As featured in the November edition of PBM, Macro-economic factors underpin the thinking in the latest instalment of The Pulse as the sector reacts to the fallout from the ex-Chancellor Kwasi Kwarteng’s ill-fated ‘fiscal statement’.

While sales expectations for October recovered compared to last year, and merchants’ confidence in their own business also improved year on year, their confidence in the market continued to slide — no doubt undermined by recent economic and political turbulence.

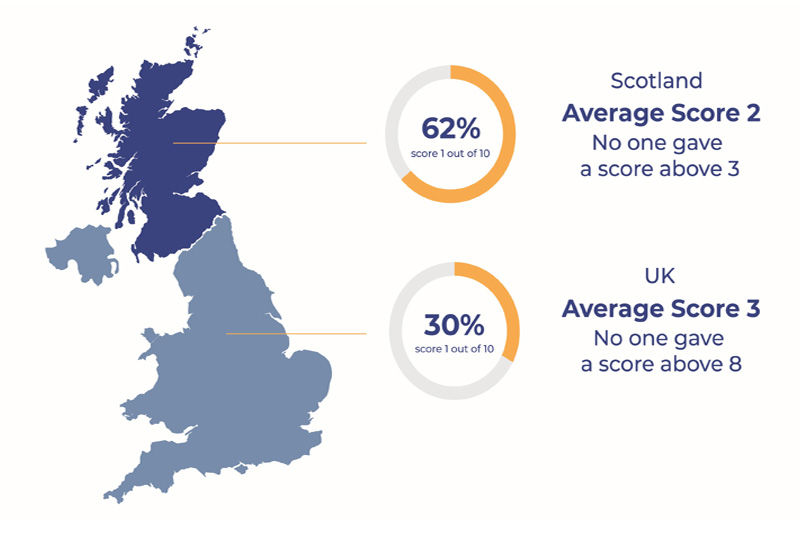

Given the turbulence, The Pulse asked merchants what they thought of the mini-budget, and how confident were they in the now-former Prime Minister and Chancellor on a scale of 1 to 10. ‘Not very’ was the answer, with three out of 10 merchants rating them one out of 10. In Scotland it was worse, with six in ten merchants giving a thumbs down of one out of 10.

Of course, a week is a very long time in politics and both the PM and her Chancellor have been consigned to history in the days that followed the reporting period and publication of the magazine. The impact, of course, will be rather more long-lasting…

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 3rd and 6th October 2022 (4 working days).

Sales expectations

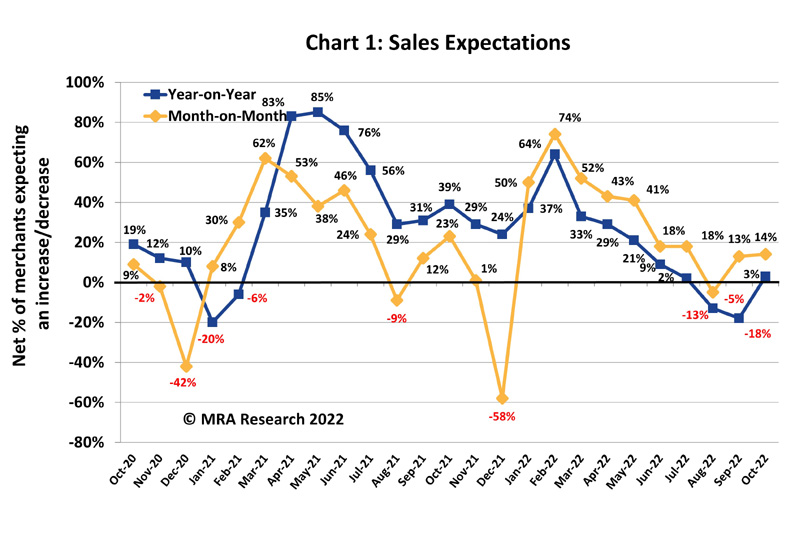

Despite the uncertainty of the trading environment merchants’ expectations for October sales remained stable at a net +14% — Chart 1. All types of outlet and particularly Small branches (+26%) expected sales to increase. Nationals (+17%) and Regionals (+22%) expected sales to grow. However, Independents (-11%) and merchants in the North (-5%) expected sales to reduce.

