The industry is under pressure, but the latest instalment of The Pulse – as featured in the December edition of PBM – shows that merchants remain confident in the prospects for their own business.

A darkening global economy, continuing price pressures, and a cost-of-living crisis hit consumer confidence and dampened builders’ merchants’ sales expectations. Confidence in the market was low but has improved since the last month, and merchants continued to be much more confident in the prospects for their own business than for the market.

And having given the Government’s mini-budget a massive thumbs down last month, merchants weren’t convinced the new Prime Minister can or will fix the UK economy. Merchants in Scotland were deeply sceptical.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 1st and 2nd November 2022 (two working days).

Problems faced

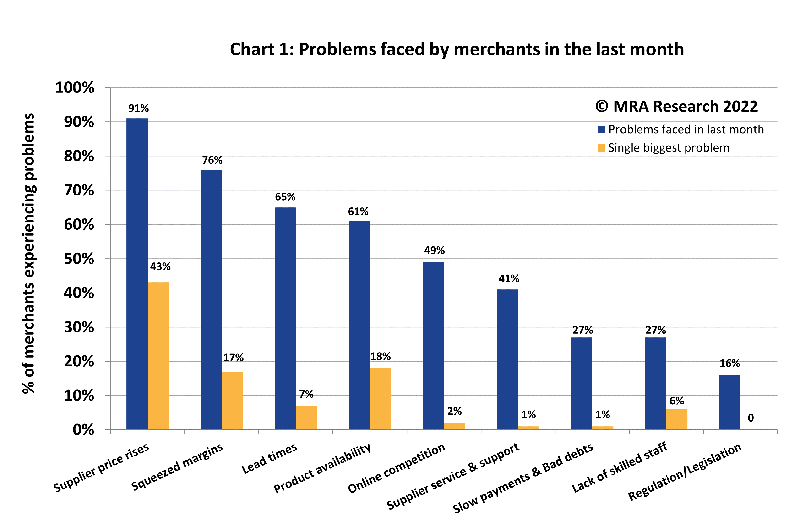

Merchants battled many problems in an unsettled economic and political environment. Supplier price rises were the single biggest problem for over four in ten merchants (43%) — Chart 1. Nearly one in five merchants said Product availability (18%) or Squeezed margins (17%) were their single biggest problem.

Sales expectations

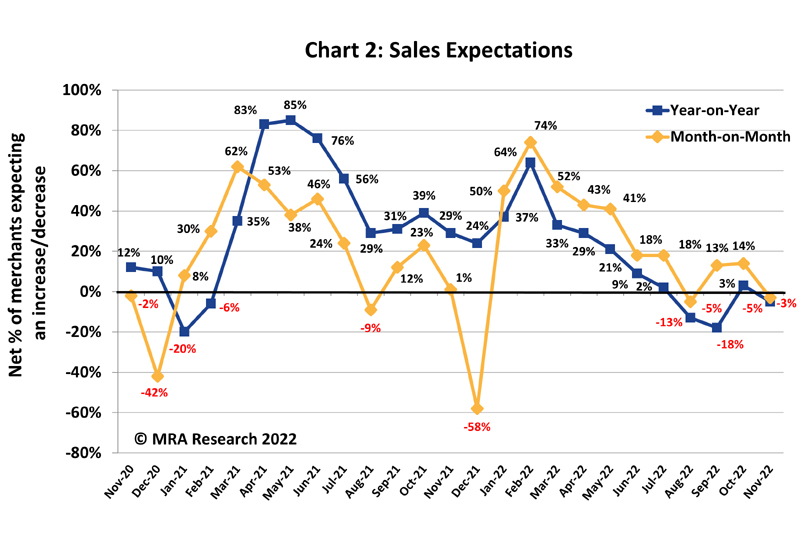

Continued turmoil in the trading environment and wider world dampened merchants’ expectations for November sales (net -3%) — Chart 2. Nationals (+5%) and Regionals (+2%) expected sales to grow, but a net -30% of Independents expected lower sales. A net -20% of Mid-sized outlets and -31% of merchants in Scotland expected sales to fall.

November sales expectations, compared to November last year, decreased to a net -5%, having recovered in October — Chart 2. Merchants in the North (-18%) and Scotland (-44%) expected lower sales, while sales were expected to grow in the South (+12%) with no change in the Midlands.

National Merchants (+11%) expected sales to grow, but Independents (-30%) and Regionals (-7%) expected sales to drop.

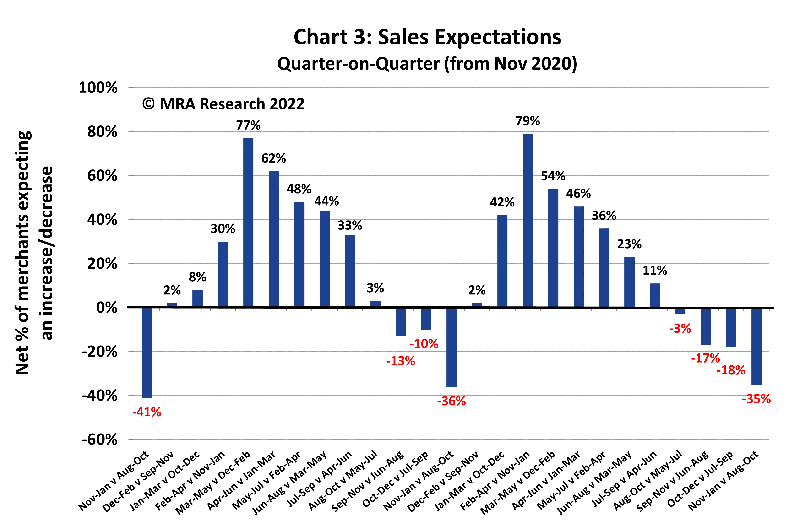

Looking three months ahead, expectations weakened markedly to a net -35% compared with the previous three months — Chart 3. Expectations were low across all merchants but particularly in Large outlets (-67%), and in Scotland (-50%). By type of merchant, a net -60% of Independents expected to sell less in the next three months compared to the previous three months. Nationals (-27%) and Regionals (-30%) also expected to sell less.

