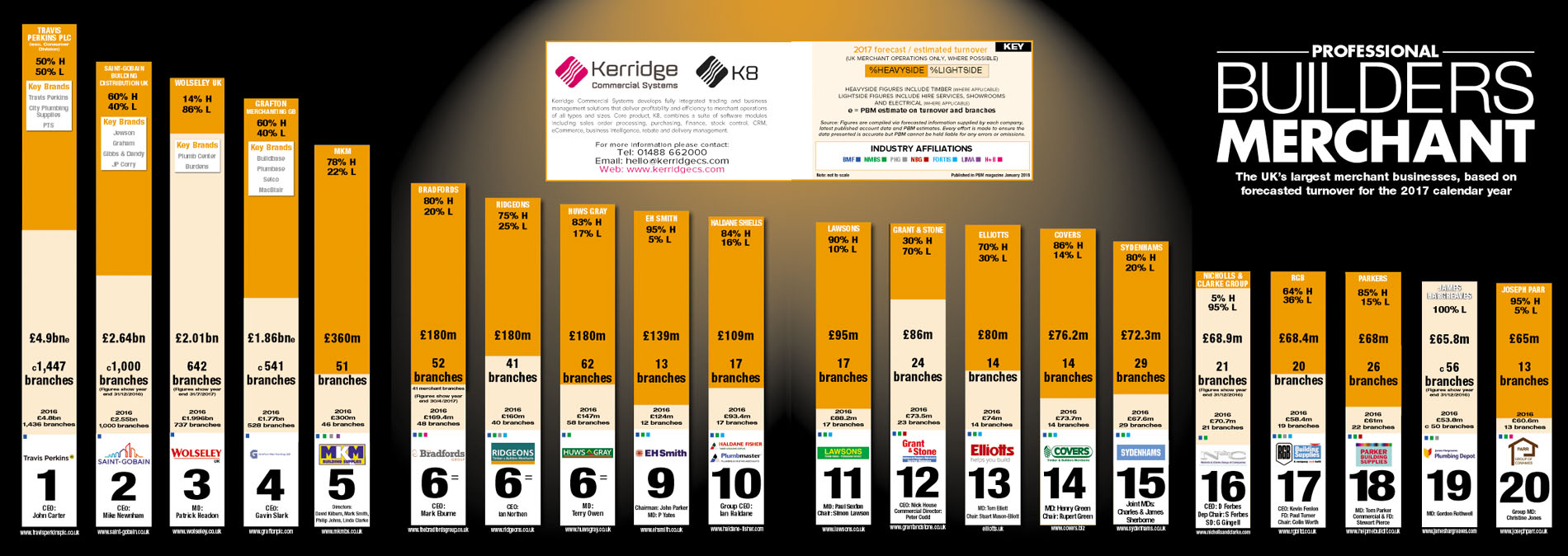

As published in our Janaury 2018 edition, PBM takes a look at the details behind the performance of the UK merchant sector’s largest businesses during the full calendar year of 2017 (based on turnover figures*).

UK merchant sector Top 20 – 2018 calendar year

UK merchant sector Top 20 – 2016 calendar year

Off the back of continually robust figures for the merchant sector being presented throughout the year by the likes of the BMBI, it should probably come as no surprise that our chart shows businesses in confident mood.

In broad terms, turnover has continued its upward curve but this is reinforced and reflected by increased sales, improved margins and inward investment. With a period of prolonged political and economic uncertainty showing little sign of improving, it is perhaps unsurprising that our respondents sound an air of caution. But make no mistake — the industry is bucking trends and optimistic for the year ahead.

Travis Perkins plc again leads the way. Again, we must state that we exclude data from the Group’s consumer division (which includes Wickes) to enable our league table to compare ‘like-for-like’ as much as possible. The business has seen a boost in its General Merchanting division, concentrating on maintaining margins against cost price inflation in addition to investing to drive growth.