Year-on-year sales expectations for October 2022 (compared to October last year) recovered to a net +3% — the first increase since January 2022. Merchants in the South (+8%) and Midlands (+4%) expected sales to increase. Regionals (+12%) and Nationals (+5%) expected growth, but Independent Merchants (-22%) expected sales to drop.

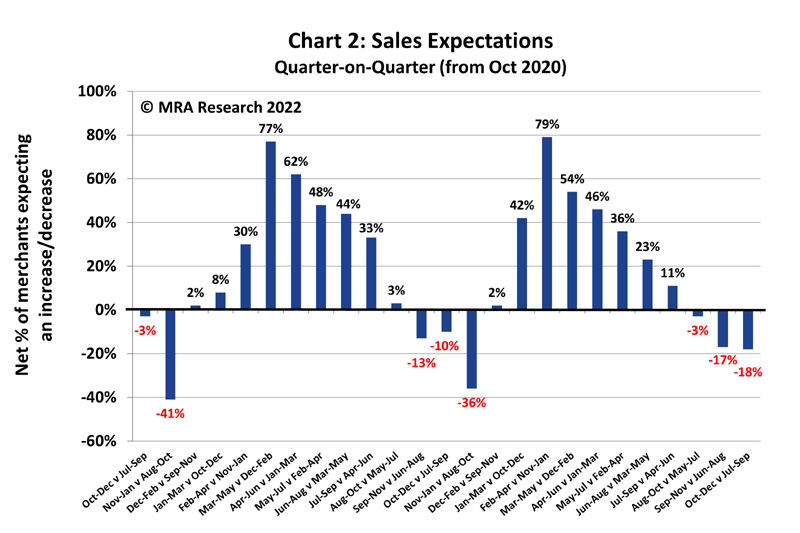

Quarter-on-quarter expectations weakened slightly to a net -18% — Chart 2. Expectations were particularly weak in Mid-sized outlets (-37%) and in the North (-42%) but all types of merchants expected sales to drop: Nationals (-27%), Regionals (-12%), Independents (-11%).

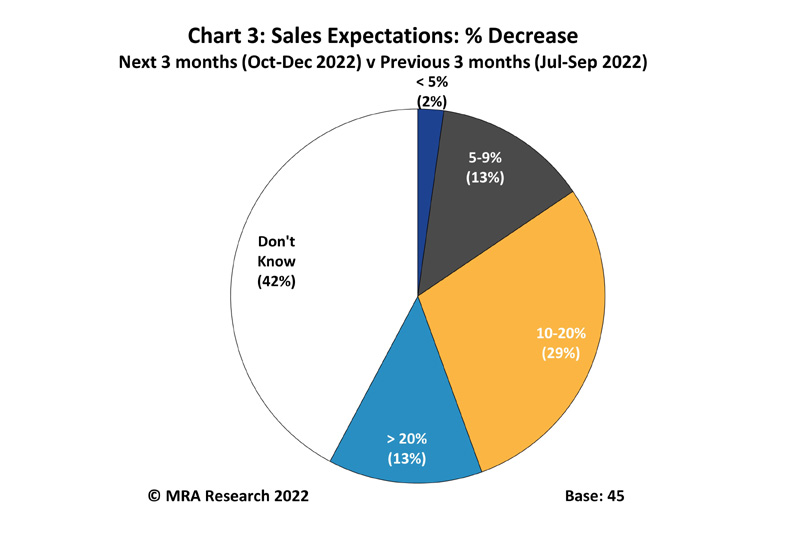

Reflecting an increase in market uncertainty, four in ten merchants (42%) who expected sales to fall were unable to say how much sales will decline — Chart 3. 15% of the merchants who expected sales to decline in the next three months expected them to fall by up to 10%. 29% expected them to decline by 10 to 20%, and 13% expected a drop in sales of more than that.

Confidence in the market

A net -30% of merchants were less confident in the market now than in September. Confidence in the market was weak across all regions and types of merchant with Small branches (-35%) and Mid-sized outlets (-35%) the least confident. Large outlets were more balanced in the prospects for the market (a net 0%).

