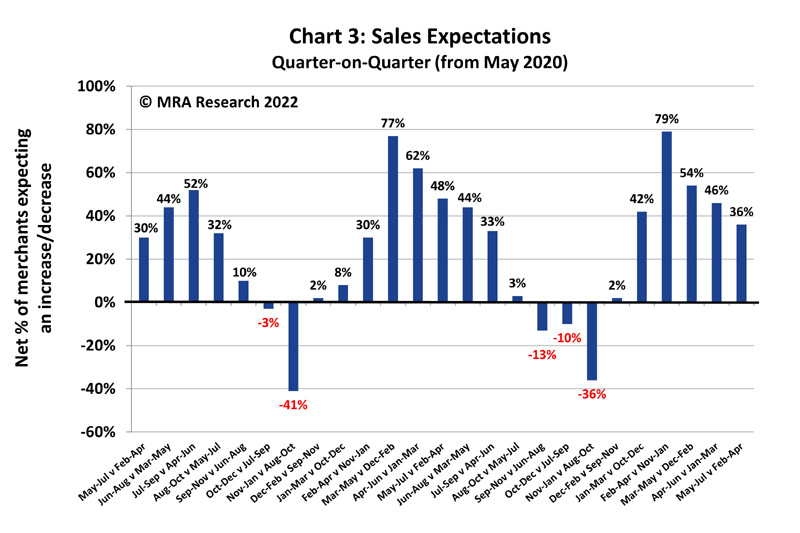

While quarter-on-quarter expectations weakened for the third month in a row, they were strong overall. A net +36% expected May to July sales to increase compared to the previous three months (February to April) — Chart 3. Expectations were particularly strong among National branches and Mid-sized outlets (+47%) and merchants in Scotland (+75%).

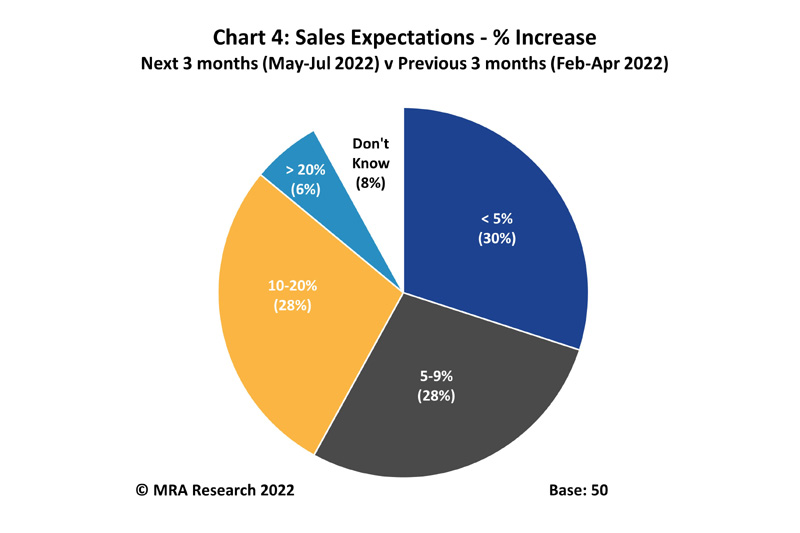

Among merchants expecting sales to grow over the next three months, 58% expected sales to increase by up to 9% — Chart 4. Just over a quarter expected sales to grow by 10-20%, and a further 6% expected even stronger growth.

A net +26% of merchants expect sales to grow in the six months May-October 2022, compared to the previous six months (November 2021-April 2022). Expectations were particularly strong for merchants in Scotland (+75%) whilst expectations were weaker in the North (+5%) and South (+8%).

Confidence in the market

Month-on-month, a net -7% of merchants were less confident in May than in April. By branch size, Small outlets (-17%) and Large outlets (-19%) were the least confident. Regionally, merchants in Scotland and the Midlands were the most confident (+44% and +32% respectively). Merchants in the South and North were least confident (-37% and -38% respectively).

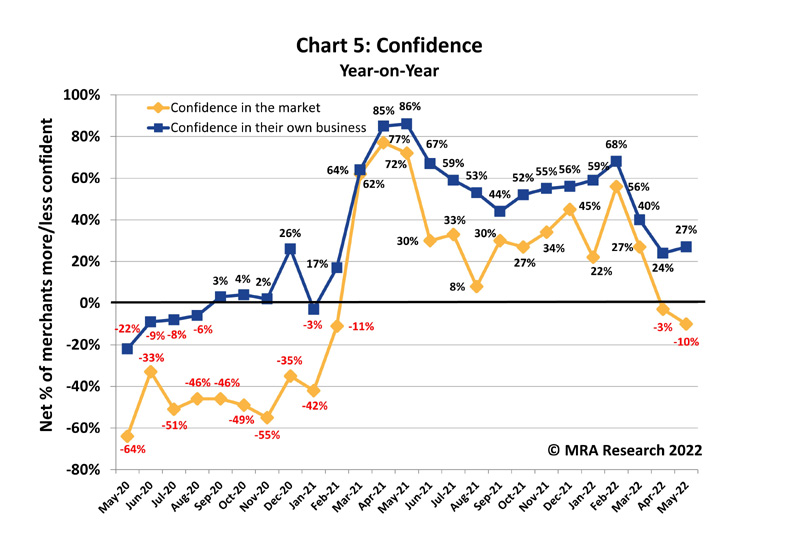

Year-on-year, confidence in the market continued to decline, with a net -10% of merchants less confident in May than the same month in 2021 — Chart 5. Large outlets were least confident (-38%), followed by Small branches (-17%). There were marked regional differences with higher confidence in the Midlands (+32%) and Scotland (+31%) and less confidence in the South (-26%) and North (-62%).

Confidence in their business

Month-on-month, merchants’ confidence in their own business strengthened in May compared with April to a net +41%. Confidence was strong across all size of branches, particularly Mid-sized branches (+49%). National (+53%) and Regional merchants (+42%) were more confident than Independents (+17%).

Year-on-Year, merchants’ confidence in their own business strengthened in May — Chart 5. A net +27% of merchants were more confident than the same month in 2021. Mid-sized outlets (+44%), and those in the Scotland (+56%) and Midlands (+40%) were most confident.

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Ralph Sutcliffe at MRA Research on 01453 521621.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 37th in the series, with interviews conducted by MRA Research between 3rd and 11th May 2022. Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.