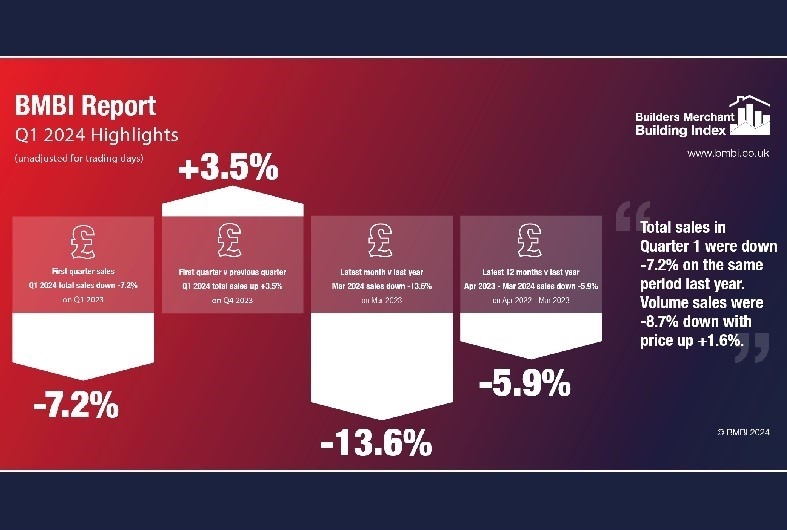

Figures for the first quarter of 2024, released in the latest BMF Builders Merchants Building Index (BMBI), highlight the continuing challenges in the construction sector, with adverse weather conditions in February and March also playing a role in dampening building material sales in the first three months of the year. Taking a more positive view, prices have largely stabilised.

Looking at Quarter 1 2024 v Quarter 1 2023, year on year total sales values in Q1 2024 fell by -7.2% compared to Q1 2023. Volume sales were down -8.7%, whereas prices rose by +1.6%. With one less trading day in Q1 2024, like-for-like sales were -5.7% lower this year.

The two largest categories were both well down on Q1 2023, with Timber & Joinery Products down by -10.6% and Heavy Building Materials down by -9.4%.

Quarter 1 2024 v Quarter 4 2023

Comparing sales in Q1 2024 with the final quarter of 2023 shows that total sales in the most recent three months were +3.5% higher than in the previous three months. Volume sales increased by +3.9% while prices were flat at -0.4%. However, with three more trading days in the first quarter of 2024, like for like total sales were -1.4% lower than Q4 2023.

Latest 12 months v Previous 12 months

Looking back across the last 12 months, total merchants’ sales between April 2023 and March 2024 were -5.9% lower than in the same period a year earlier, with no difference in trading days. Volume sales fell by -11.8% while prices rose by +6.6%.

Although eight of the smaller categories sold more in the last 12 month period, the three largest categories all sold less, namely Heavy Building Materials at -5.7%, Timber & Joinery Products at -13.2% and Landscaping at -8.4%.

Emile van der Ryst, Senior Client Insight Manager – Trade at GfK said: “Although the start to 2024 has been challenging, as could be expected, slowly but surely inflation has started coming down, while the UK moved out of a recession again.

“A headline story of the first quarter is the noticeable decline in price growth, which now sits at only +1.6% compared to +7.1% for 2023 Q4 vs 2022 Q4, and +16% for 2023 Q1 vs 2022 Q1. This is something we predicted at the end of 2024, when we also foresaw volumes recovering in the second half of the year.”

Emile continued: “The construction sector has been hampered by a lack of focused government input for the sector. We must hope that the earlier than expected election will sharpen that focus in the second half of the year.”

John Newcomb, CEO of the BMF, commented: “The first quarter’s results reflect the lowest number of housing starts in over a decade, a lack of consumer confidence and what feels like several months of continuous rain. The announcement of a General Election on July 4th brings fresh hope of better times around the corner.

“The combination of a new government, a continued fall in the rate of inflation and a reduction in interest rates should greenlight public projects, boost confidence in the housing market and encourage commercial and industrial projects to proceed.”

Mike Rigby, CEO of MRA Research who produce this report, added: “Exceptionally wet weather in Q1 and a hold on interest rates did little to revive the faltering newbuild market. The National House Building Council (NHBC) recently confirmed that new home registrations in Q1 were down 20% on last year, and this drop in demand has been felt throughout the supply chain.

“Despite the clouds hanging over the sector – figuratively and literally – there may be a break ahead. The latest ONS data for Q1 shows a marked increase in new construction orders (+15.9% quarter-on-quarter), buoyed by private commercial orders for offices, health and entertainment premises, while GfK’s Consumer Confidence Index shows another 2-point increase in consumer confidence in April, following a positive March. The consumer confidence Overall Index Score is still negative (-19), but it’s a vast improvement on the picture a year before, with five of the underlying measures significantly better than April last year.”

Mike concluded: “Could lowering inflation and the promise of tax and interest rate relief and the prospect of a new Government be boosting consumer confidence? If so, it could be a welcome shot in the arm for the housing market – and merchants and their suppliers – as we head into summer.”

More information can be found at www.bmbi.co.uk

The Builders Merchant Building Index (BMBI) report contains data from GfK’s ground-breaking Builders Merchants Panel, which analyses data from over 80% of generalist builders’ merchants’ sales throughout Great Britain. The BMBI, a brand of the BMF, is produced and managed by MRA Research. GfK’s Builders’ Merchant Point of Sale Tracking Data was created to set a gold standard in reliable market trends.

Unlike data from sources based on estimates, or sales from suppliers to the supply chain, this up-to-date data is based on actual sales from merchants to builders and other trades.