Forget the gloomy forecasts, merchants are full of confidence according to the latest survey findings from The Pulse as revealed in the March 2023 edition of PBM.

Most economists are forecasting a shallow and relatively short recession, and technically we still seem to be on the brink of recession at present. But whatever forecasts say, based on what builders’ merchants are experiencing, sales expectations continue to build with merchants across the country expecting growth.

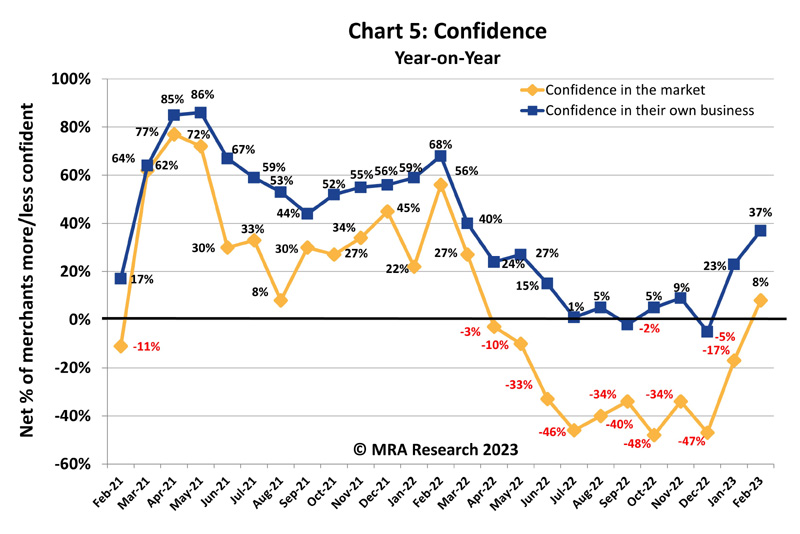

While inflation-driven supplier price rises and squeezed margins remain significant problems for merchants, market confidence has improved from a low point in mid-2022 and is back in positive territory. Furthermore, confidence in the prospects for their own business is significantly stronger.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 1st and 2nd February 2023 (two working days).

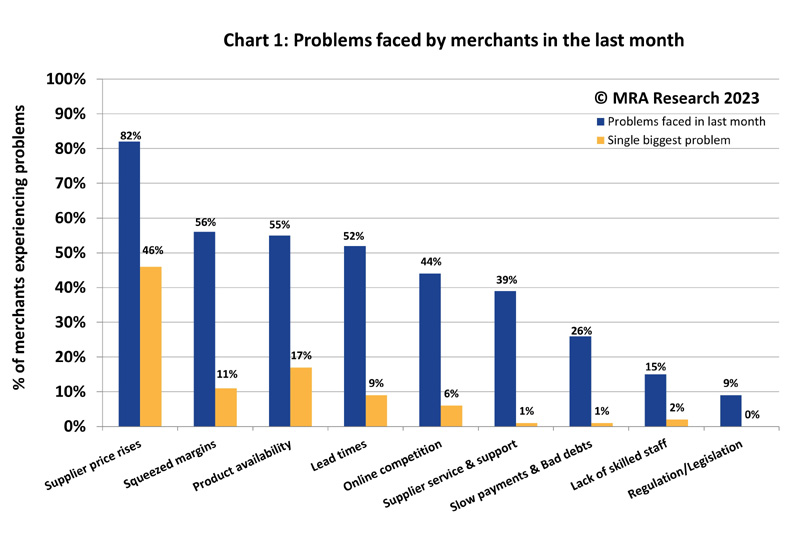

Problems faced

Supplier price rises were the single biggest problem for nearly 1 in 2 merchants (46%) — Chart 1. However, merchants continued to face many headwinds. Supplier price rises were the problem for 8 in 10 (82%) merchants, with squeezed margins a problem for almost 6 in 10 (56%). Sales expectations

Sales expectations

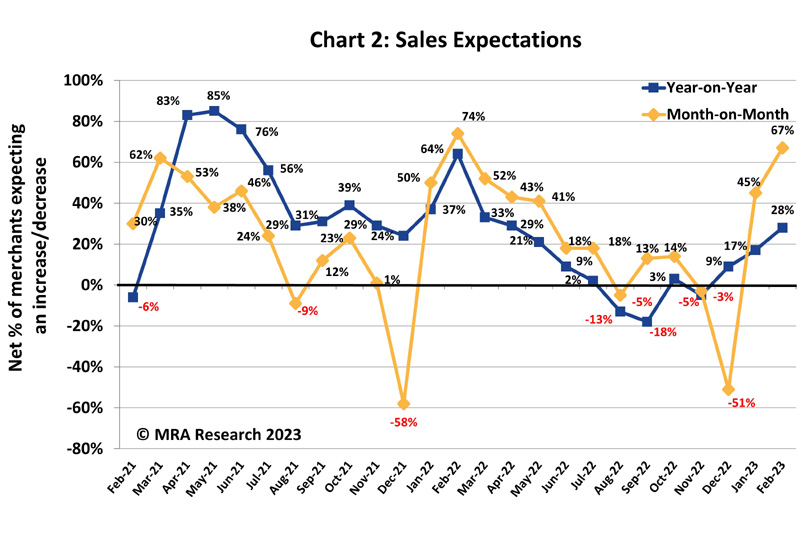

Month-on-month sales expectations have strengthened remarkably since December (to a net +67%) and nearly at the same level as in February 2022 — Chart 2. All types and size of merchants expected growth.

