As published in PBM’s February edition, the first ‘The Pulse’ survey conducted this year offers a refreshing amount of positivity in the marketplace.

Despite continuing strong headwinds, and the steady drip of gloomy news from Westminster and Fleet Street, merchant sales expectations for the first quarter, and the first half of the year, were unexpectedly robust.

Price rises were a continuing concern, but confidence in the market was rebuilding. Merchants’ confidence in the prospects for their own businesses had bounced back very strongly.

Looking ahead, we used the Builders’ Merchants Omnibus Survey to ask merchants about the forecast loss of trade customers, as older tradespeople retire and are not replaced by a similar number of young tradespeople. Merchants seemed poorly prepared for this demographic challenge (see panel below for full details).

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 4th and 6th January 2023 (three working days).

Problems faced

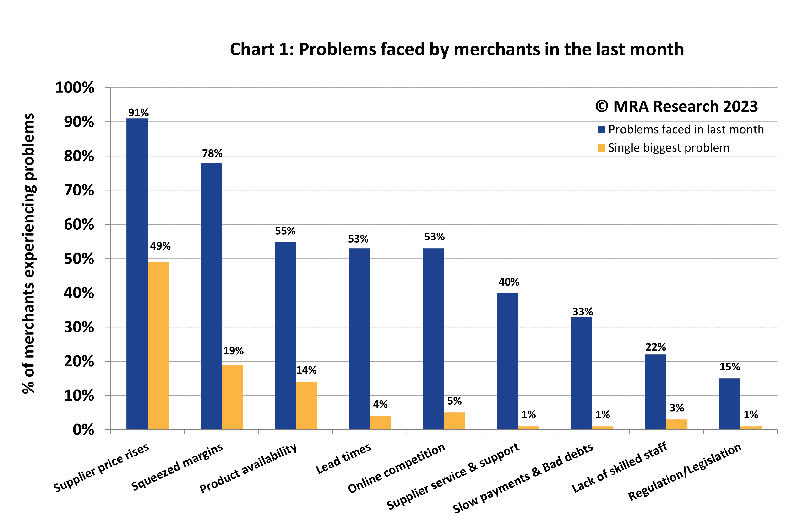

Merchants continued to battle challenges on multiple fronts. Supplier price rises were a problem for 9 in 10 (91%) with squeezed margins a problem for almost 8 in 10 (78%) — Chart 1. Supplier price rises were the single biggest problem for nearly 1 in 2 merchants (49%). Sales expectations

Sales expectations

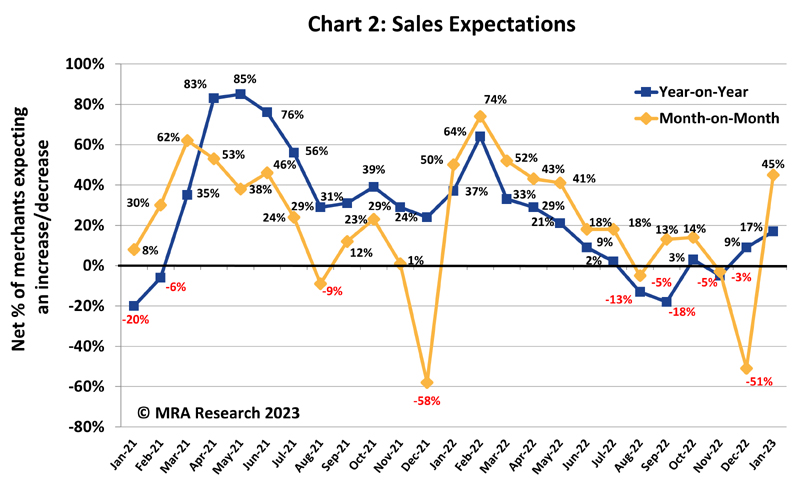

Sales expectations had bounced back significantly in January compared to December (from a net -51% to a net +45%) — Chart 2. Expectations were particularly strong in the Midlands (+65%), in large outlets (+55%) and Nationals +54%). Independents (+25%) and merchants in Scotland (+20%) had lower expectations.

Although just over 1 in 10 (13%) of the merchants expecting sales to increase in January compared to December expected sales to grow by less than 10%, nearly half (48%) expected sales to increase by 10 to 20%, and 17% expected an increase of over 20%.

Compared with January 2022, sales expectations were significantly up this January (net +17%). Expectations were strongest among Large outlets (+64%) and Nationals (+34%). Merchants in the Midlands (+23%) and the South (+29%) also anticipated sales growth, however merchant in the North and Scotland were more balanced with an equal number expecting increases as decreases (a net 0%).

