The results shown in the latest installment of The Pulse (as seen in the April 2023 edition of PBM) reveal that merchants remain confident in their own prospects, but confidence in the market has started to waver.

Builders’ merchants’ sales expectations are robust and merchants’ confidence for the prospects of their own business remain strong, however their confidence in the market is being tested. Indeed, with continuing price inflation, merchant margins are coming under pressure whilst slow payments and bad debts are also growing problems.

The Pulse, by MRA Research, is a monthly tracking survey of merchants’ confidence and prospects. Telephone interviewing took place between 1st and 2nd March 2023 (two working days).

Problems faced

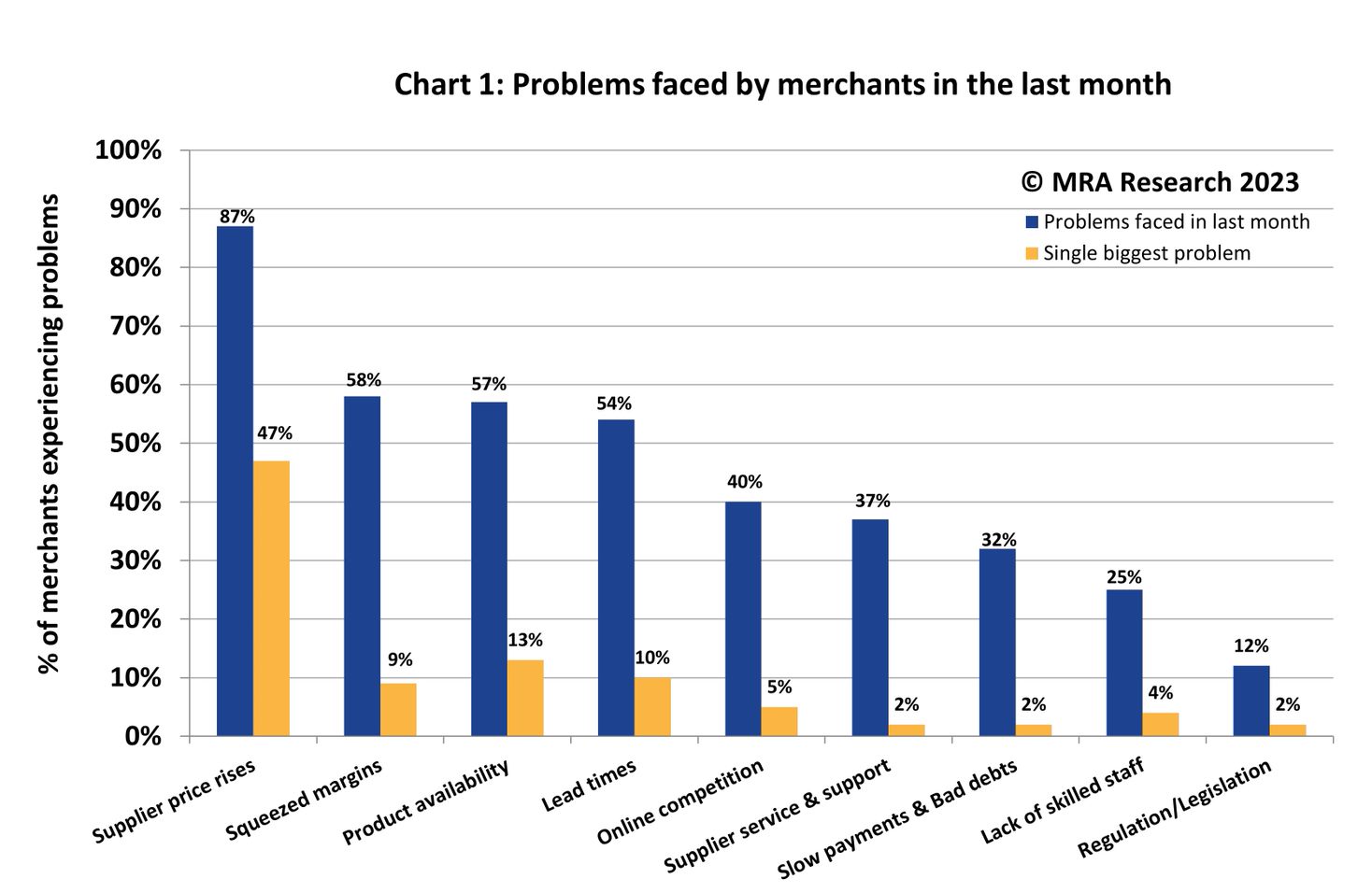

Supplier price rises remained the single biggest problem for nearly 1 in 2 merchants (47%) — Chart 1. Squeezed margins (58%), Product availability (57%) and Lead times (54%) were problems for over 1 in 2 merchants.