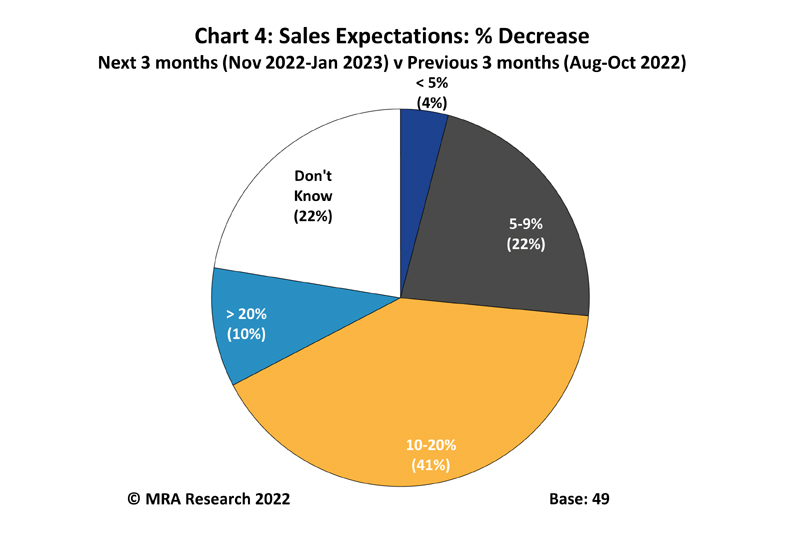

A quarter of the merchants (26%) who expect sales to decline in the next three months expect them to fall by up to 10% — Chart 4. Four in ten (41%) expected a drop of 10 to 20%, and 10% expected a steeper drop.

Confidence in the market

A net -13% of merchants were less confident in the market in November than in October, albeit that was an improvement on the previous month. Confidence in the market was weak in Scotland (-38%) and in the South (-18%). Merchants in the Midlands and North were more balanced (a net 0%) with those more confident balanced by an equal number who were less confident in the market.

Year-on-year confidence in the market recovered a little from the previous month — Chart 5. However, a net -34% of merchants were still less confident in the market at the start of November than they were in November 2021. Confidence was low across all sizes of outlet, regions and types of merchant. Independents (-50%), Merchants in the North (-45%) and the South (-36%) were least confident.

Confidence in their business

Merchants were consistently more confident in their own business than in the market. Confidence dropped slightly but remained at a net +8%, month on month. Small branches (+15%) and Mid-sized outlets (+4%) were confident. Confidence was stronger in the Midlands (+17%) and among Nationals (+16%).

Merchants’ confidence in their own business strengthened Year-on-Year to a net +9% — Chart 5. Nationals (+27%) and Small branches (+20%) were most confident. A net -2% of Regional merchants were less confident in the prospects for their business than they were last year.

Optimism for the future and the new PM

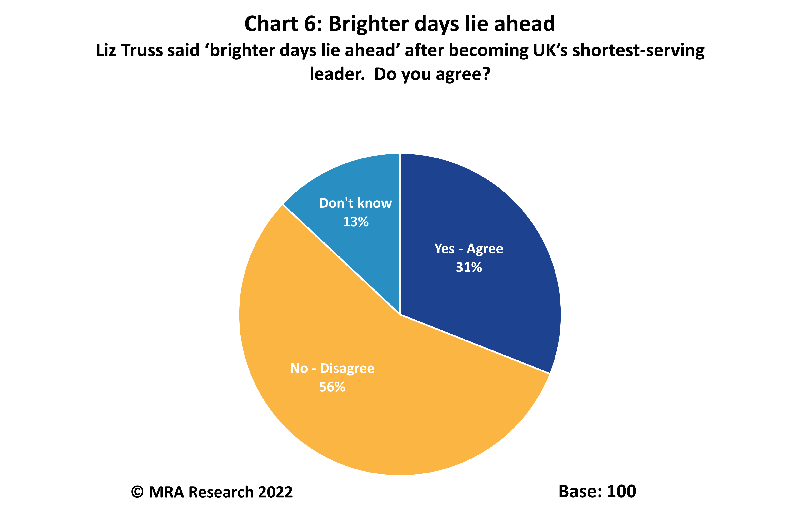

While one in three merchants (31%) were optimistic for the future and agreed that brighter days lie ahead 56% were not. Merchants in the South (59%) and Scotland (62%) were the least convinced — Chart 6.

Merchants were not confident in Rishi Sunak’s chances of fixing the UK economy. Confidence was asked on a scale of 1 to 10 where 1 was no chance and 10 a racing certainty, and less than three in ten merchants (28%) believed the new Prime Minister would fix the UK’s economic problems.

Most sat on the fence with scores of 4-7, but the PM got a big thumbs down from Merchants in Scotland with 50% rating his chances 1-3 out of ten. Less than one in ten (7%) gave him a ringing endorsement of 8, and there were no 9s or 10s.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 42nd in the series, with interviews conducted by MRA Research between 1st and 2nd November 2022 (two working days). Each month, a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The full report can be downloaded for free from www.mra-research.co.uk/thepulse or call Ralph Sutcliffe at MRA Research on 01453 521621.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.