Grafton Group plc has announced its half year results for the period ended 30 June 2023, citing a ‘resilient performance in challenging markets’ with its ‘full year expectations reaffirmed.’

The report notes that the Group’s Full year adjusted operating profit is expected to be in line with Analysts’ expectations with the underlying market fundamentals remaining strong “despite the current challenges.” Within its UK merchant operations (‘Distribution’), the company cited a “resilient first half performance” in spite of lower volumes.

Eric Born, Chief Executive Officer, said: “The strength of the Group’s market positions and our experienced management teams have underpinned a resilient performance in the face of challenging conditions during the first half. Grafton’s robust cash generation has enabled us to return £132.7 million to shareholders in the half year by way of share buybacks and dividends whilst leaving our net cash position broadly unchanged.

He continued: “This strong balance sheet, together with our nimble operating structure, will allow us to take advantage of organic and acquisitive growth opportunities. Whilst uncertainties remain in the short term, we are confident that Grafton is exceptionally well positioned to benefit as the cycle turns, markets normalise and consumer confidence gains momentum.”

Taken from the report, Grafton said the business “achieved a resilient set of results in the first half in challenging markets and measured against a strong performance outcome in the comparative period.” The half year results were “in line with the Board’s expectations and reflect the successful response by management in mitigating the decline in profitability from the combined

impacts of weaker markets and cost pressures.”

Residential repair, maintenance and improvement and house building activity across the four geographies where the Group operates was, in the words of the report, “adversely affected by cost-of-living pressures caused by the current environment of high inflation and successive interest rate increases.”

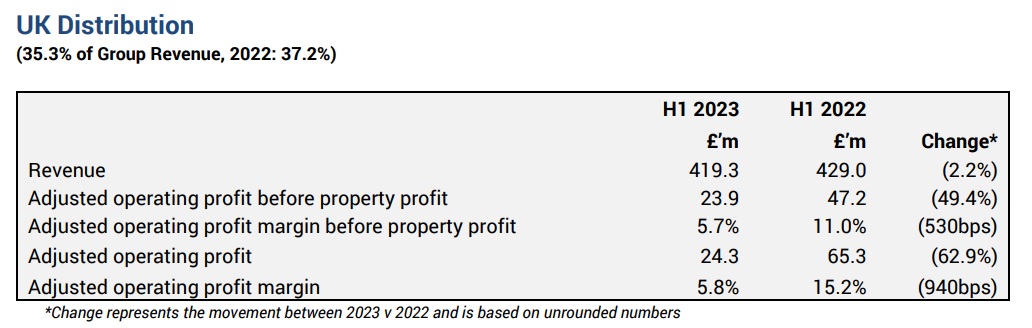

Volumes were lower in the Distribution (ie: merchanting) segment where “inflationary pressures in building materials and construction supplies moderated significantly with sharp and sustained falls in steel and timber prices from record highs.” These, it added, “were among the commodities that were most affected by the pandemic related rebound in activity and the spike in the price of building materials.” Distribution product price inflation elsewhere was said to have moderated significantly but remained positive.

Lower volumes and steel and timber price deflation “contributed to gross margin pressure in competitive markets and reduced profitability in the Distribution businesses in Ireland and the UK.”

The Group outlined that “the medium and long-term underlying fundamentals of the markets that Grafton operates in remain strong and its businesses are well positioned to benefit from structural growth drivers as markets recover.”

For example, it noted: “An ageing housing stock and the drive to improve energy efficiency and reduce carbon emissions, that is vital to creating a more sustainable future, support a positive outlook for housing RMI activity over the medium and longer term.”

UK Distribution

Looking specifically at its UK merchanting operations, Selco was reported to have “experienced challenging trading conditions in the residential RMI market as households reduced investment on home improvements and discretionary spending on repairs and maintenance in response to the cost-of-living increases, the decline in real disposable incomes and interest rate rises.”

Solely supplying the RMI market, the pace of the decline in volumes at Selco “moderated towards the end of the half year” with the business responding to market conditions having “invested in price on core products, balancing volume and margin to optimise profitability.” It also “implemented measures to realign volumes and operating costs that will create material savings in the second half of this year and next year.”

A new Selco branch was opened in Peterborough in April, increasing the estate to 75 branches.

For its Leyland SDM operation, revenue and profitability recovered through the half year whilst a new store opened in Hammersmith in February 2023. The London-based TG Lynes commercial pipes and fittings distribution business “delivered a good result maintaining operating profit in line with the record performance in the prior year.”

Meanwhile, “subdued demand and weak sentiment resulted in lower activity in the new housing market in Northern Ireland and contributed to a decline in revenue and profitability in the MacBlair distribution business.” However, MacBlair extended its market coverage in the province with the acquisition in June of a single branch in Portglenone, County Antrim. In July (outside the half year reporting period), it acquired a further branch in Strabane, County Tyrone.

Overall, average daily like-for-like revenue in the UK Distribution business was down by 2.3% in the first half. The rate of decline eased from 3.8% in the first quarter to 0.9% in the second quarter. Acquisitions and new branches contributed revenue of £4.1 million.

For more information on the half year results, visit the Grafton Group plc website.