Trends in merchants’ problems

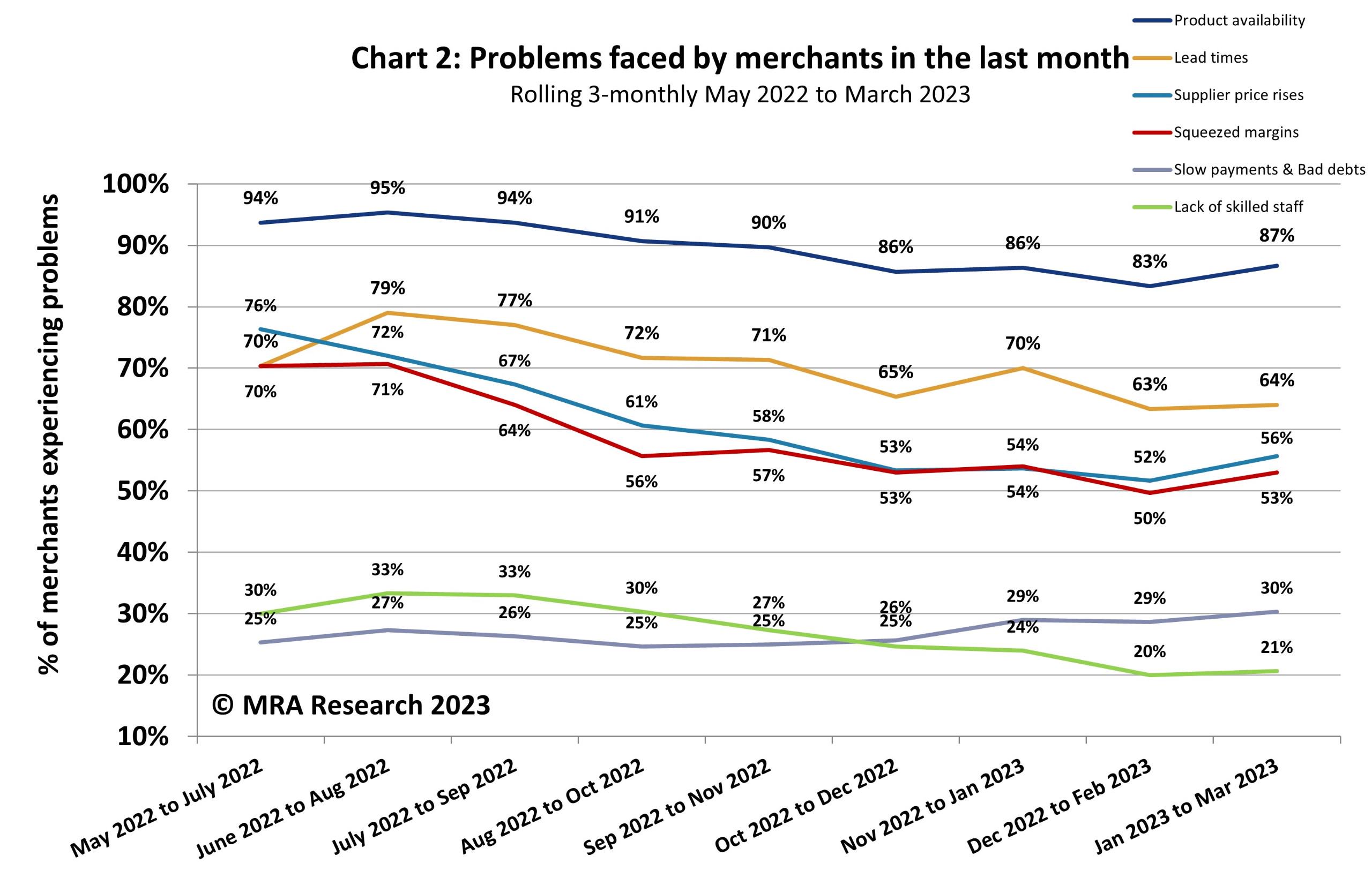

Product availability was not the most important problem, but it is still widespread and a consistent concern. Lead times were easing. Seven out of 10 merchants were concerned about squeezed margins in the three months May to July 2022 — Chart 2 — and it is still a concern to over 1 in 2 in the first three months of 2023. Slow payments and bad debts were a growing problem.

