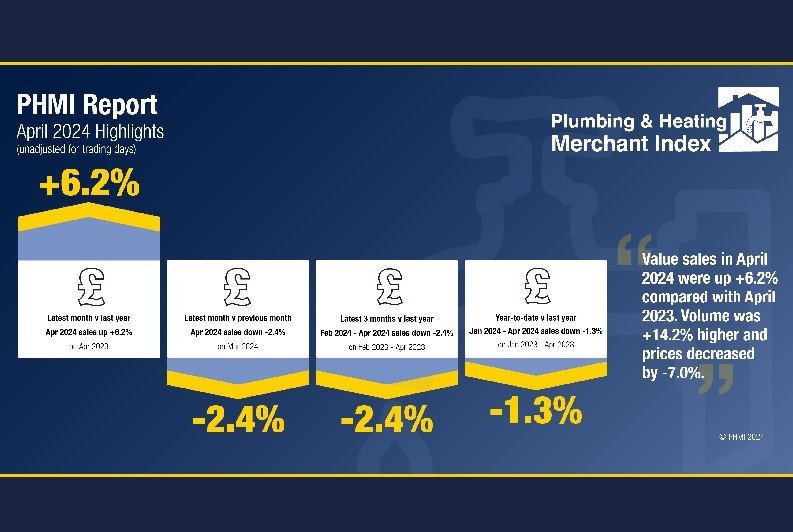

The latest figures from the Plumbing & Heating Merchant Index (PHMI) report show total value sales for April through specialist plumbing and heating merchants were up +6.2% in 2024 compared to April 2023. Volumes rose +14.2% and prices fell -7.0%.

However, with three additional trading days in 2024, like-for-like sales for April (taking trading day differences into account), were -9.0% lower than 2023.

Compared to March, April value sales were down -2.4%. Volume sales were up +7.9% while prices fell -9.6%. With one extra trading day in April, like-for-like value sales were -7.1% lower.

Total value sales in the three months February to April 2024 were down -2.4% compared to the same period a year ago. Volume sales fell -1.0% and prices were also down -1.4%. With one more trading day in the most recent three-month period, like-for-like sales were -4.0% lower.

Value sales in the three months February to April 2024 were -2.8% down on the previous three-month period (November 2023 to January 2024). Volume sales were +6.1% higher, however prices decreased -8.4%. With two more trading days in the most recent period, like-for-like sales were down -6.0%.

Plumbing & Heating merchants’ value sales in the rolling 12-month period from May 2023 to April 2024 were +1.2% higher than the previous 12-month period. However, volume sales were down -2.7%, with prices up +4.0%. With four extra trading days this year, like-for-like value sales were flat (-0.4%).

April’s PHMI index was 97.9 with no difference in trading days compared to the base period.

Mike Rigby, CEO of MRA Research which produces the report, commented:

“It was a better April for specialist plumbing and heating merchants with the monthly volume recovering +14.2% year on year. But, on like-for-like trading days, April’s value sales were -9.0% down compared to April 2023.

“With house building at historic lows, any uplift in plumbing and heating installations is likely to come from the residential repair, maintenance and improvement market. Despite the uncertainty of a general election, property prices hit a new average high in May and a survey by Rightmove suggested that 95% of people planning to move weren’t about to change their plans because of the prospect of a government change.

“The GfK Consumer Confidence Index also reflected a growing positivity, as the overall index improved two points to -17 in May, driven by significant jumps in the outlook for consumers’ personal finances and their expectations for the general economic situation. While the announcement of a July election caught many off guard, improving confidence and a wealth of polls indicating a change in government may be just the ticket to get consumers spending on home improvements again.”

To download the latest report, visit www.phmi.co.uk.

The Plumbing & Heating Merchant Index (PHMI) is the first to analyse point of sales data collated from specialist plumbing & heating merchants with combined annual sales of £3bn, to chart their performance month-to-month.

Based on data from GfK’s Plumbing & Heating Merchant Panel, which represents over 70% of the market by value, the report provides reliable data and a platform and voice for the industry, as well as for leading plumbing & heating brands.

It is produced by MRA Research for the Builders Merchants Federation and there is no overlap or double counting between PHMI and the Builders Merchants Building Index (BMBI) sales data.