Travis Perkins plc’s latest figures for Q1 2021 outline a positive start to 2021 “driven by strong RMI demand” and also notes that the demerger of Wickes is “on track for completion on 28th April”.

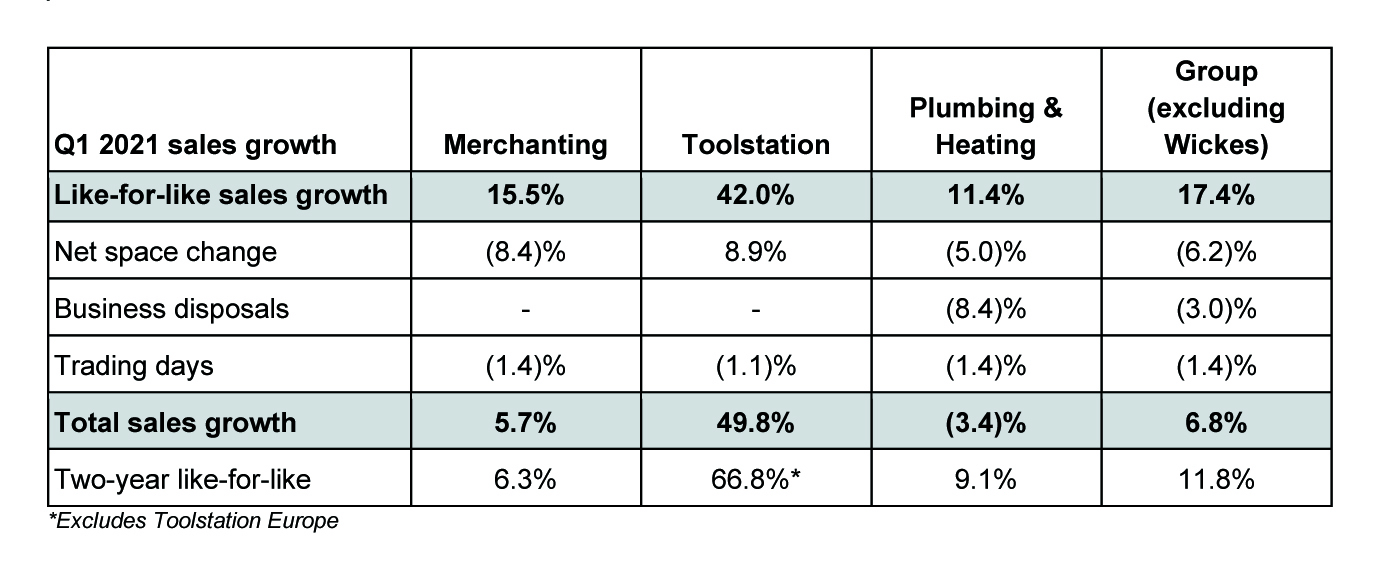

Good like-for-like growth in Merchanting and Plumbing & Heating was reported, up 15.5% and 11.4% respectively, and said to be “underpinned by sales retention from the 2020 restructuring programme”. The continued acceleration of growth through was made clear, with like-for-like sales up 42.0%. And as the demerger nears its conclusion, there was an “ongoing strong performance” in Wickes with like-for-like sales up 19.7%.

Nick Roberts, Chief Executive, commented: “The Group has enjoyed an encouraging start to the year with robust like-for-like sales growth across our businesses, underpinned by strong demand in the RMI market. The Merchanting business has maintained the momentum seen in the second half of last year while Toolstation continues to outperform, driven by its convenient and trade focused proposition.

“I am also pleased to report that the Wickes demerger process remains on schedule to be completed at the end of April, leaving the business a simplified and trade focused group.”

Nick added: “We are encouraged by the robustness of the RMI market and the continued recovery in our other key end markets. However, at this early stage in the year, our expectations remain unchanged as we continue to make progress on the delivery of our longer-term strategic plans.”

Revenue performance was said to have been boosted by the retention of sales from the branch closure programme conducted last summer and the “lapping of a weaker prior year comparator which included the start of the first national lockdown in March 2020”, leading to Group like-for-like sales growth of 17.4%.

Throughout January and February, all TP plc businesses saw a continuation of the trends from the last quarter of 2020. During March, however, the Group “experienced a marked step up in activity with pent-up demand and continued high levels of housing transactions fuelling higher RMI spend”.

Throughout January and February, all TP plc businesses saw a continuation of the trends from the last quarter of 2020. During March, however, the Group “experienced a marked step up in activity with pent-up demand and continued high levels of housing transactions fuelling higher RMI spend”.

In contrast, the results report noted that the new build housing and commercial sectors remain “subdued” although the businesses with exposure to the “early cycle” trades are seeing the first signs of improvement.

Like-for-like sales in the Merchanting segment were up by 6.3% on a two-year basis, supported by the retention of sales from 2020 branch closures. On a total sales basis, Merchanting sales were down (2.6)% vs Q1 2019 reflecting the overall reduced network capacity.

Toolstation’s impressive like-for-like growth continued, driven by its digitally enabled and convenient sales proposition. The Group remains on track to open 60 new branches in the UK in 2021, with further encouraging progress also reported in expanding the European business.

The Plumbing & Heating business continued the positive momentum seen in the second half of last year with two year like-for-like sales up 9.1%. Similarly to the Merchanting business, P&H has seen strength in its smaller, RMI focused customer base with the large contract segment slower to recover.

The Group notes it is experiencing “an increasingly inflationary environment, over and above that seen in the second half of 2020, with prices on certain raw material categories, such as timber, copper and steel, rising significantly”. At this stage, however, “cost price inflation remains manageable”. Additionally, the Group has seen availability shortages on some lightside products imported from Asia, as well as some key heavyside products moving onto allocation, “albeit this has not had a material impact on trading at this stage”.