The value of sales through specialist plumbing and heating merchants rose in the final quarter of 2022, according to figures released by the Builders Merchants Federation (BMF) in its latest Plumbing and Heating Merchants Index (PHMI). This was, however, largely driven by higher prices rather than increased volumes.

Quarter 4 2022 v Quarter 3 2022

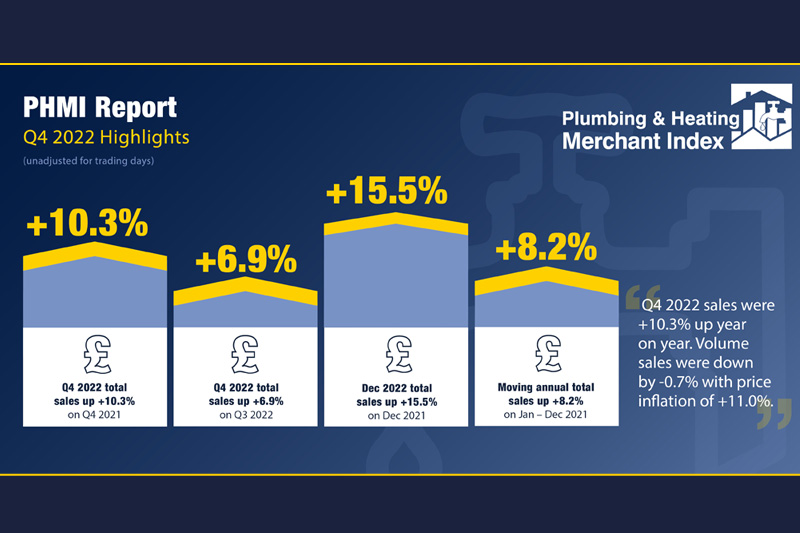

Despite their being five fewer trading days in the final quarter of the year, in value terms absolute sales in Q4 2022 were +6.9% higher than in the third quarter of the year. Volume sales were lower at -2.6%, but prices increased by +9.7%. Comparing like-for-like sales, adjusted for the difference in trading days between the two quarters, shows an increase of +15.9% in value sales in Q4.

Quarter 4 2022 v Quarter 4 2021

A comparison of the final quarter of 2022 with the same period in 2021 also highlights the effect of price increases over the past 12 months. Value sales in Q4 2022 were up by +10.3% over Q3 2021. Volume sales were 0.7% lower, while price was up by +11.0%. There was one less trading day in 2022, adjusted for this like-for-like sales increased by +12.2%.

2022 v 2021 Full Year

A review of the year shows sales from January to December 2022 rose by +8.2% over the previous year. Once again this was driven by price, up by +9.3% with volume sales -1.0% lower. With three less trading days in 2022, like-for-like sales were up by +9.5%.

Mike Rigby, CEO of MRA Research, which produces the report comments: “A return to more seasonal trends, a particularly cold snap at the end of the year, high energy bills and low consumer confidence were all part of the mix contributing to a sharp drop in December sales. This muted Q4 results after better than expected October and November figures.

“Fluctuations in prices (going up) and volumes (going down) have been a theme throughout 2022 and these have been quite pronounced on a monthly and quarterly basis. But the overall picture for 2022 is less dramatic. Twenty twenty-two was still a year of growth, and the fall in volumes was marginal and nowhere near as bad as expected.”

Mike continued: “As we move into 2023, hopefully there is an end in sight to the rolling ‘permacrisis’ which has affected consumers, housebuilders, trades and merchants since 2020. Supply problems have eased, and shipping costs from China and SE Asia have returned to normal. Inflation is starting to come down, and material costs are moderating, all of which will help to stimulate housebuilding and RMI markets again.

“Predictions have been so wide of the mark in the last three years, when no one expected any of the events influencing the extreme outcomes, that I hesitate to say that forecasts for doom in 2023 have been reined in. We could be starting the year in a much better position than previous years with the worst of times finally behind us.”

To download the latest report visit www.phmi.co.uk.

A brand of the Builders Merchants Federation, the data for the PHMI is taken solely from P&H specialists, including City Plumbing Supplies, James Hargreaves Plumbing Depot, Plumbfix, PTS, Williams & Co, and Wolseley, who form part of GfK’s Plumbing & Heating Merchants Panel. There is no overlap or double counting between the PHMI and the BMF’s established Builders Merchants Building Index which analyses sales at generalist merchants.