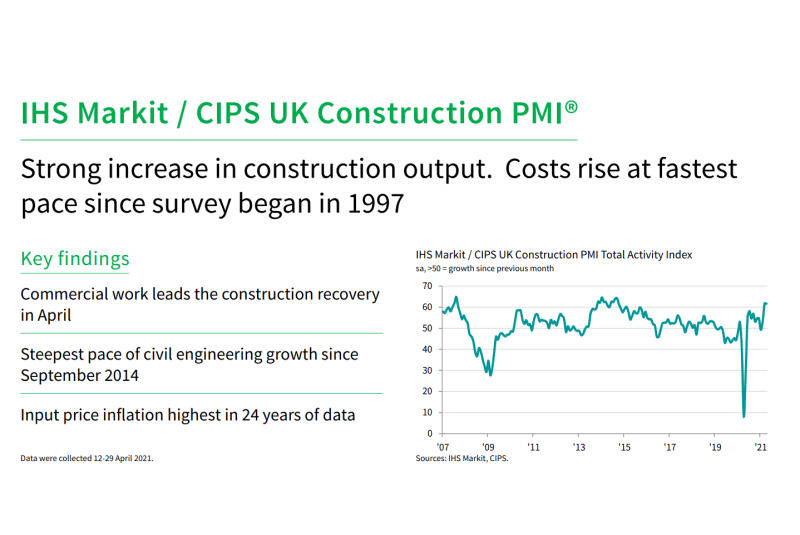

UK construction companies signalled a strong increase in output volumes during April, with continued recoveries seen in civil engineering activity, commercial work and house building. Workloads were boosted by the fastest rise in overall new orders since September 2014.

On a less positive note, demand and supply imbalances meant that the rate of input cost inflation picked up for the seventh month in a row to its highest since the survey began in April 1997.

The headline IHS Markit/CIPS UK Construction PMI Total Activity Index posted 61.6 in April, down only fractionally from March’s six-and-a-half year peak of 61.7. Any figure above 50.0 indicates an overall expansion of construction output. The index has posted in growth territory in ten of the past eleven months, with January 2021 the exception.

Commercial work (index at 62.2) was the best-performing broad category of construction output in April, although the rate of expansion eased slightly since March. Survey respondents widely commented on a boost to client demand from rising business confidence and the reopening of the UK economy.

Civil engineering (index at 61.5) bucked the softer overall growth trend in April and signalled its fastest speed of recovery since September 2014. Construction companies often cited increased levels of work on major infrastructure programmes, including contract awards from HS2 and Highways England.

Meanwhile, house building (index at 61.2) continued to rise at a strong pace in April, but the rate of growth eased from March’s recent peak (64.0). There were widespread reports of robust demand for residential building projects and new housing developments.

Total new work increased for the eleventh consecutive month in April. Moreover, the latest improvement in order books was the strongest for just over six-and-a-half years. This contributed to the steepest rate of job creation across the construction sector since December 2015.

Mirroring the trend for new business, input buying expanded at the fastest pace since September 2014. A rapid rise in demand for construction products and materials continued to stretch supply chains in April. The latest lengthening of suppliers’ delivery times was the third-greatest since the survey began in 1997, exceeded only by those seen during the lockdown in April and May last year. Construction firms mostly cited demand and supply imbalances, but some suggested that Brexit issues had led to delays with inputs arriving from the EU.

Higher prices paid for a wide range of construction items contributed to the fastest overall rate of cost inflation since the survey began in April 1997 (index at 84.6, up from 77.8 in March). Steel, timber and transportation were among the most commonly reported items up in price.

Looking ahead, construction companies remained highly upbeat about their growth prospects in April. More than half of the survey panel (57%) expect a rise in business activity during the next 12 months, while only 7% forecast a decline.

Tim Moore, Economics Director at IHS Markit, which compiles the survey, said:

“The UK construction sector is experiencing its strongest growth phase for six-and-a-half years, with the recovery now evenly balanced across the house building, commercial and civil engineering categories.

“New orders surged higher in April as the end of lockdown spurred contract awards on previously delayed commercial development projects. This added to the spike in workloads from robust housing demand and the delivery of major infrastructure programmes such as HS2.

“Shortages of construction materials and much longer wait times for deliveries from suppliers were a sting in the tail for the sector. Aggregates, timber, steel, cement and concrete products were all widely reported as in short supply by survey respondents.

“Supply and demand imbalances for construction items, alongside higher transport costs, resulted in severe price pressures across the board during April. The overall rate of input cost inflation reached its fastest since data collection began 24 years ago, exceeding the previous record seen at the top of the global commodity price cycle in 2008.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, added:

“The building blocks were in place in April as builders confirmed more work, more job opportunities and strong optimism for the next 12 months.

“The overall growth rate of new business strengthened to the fastest since September 2014 as all three sectors improved and civil engineering the laggard of last year gained the most momentum.

“Issues around supply chain performance acted as a drag on capacity however as supply constraints on essential materials increased to one of the third highest levels since 1997 when the survey began. Brexit issues remained a factor affecting deliveries from the EU and suppliers generally were struggling to meet the sudden rush in demand leading

to shortages of basic materials.“This inevitably led to the sharpest rise in cost inflation in a generation as builders scrambled to catch up on projects but the biggest rise in job creation since December 2015 also followed, signalling sustainable growth in the sector this summer.”

Related News:

UK Construction PMI for March 2021

UK Construction PMI for February 2021