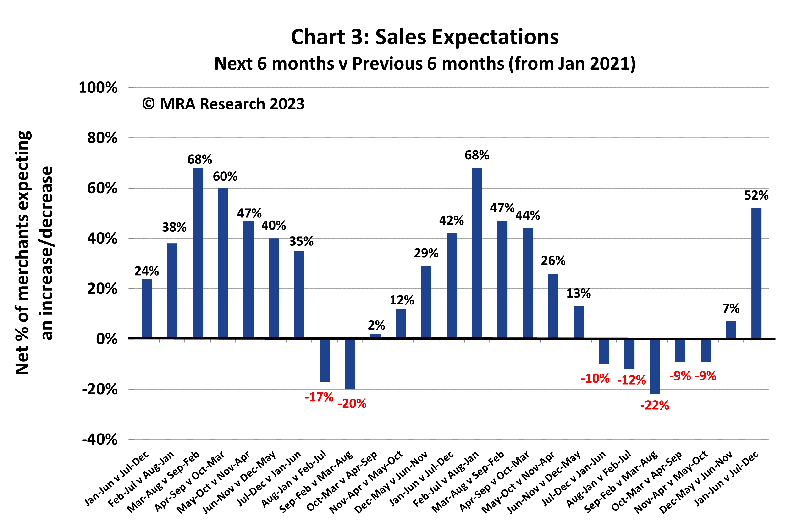

Just over 1 in 4 (27%) of those expecting sales to increase in January, compared to the same month in 2022, expected modest increases of up to 9%. But over a third (36%) expected sales to increase by 10 to 20%. And almost 1 in 10 (9%) expected growth of more than 20%. Looking six months ahead, a net +52% of merchants expected sales to increase in the six months January 2023 to June 2023 compared to the previous six months — Chart 3.

Looking six months ahead, a net +52% of merchants expected sales to increase in the six months January 2023 to June 2023 compared to the previous six months — Chart 3.

All regions expected growth. Merchants in the Midlands (+69%) and South (+63%) had the highest expectations, whilst fewer in Scotland (+20) and the North (+33%) expected growth. Nationals (+63%) and Large outlets (+82%) were strongest.

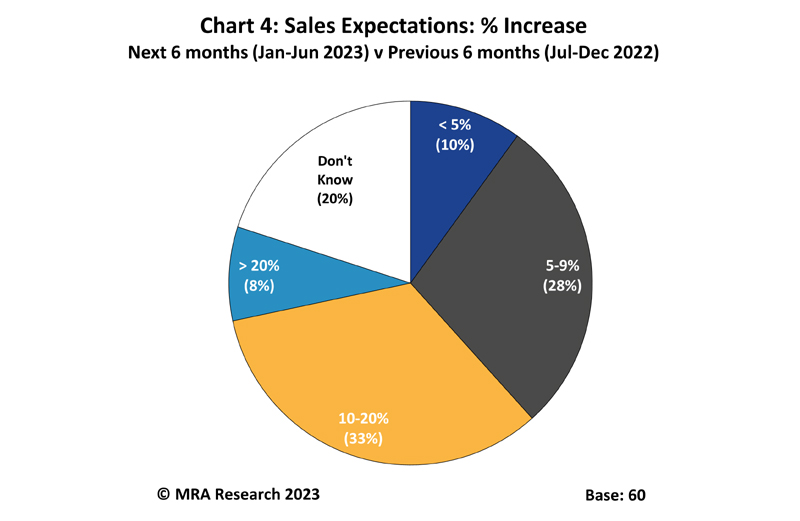

One in ten (10%) merchants expecting higher sales in the next six months expected to increase by less than 5% — Chart 4. However, just over a quarter (28%) expected an increase of 5 to 9% and a third (33%) expected growth of 10% to 20%. A further 8% were expecting growth of more than 20%.

Confidence in the market

Month-on-month confidence in the market built in January. From a low point of -35% last June merchants’ confidence in the market had been recovering, bouncing back from -27% in December to a net -6% in January.

Confidence was particularly strong in Large outlets (+27%) while merchants in Scotland (+13%) were more confident than in the South (-16%) and the North (-10%). An equal number of merchants in the Midlands were now more and less confident in the market (net 0%). Confidence was weaker among Nationals (-11%) with Regionals (-2%) and Independents (-5%) more confident.