Expectations were particularly strong among Regionals (78%) and Independents (75%), in the Midlands (74%) and the South (71%). Expectations in the Nationals (+51%), small branches (+58%) and Merchants in Scotland (+47%) were also strong.

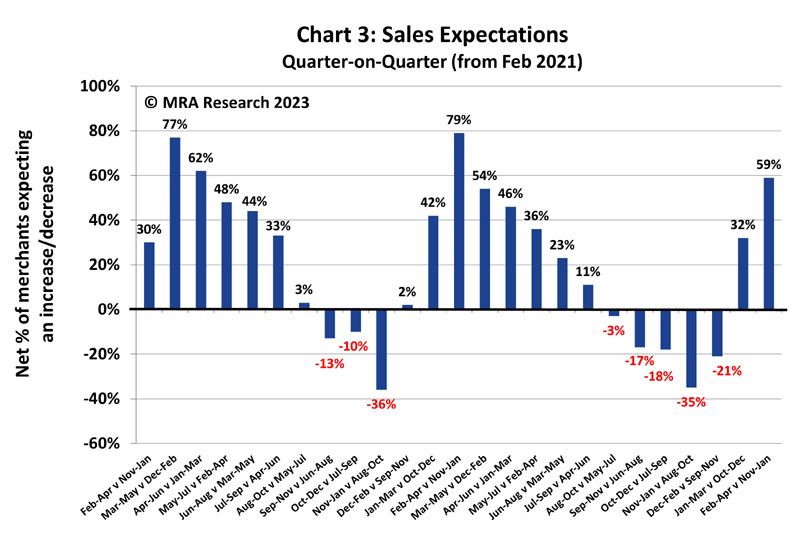

Compared with February 2022, this February’s year-on year sales expectations were well up (net +28%). Expectations were strongest among Large outlets (+50%) and Nationals (+36%). All types and size of Merchants expected growth. By region, only Scottish Merchants expected a decline (-6%). A net +59% of merchants expected sales to improve in February-April compared to the previous three months — Chart 3. All merchants expected growth. Merchants in the South (+74%) and Larger outlets (+75%) had the strongest expectations. Nationals (+46%) and merchants in Scotland (+47%) also expected growth.

A net +59% of merchants expected sales to improve in February-April compared to the previous three months — Chart 3. All merchants expected growth. Merchants in the South (+74%) and Larger outlets (+75%) had the strongest expectations. Nationals (+46%) and merchants in Scotland (+47%) also expected growth.

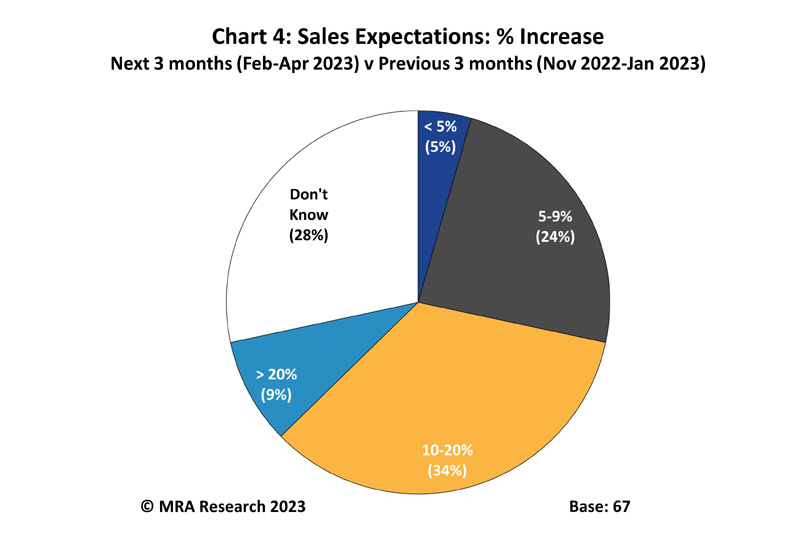

Nearly 1 in 3 (29%) of those expecting sales growth said they will grow by less than 10% — Chart 4. However, almost half (43%) expected sales growth of more than 10%.

Confidence in the market

Month-on-month confidence in the market soared to a net +26% in February. This was the first time in 10 months that more merchants were confident about the prospects for market than those who were less confident.

Merchants in the Midlands (+43%) and Independents (+38%) were most confident. The number of Large outlets who were more confident in the market was balanced by those who were less confident (net 0%).

Year-on-year confidence in the market continued to build. A net +8% of merchants were more confident in the market at the start of February than they were in February 2022 — Chart 5. All sizes of outlet, types of merchant, and all regions except the North were more confident in the prospects for the market. Confidence in the North is balanced with as many more confident as less (net 0%).

Confidence in their business

Merchant confidence in the prospects for their own business continued to build with a net +42% now more confident month on month. Confidence was strong across the board.

Scottish merchants were particularly confident (+53%) whilst Independents (+38%) and those in the South (+37%) were a little less confident.

Year-on-Year, Merchants’ confidence in their own business had strengthened markedly to a net +37% — Chart 5. Large outlets (+50%) and Regionals (+47%) were the most confident. Merchants in the South (+29%) were the least confident. The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Yvette Kirk at MRA Research on 01453 521621.

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Yvette Kirk at MRA Research on 01453 521621.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 46th in the series, with interviews conducted by MRA Research between 1st and 2nd February 2023 (two working days). Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.