Sales expectations

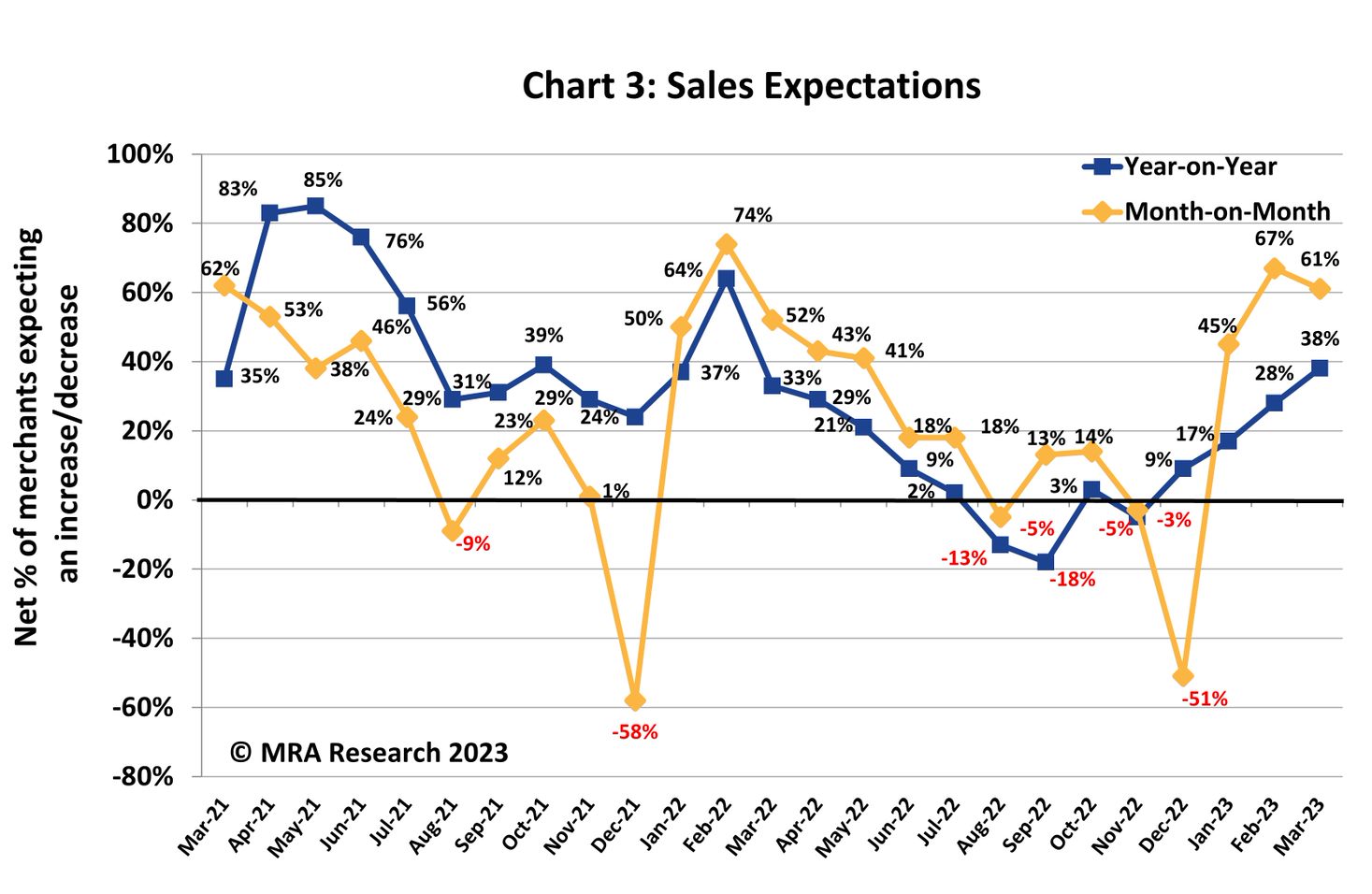

Month-on-month sales expectations dropped a little in March, but a net +61% expected growth — a level only exceeded three times in the last two years. All types and size of merchants expected growth. Expectations were strong among Regionals (62%) Nationals (61%) and Independents (60%). And across regions.

Expectations were particularly strong in Mid-sized outlets (78%) whilst Large outlets had lower expectations (38%) — Chart 3.

And compared with March 2022, sales expectations were well up with this March (net +38) the fourth month in a row where expectations had built. Expectations were strongest in Mid-sized outlets (+51%) and Nationals (+42%), and only Large outlets (-12%) expected to sell less year on year.