It has seen a ‘stand-out’ performance in its contract division, with two year LFL growth of 12% according to the latest data available. Plumbing & Heating, however, continues to be described as a “tough market” albeit one where a “transformation plan” is showing “positive progress”.

Saint-Gobain Building Distribution maintains second position and, as seen earlier in this issue, has continued the expansion of its Trade Park network — in which it is co-locating Jewson operations with outlets for group companies such as Graham and CTD — with the opening of a new site in Royston, Hertfordshire.

In third, Wolseley UK (or should that now be Ferguson, given the renaming of its parent company this year…?) states that it remains focused on implementing its “major transformation programme” of “simplifying customer propositions and optimising the supply chain and branch network to deliver a more efficient business.”

This is involving some tough decisions and, in December, it was reported that further branches are set to close (to an overall total of 98) in addition to the organisation’s distribution centre in Leamington Spa.

Once more, the ongoing expansion of its Selco business grabs the headlines for Grafton’s UK merchanting business. The division was on track to open 12 new branches in 2017, with sites in Hayes and Solihull increasing the network to 59.

In fifth, MKM is boosted by the opening of five new branches in 2017. This year, the company is to “ramp up” its expansion programme still further, with 10-15 new locations planned as part of a strategy to “maintain and grow market share” in key geographical areas whilst maintaining focus on “key product sectors, increasing customer numbers (along with) margin and cash management.”

Something we’ve never had before on our chart is a three-way dead heat on turnover, but Bradfords, Ridgeons and Huws Gray all report a darts-flavoured £180m. It is a year in which Bradfords has taken the step of joining the H&B Group, whilst Ridgeons has continued to expand its network of PlumbStock branches — established in 2015, a site just opened in Cambridge takes the total of award-winning plumbing and heating stores to 23. Huws Gray, meanwhile, added a further four branches throughout the year and is looking for more strategic opportunities in neighbouring geographies throughout 2018.

In ninth, EH Smith opened a new store in Castle Bromwich with a site in central Birmingham to follow soon. More investment is being made in renovating branches to be more collection friendly whilst it will “continue to concentrate on increasing sales volumes and margins (whilst) maintaining a tight control over costs”.

Our Top 10 is completed by the Haldane Shiells Group. We are told that 2018 will see “at least two branches” open early in the year, with plans to add two more by the year’s close. Perhaps unsurprisingly given its trading locations, the company’s most recent report noted it was “cautious” about Brexit, stating it will “undoubtedly throw up new challenges for trade in and between the UK and Ireland.”

The company was not alone in referencing our departure from the EU. Lawsons, for example, cited that despite the uncertainty it was causing within the market, sales continued to grow and the business delivered an 8.5% increase compared to the previous year. Grant & Stone has three new branches in the pipeline, including its first timber merchant complete with in-house milling facilities.

2017 was a milestone year for Elliotts, with the firm celebrating its 175th anniversary — a commemorative film is to be unveiled this month. Sydenhams notes its plans for “continued expansion” throughout 2018; a sentiment echoed by RGB’s “continued drive to achieve sustainable growth”.

Parkers added four new trading locations, whilst the final positions on our countdown saw a real scramble for places… James Hargreaves and Joseph Parr ultimately secured the slots, but — with significant acquisitions already undertaken in 2017 — the likes of Lords and JT Atkinson will likely be present this time next year.

Equally, MP Moran, James Burrell, LBS and Murdock Builders Merchants — amongst others — narrowly miss out, but serve to illustrate the real ‘strength in depth’ of the merchant sector. A final caveat is that Howarth Timber & Building Supplies and Builder Depot should arguably each secure a place on our listing, however, we have been unable to obtain fully accurate and up-to-date information in all of our required categories and so have elected to refrain from including them this year.

Source: Figures are compiled via forecasted information supplied by each company, latest published account data and PBM estimates. Every effort is made to ensure the data presented is accurate but PBM cannot be held liable for any errors or omissions.

Published in PBM January 2018 and detailing he full calendar year of 2017