The latest report from the BMF’s Builders Merchants Building Index (BMBI) shows sales of building materials continuing their upward growth trend during Q1 2021.

One year on from the onset of the Covid pandemic, comparisons with Q1 2020 inevitably reference the initial fall in sales during the first lockdown period, which began on 24 March 2020. The reality of the bounceback is impressive nonetheless with Q1 2021 sales volumes continuing the upward trend seen in Q4 2020, and comparing well with the pre-Covid levels seen in Q1 2019.

Looking at Q1 2021 in detail, January was down -3.7% on the same month the previous year, with February seeing annual growth of 2.3%. March however was a record month for the industry, with sales increasing by 47.4% against March 2020 and by 23.0% against March 2019.

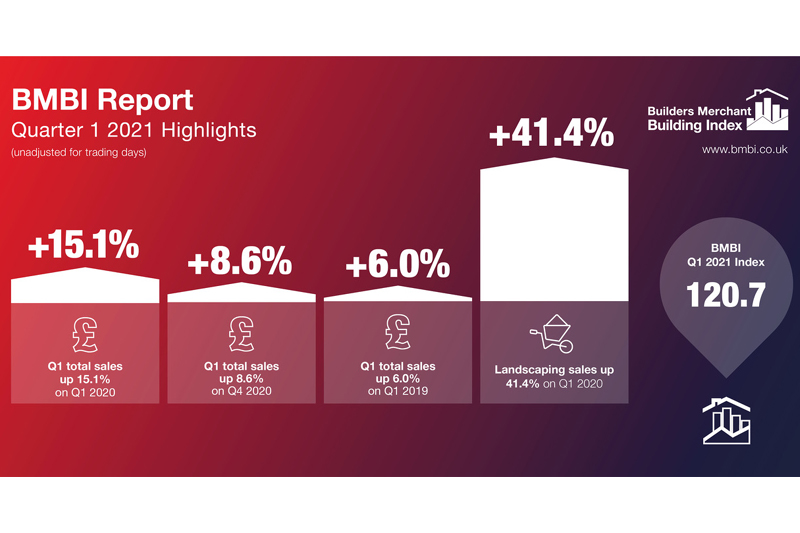

This results in overall Q1 growth of 15.1% against Q1 2020 and 6.0% against Q1 2019. The figures also confirm overall growth of 8.6% against Q4 2020, helped by three more trading days in Q1. Average sales a day were up by 3.4%.

Q1 2021 vs Q1 2020

The strongest year on year performers were Landscaping, up by +41.4% on Q1 2020, and Timber & Joinery (+30.5%). Sales of Tools increased by +15.9% year on year, and were also up for the largest product group, Heavy Building Materials (+10.3%) and Plumbing, Heating and Electrical products (+3.7%).

Workwear and Safetywear (-8.9%), one of the strongest performers a year ago when PPE was in great demand, was one of only four categories to record a fall in year on year sales for the quarter.

Q1 2021 vs Q1 2019

Comparing Q1 2021 with Q1 2019, Landscaping (+32.3%) and Timber & Joinery (+15.8%) were again the strongest performers. Heavy Building Materials also increased (+1.3%), but sales of Tools (-1.8%) and Plumbing Heating and Electrical products (-4.4%) were both lower on the two year comparison.

Q1 2021 vs Q4 2020

A similar picture emerges when comparing quarter on quarter results. Sales increased in 11 out of 12 categories in Q1 2021 vs Q4 2020, again led by Landscaping (+26.2%) and Timber & Joinery (+12.9%), strongly supported by Tools (+9.9%), Heavy Building Materials (+5.9%) and Plumbing, Heating & Electrical (+5.9%).

Kitchens and Bathrooms was one of the few areas to record a fall in sales in Q1 2021 against all three comparators, at -2.1% vs Q4 2020, -1.8% vs Q1 2020 and -6.7% vs Q1 2019. This may be due to showrooms being deemed non-essential retail and closed during the period.

John Newcomb, CEO of the Builders Merchants Federation, said: “The first three months of the year may have seen the country once again in lockdown but even this could not prevent a boom in construction activity. This is an excellent start to the year and we are already seeing strong product demand in many areas, notably timber which has been one of the main drivers for growth during the quarter.

“Managing product demand and supply will be a recurring theme this year and the Construction Leadership Council product availability group, which I co-chair, is issuing monthly updates to assist with forward planning.”

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK added: “To say the first quarter, and March in particular, has gone well is an understatement. It was not only the big hitters such as timber, bricks, aggregates, insulation, cement and plasterboard reporting record sales, but also areas such as tool hire, plumbing equipment, power tools, hand tools, boilers, tanks and boiler accessories. Repair, maintenance and improvement is expected to be the main driver during the first half of the year, and quite possibly beyond, which bodes well for the industry if supply can keep up with demand.”

Mike Rigby, CEO of MRA Research, commented: “Considering where the industry was this time last year, the rate and strength of recovery has been phenomenal, and it caught forecasters, including the OBR, flat footed. Recovery has been fuelled by strong growth in new house building and RMI (Repair, Maintenance & Improvements), amplified by homeowners – synchronised by lockdowns – getting the idea and desire for home improvement at the same time. The latest ONS figures confirm that construction output recovered to 2.4% above its pre-pandemic February 2020 level, with RMI 7.7% above February 2020.

“However, the pace of recovery varies between product sectors, with Landscaping and Timber & Joinery the strongest. Lead times are extending and prices rising as demand for building materials exceeds supply. It’s reported that many hard landscaping installers are booked out to the end of the year.

“It is encouraging, now that lockdowns have eased, to see internal categories like Kitchens and Bathrooms, Plumbing, Heating & Electrical and Decorating, starting to catch up with growth across the board in March compared to February. We expect differences across sectors to start to even out over the coming months.”

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchant Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.