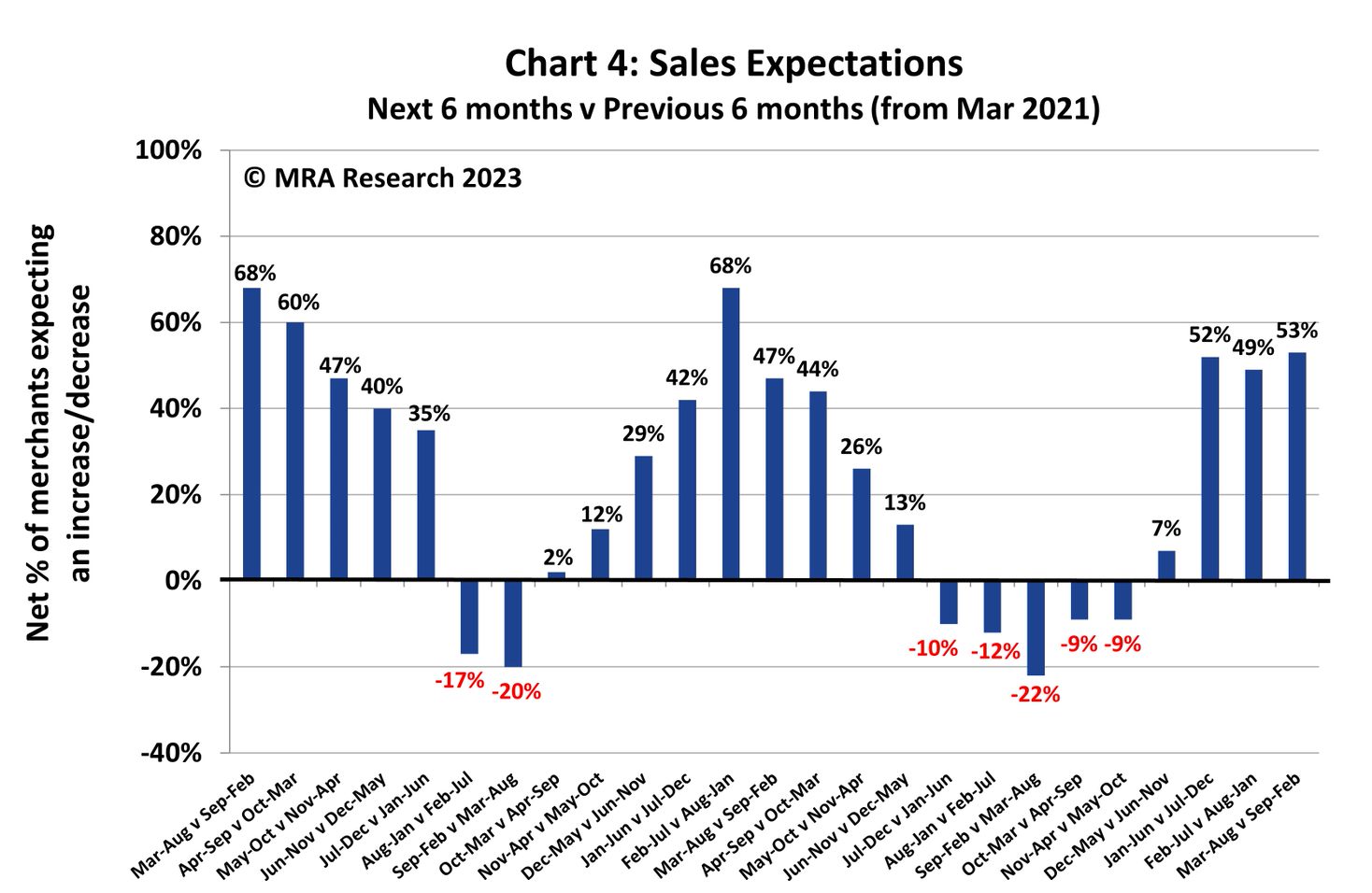

Looking six months ahead, a net +53% of merchants expected sales to increase in the six months of March 2023 to August 2023 compared to the previous six months. Expectations had been stable across the first three months of 2023. All merchants expected growth.

Regionals (+62%) and Independents (+60%) had higher expectations than Nationals (+39%).

Merchants in the North (+64%) lead in regional growth expectations but those in the South (+54%), Midlands (48%) and Scotland (44%) also expected growth — Chart 4. Over a third (35%) who anticipated higher sales expected them to improve by up to 10% in the next six months. Just over a third (35%) expected sales to grow by 10 to 20%, and 7% by more than that.

