After two positive quarters, figures released in the latest BMF Builders Merchant Building Index show a small decline in sales performance in the third quarter.

The downturn is said to underscore growing pessimism within the sector about future market activity for the remainder of 2025 and into 2026.

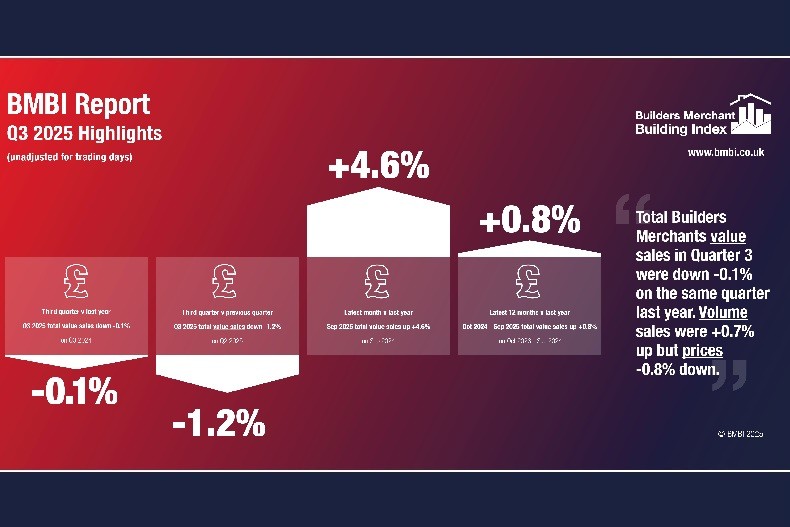

Quarter 3 2025 v Quarter 3 2024: Looking at the Quarter as a whole, year-on-year total value sales in Q3 2025 were marginally lower than the same period in 2024. With no difference in trading days between the two periods, Total Builders Merchants value sales in Q3 2025 were -0.1% lower than Q3 2024. Volume sales increased by +0.7% but prices were down by -0.8%.

Value sales increased in eight of 12 product categories, led by Renewables and Water Management, which increased by +6.0%. Timber and Joinery Products, the second largest category, increased by +2.1% outperforming the total market, but the largest category, Heavy Building Materials, at -1.7%, was one of four categories to underperform, with volume and average price down by -0.4% and -1.3% respectively.

Quarter 3 2025 v Quarter 2 2025: Value sales in Q3 2025 were weaker than in the second quarter of the year. A comparison shows total value sales in the latest three months were -1.2% lower than in the previous three months. Total volume sales fell by -1.0%, and prices were down by -0.8%.

With four more trading days in Q3 2025, like-for-like value sales were -7.3% lower than the previous quarter.

By value, nine of the 12 categories sold more, led by Plumbing, Heating & Electrical at +3.2%. Landscaping, a seasonal category, proved the weakest, with value sales falling by -13.8%. Once again Timber and Joinery Products (+1.6%) performed better than the total market, while Heavy Building Materials (-1.2%) was on par.

Year to date vs last year

January-September 2025 v January-September 2024: Total Builders Merchants value sales in the nine months January to September 2025 were +1.2% higher than in the same period in 2024. The increase was driven by volume (+2.8%), while prices fell by -1.6%. With one less trading day in 2025, like-for-like value sales increased by +1.7%.

By value, ten of the 12 categories sold more in the first nine months of the year, led by one of the smallest categories, Renewables & Water Saving (+7.4%). Timber & Joinery Products (+1.5%) performed better than Total Builders Merchants, but the largest category, Heavy Building Materials (+0.9%) fell below the average. Decorating (-2.8%) and Workwear & Safetywear (-0.7%) were the weakest categories.

Latest 12 months v last year (October 2024-September 2025 v October 2023-September 2024): Total value sales in the year October 2024 to September 2025, were up +0.8% against the same period a year earlier, with no difference in trading days. Total volume sales were up by +2.7%, while prices decreased by -1.9%.

Commenting on the figures, BMF CEO John Newcomb said: “This proved to be a difficult quarter, with concerns about the UK economic outlook and high levels of uncertainty ahead of the autumn budget limiting growth.

“Unfortunately, the budget didn’t provide the hoped-for incentives to spark the housing market. While we expect conditions to improve in 2026, significant growth is unlikely until the second half of the year, when interest rates are expected to be lower.”

Emile van der Ryst, Key Account Manager – Trade & DIY at NiQ GfK, added: “The pessimism in the sector is aligned with most macroeconomic indicators, with uncertainty around government budgets and policies as a key component. Geopolitical tensions continue to play a role, while a predicted stock market correction due to AI has started moving to the forefront.

“The fourth quarter is expected to be challenging, with confidence in market conditions continuing to deteriorate.”

Offering a detailed analysis, Mike Rigby, MD of MRA Research who produce this report, commented: “September shone against an unremarkable July and torrid August, so Q3 turned out to be much of the same for Britain’s builders’ merchants, with marginal movement in values and volumes compared to both the previous quarter and the year before.

“The latest ONS data for GB construction has total output increasing by +0.1% in Q3 compared to Q2. At a sector level, four of the nine sectors grew during Q3, with private housing repair and maintenance the main contributor for growth while the biggest drag was private new housing, which fell by -1.9%. On a monthly basis, September output grew by just +0.2%.

“With construction effectively still on hold and growth in one area offset by a drop in another, getting things moving again is going to take a considerable effort against strong headwinds. After five interest rates cuts since August, the Bank of England held interest rates at 4% in November with inflation stuck at 3.8%. Unemployment increased to 5.0% and activity in the housing market slowed to a four-year low, according to RICS. Household budgets are being squeezed, and there will be more hits to come from the budget fallout.

“The latest GfK Consumer Confidence index for November came in at -19, down two points from October, as public sentiment wilted ahead of the Budget, and households braced for possible bad news. All measures were lower. Expectations for personal finances shed two points to 1, while the outlook for the economy lost two points, at -32. The major purchase index slid three points at -15 too, as nervous shoppers put off big ticket spending. A fall across all five measures, says GfK, suggests the public was bracing for difficult news, with little in the current climate to lift expectations.

“The Budget won’t have done much to lift Britain’s animal spirits. But people can now start to think more purposely about house moves and home improvements, and businesses can firm up their view of the prospects for 2026.”

The Q3 2025 BMBI report is available to download at www.bmbi.co.uk.

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date proxy for Repair, Maintenance, and Improvement (RMI) activity in the UK.

The index is based on actual sales from NiQ GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 88% of total sales from builders’ merchants throughout Great Britain.

An in-depth review, which includes commentary by sector experts, is produced each quarter.