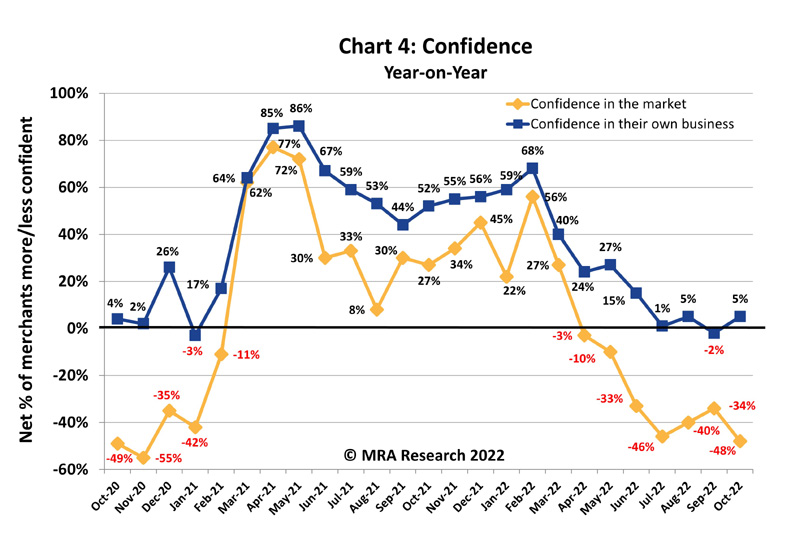

Confidence in the market dropped markedly year-on-year to a net -48% of merchants less confident in the market at the start of October than they were in October 2021 — Chart 4.

Confidence dropped across all sizes of outlet, regions and types of merchant. Small branches (-58%), Merchants in the South (-61%) and the Midlands (-50%) were least confident.

Confidence in their business

However, merchants’ confidence in their own business improved to a positive net +14%, month on month. Confidence was strong among Small branches (+21%) and merchants in the North (+38%). Confidence was weak in Scotland (-6%) whilst Independents (-6%) were less confident in the prospects for their own business than Nationals (+22%) and Regionals (+15%).

Merchants’ confidence in their own business also strengthened Year-on-Year to a positive net +5% — also Chart 4.

Small branches (+9%) and Large outlets (+14%) were confident but a net -2% of Mid-sized outlets were less confident in the prospects for their business than they were last year. A net +21% of Merchants in the North were confident. Scotland was least confident (-6%).

Confidence in the PM and economic policies

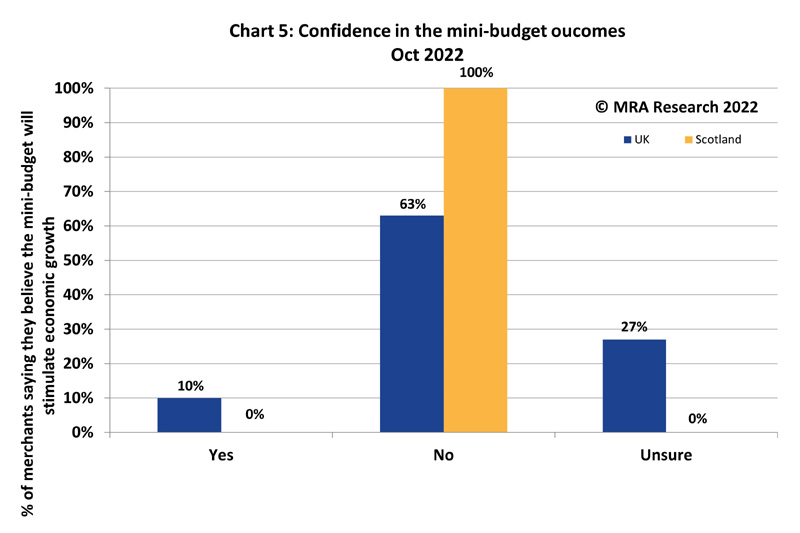

On the 23 September, former Prime Minister Liz Truss and ex-Chancellor of the Exchequer Kwasi Kwarteng announced a set of economic policies in what was widely referred to as a “mini-budget”. Two-thirds of Merchants across the UK (63%), and all in Scotland (100%), did not believe the policies would stimulate economic growth — Chart 5. Only 1 in 10 were confident; the rest were unsure (27%).

Merchants scored the performance of Truss and Kwarteng on a scale of 1 to 10. Three out of 10 rated them the lowest score of 1 — Chart 5. In Scotland, it was worse, with six in ten merchants (62%) giving them a score of one out of ten and no one scored them higher than 3.

(editor’s note: given the subsequent, rapid departure of both, it seems that the merchant sector viewpoint was rather prescient…)

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 41st in the series, with interviews conducted by MRA Research between 3rd and 6th October 2022. Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Ralph Sutcliffe at MRA Research on 01453 521621.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.