Confidence in the market

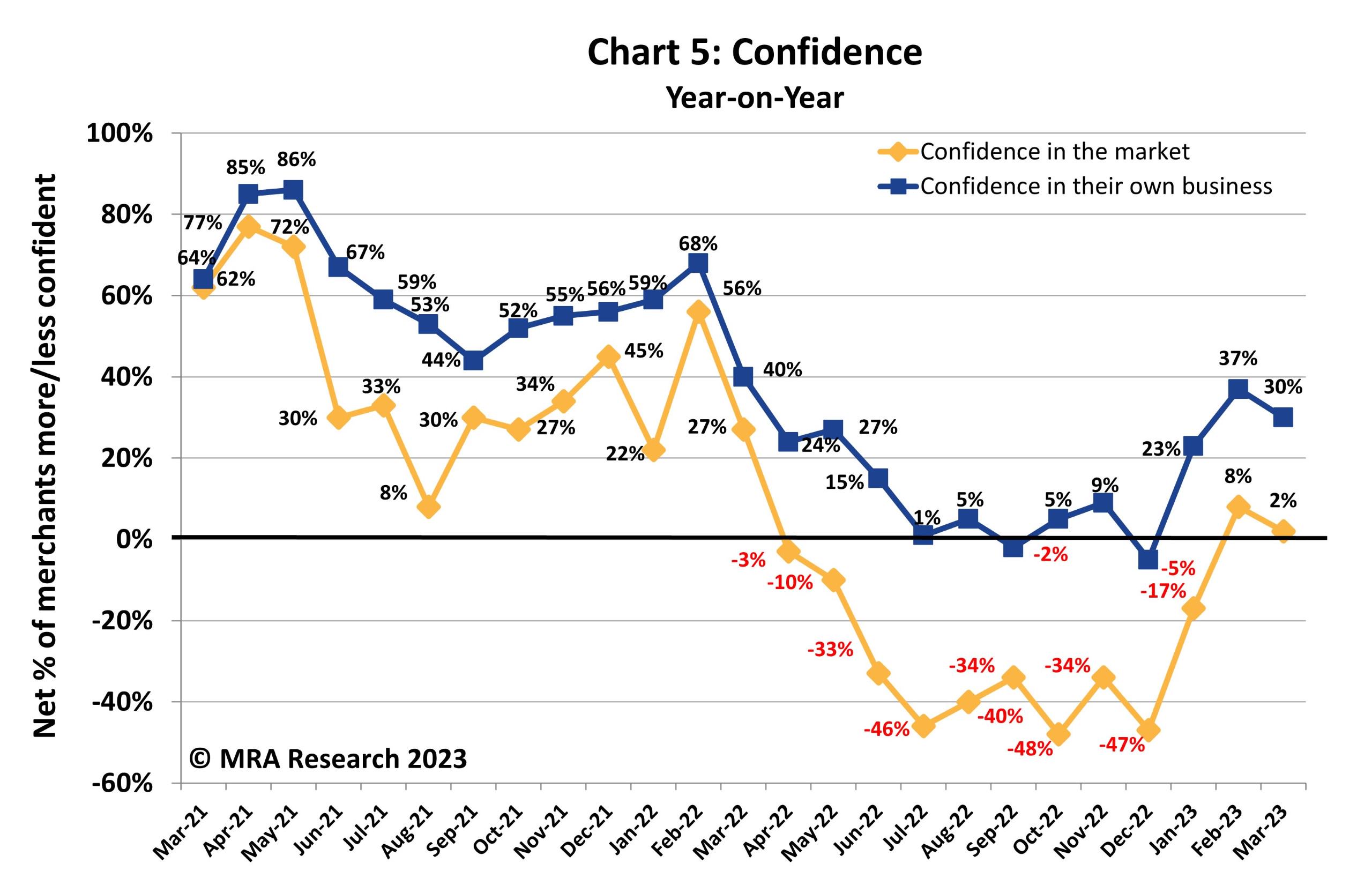

Having jumped to a net +26% in February, month-on-month, confidence in the market were tempered a little in March to a net +16%. Merchants in the North (+27%), Midlands (+26%) and Nationals (+29%) were most confident — Chart 5. The number of merchants in Scotland, Independents and Large outlets who were more confident in the market is balanced by the number who were less confident (net 0%).

Year-on-year, confidence in the market also weakened a little. A net +2% of merchants were more confident in the market in March 2023 than they were in March last year. Nationals (+11%) and merchants in the North (+14%) were the most confident. Merchants in the South (-5%), Scotland (-6%) and Regionals (-5%) were least confident.

Confidence in their business

Merchants’ confidence in the prospects for their own business was not only strong, at a net +40% who were more confident month-on-month, but much stronger than their confidence in the market. Merchants in the Midlands were particularly confident (+52%). Independents (+35%), Small outlets and those in the South (+33%) were also confident. And confidence was strong across the board.

Year-on-Year, Merchants’ confidence in their own business showed a slight drop from a net +37% in February to +30% in March. Nationals (+47%) were the most confident. Merchants in the South (+13%) and Large outlets (+12%) were the least confident — Chart 5.

The full report can be downloaded for free from www.mra-research.co.uk/the-pulse or call Yvette Kirk at MRA Research on 01453 521621.

The difference between the percentage of merchants expecting growth and those expecting a decrease is the net figure, expressed as a percentage. A positive net percentage indicates growth, a negative indicates decline. Net zero implies no change.

About the Pulse

The Pulse is a monthly trends survey tracking builders’ merchants’ confidence and prospects over time. Produced by MRA Research, the insight division of MRA Marketing, it captures merchants’ views of future prospects in terms of sales expectations, confidence in their business, confidence in the market, and the key issues and problems they experience.

This report is the 47th in the series, with interviews conducted by MRA Research between 1st and 2nd March 2023 (two working days). Each month a representative sample of 100 merchants is interviewed. The sample is balanced by region, size and type of merchant, including nationals, regional multi-branch independents, and smaller independent merchants.