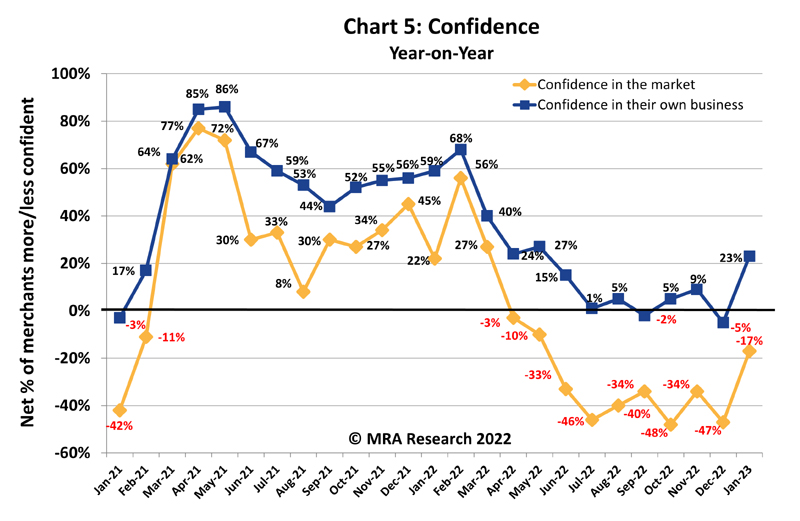

Year-on-year, confidence in the market had rebuilt significantly from a net -47% last month. A net -17% of merchants were less confident in the market at the start of January than they were in January 2022 — Chart 5. Indeed, market confidence remained low year on year across all sizes of outlet, regions and types of merchant. Nationals (-11%) were most confident with Independents (-25%) and Merchants in the North (-43%) least confident.

Confidence in their business

While merchants lacked confidence in the market, they were consistently more confident in the prospects for their own business with a net +33% now more confident month on month. Nationals (+43%) and Regionals (+31%) were most confident, but Independents were also confident in their own business (+20%). All types of Merchant in all regions were confident.

Year-on-Year, Merchants’ confidence in their own business had recovered to a net +23% — Chart 5. Nationals (+46%), Large outlets (+36%) and the Midlands (+42%) were the most confident but a net -5% of Independents were still less confident in the prospects for their business than they were last year.

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Yvette Kirk at MRA Research on 01453 521621.

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Yvette Kirk at MRA Research on 01453 521621.

“While merchants lacked confidence in the market, they were consistently more confident in the prospects for their own business with a net +33% now more confident month on month.”

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 45th in the series, with interviews conducted by MRA Research between 4th and 6th January 2023 (3 working days). Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.

The Pulse Omnibus: Confronting the demographic challenge in the construction industry

MRA Research’s newly launched Builders’ Merchants Omnibus Survey supplements The Pulse by providing informative feedback and commentary on a number of the key issues facing the merchant sector. This month, merchants were asked to consider the impact of an impending demographic threat developing within their trade customer profile.

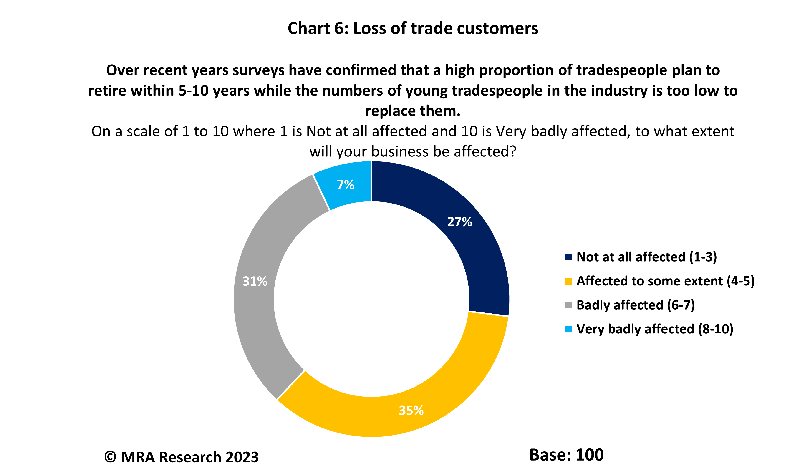

Over recent years, numerous surveys have confirmed that a high proportion of tradespeople plan to retire within 10-15 years while the numbers of young tradespeople in the industry is too low to replace them. PBM’s Omnibus questions in January focused on shedding light on this issue and the forecast loss of customers.

We asked whether merchants thought their business would be affected and if they had a plan in place.

Almost 4 in 10 merchants (38%) said their business would be badly (31%) or very badly (7%) affected by a forecast shortage of trade customers. More than a quarter (27%) believed their business would be largely unaffected — see Chart 6 above.

Just over 6 in 10 merchants (63%) said they had a plan to cope with the forecast shortage of trade customers, set out in one, three or five-year plans. A little over half (54%) of the merchants who had a plan said they were not able to give any details of the plan.

Furthermore, nearly 4 in 10 (37%) didn’t know if they had a plan for the forecast loss of customers.

“Almost 4 in 10 merchants (38%) said their business would be badly (31%) or very badly (7%) affected by a forecast shortage of trade customers. More than a quarter (27%) believed their business would be largely unaffected.”