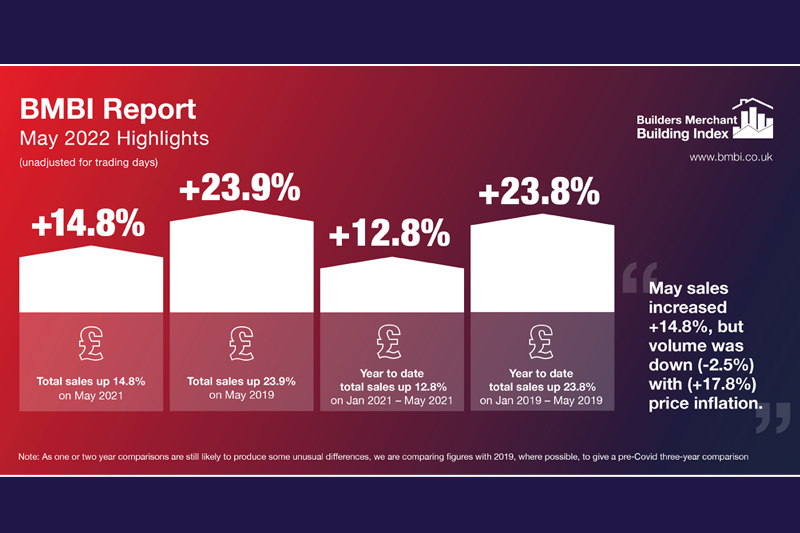

The latest Builders Merchant Building Index (BMBI) report reveals that builders’ merchants’ value sales were up +14.8% in May 2022 compared to the same month in 2021, driven more by rising prices (+17.8%) than volume sales (-2.5%) year-on-year.

All categories sold more in May 2022 compared to the previous year, with Kitchens & Bathrooms increasing the most (+29.7%). Six other categories fared better than merchants overall including Plumbing, Heating & Electrical (+21.6%), Heavy Building Materials (+20.6%) and Decorating (+16.5%). Tools (+11.9%), Ironmongery (+11.3%), Timber & Joinery Products (+6.8%) and Landscaping (+5.1%) grew more slowly. Like-for-like sales, which take into account the extra trading day in May 2022, were 9.1% higher.

Compared to May 2019, a more normal pre-pandemic year, total merchant value sales were 23.9% higher with one less trading day in the most recent period. All categories sold more, with three outperforming total merchants: Renewables & Water Saving (+50.8%), Timber & Joinery Products (+36.8%) and Landscaping (+33.0%). Like-for-like sales were up +30.1%, while price inflation hit +30.0% and volumes were down -4.7%.

Month-on-month, total merchant sales were +8.7% up in May compared to April 2022, with one more trading day this year. All categories sold more, including Heavy Building Materials (+10.5%) and Kitchens & Bathrooms (+10.0%). Like-for-like sales were +3.3% up.

Mike Rigby, CEO of MRA Research which produces this report, said: “Rampant price inflation continues to deceive, giving the illusion of growth. In reality the scales are starting to tip the other way with May volumes down in real terms, both against May last year and May 2019, a more normal pre-Covid year.

“It’s no surprise volumes are falling. The cost-of-living crisis is really starting to bite, and while this is unlikely to have much impact on older homeowners with little or no mortgage, younger homeowners (under 45s) are feeling the pressure of doubling energy bills and higher food costs, particularly if they have families to support. Home improvement projects are now lower down the priorities list, outside of essential repairs and maintenance, so a tail off in RMI-related sales is inevitable. How long will that last? Industry forecasts by Glenigan predict a strong three year recovery starting next year.”

May’s BMBI report, published in July, is available to download at www.bmbi.co.uk.

Developed and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK. The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for over 80% of total sales from builders’ merchants throughout Great Britain. An in-depth review, which includes commentary by sector experts, is provided each quarter.