UK construction companies recorded a sustained rebound in business activity during December, according to the latest PMI data compiled by IHS Markit.

Stronger order books helped to drive the recovery across the construction sector, with survey respondents often citing work on projects that had been delayed earlier in 2020.

Higher levels of demand led to a slight rise in employment numbers and greater demand for construction inputs in December. However, stretched supply chains and delays at UK ports resulted in longer delivery times and the fastest rate of input cost inflation since April 2019.

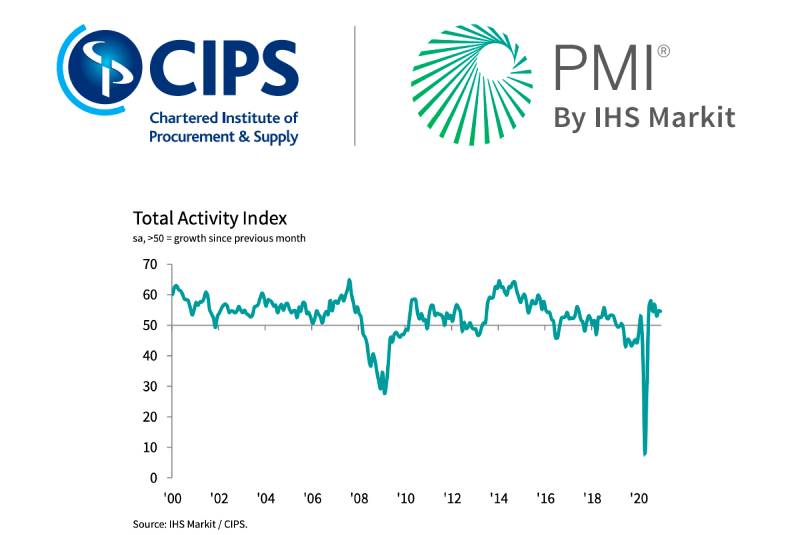

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index posted 54.6 in December, little-changed from 54.7 in November and above the crucial 50.0 no-change threshold for the seventh consecutive month.

Increased construction activity primarily reflected another sharp rise in house building during December (index at 61.9). Commercial activity also expanded (51.2), but the rate of growth eased to its lowest since the recovery began last June. Civil engineering was the weakest-performing category (48.0), with activity falling for the fourth time in the past five months.

Total new orders increased at a strong pace in December, which extended the current period of expansion to seven months. Survey respondents noted improving client demand, alongside a boost from new business wins on construction projects that had been deferred at the start of the pandemic.

Rising workloads contributed to a sharp increase in purchasing activity at the end of 2020, with the rate of expansion holding close to November’s six-year high. Some construction companies also cited efforts to bring forward input buying due to concerns about longer lead times among suppliers. The latest downturn in vendor performance was the sharpest since June 2020 and more marked than any seen prior to the pandemic.

Purchasing prices increased at the steepest pace for just under two years, reflecting supply shortages and strong demand for construction inputs. Survey respondents often cited rising prices for timber and steel.

December data indicated a return to jobs growth in the construction sector, although the rate of expansion was only marginal. Additional staff hiring reflected forthcoming new projects and improved confidence about the business outlook. Exactly half of the survey panel (50%) forecast a rise in business activity over the course of 2021, while only 10% anticipate a decline, which signalled the strongest optimism across the construction sector since April 2017.

Tim Moore, Economics Director at IHS Markit, which compiles the survey, said:

“December data illustrated a positive end to the year for the UK construction sector, mostly fuelled by a sharp rebound in house building. Overall output growth has slowed in comparison to the catch-up phase last summer, but now it is encouraging to see the recovery driven by new projects and stronger underlying demand.

“A sustained improvement in construction order books resulted in a rise in employment numbers for the first time in nearly two years and the most optimistic growth expectations since April 2017. Construction companies are hopeful that higher demand will broaden out beyond residential projects in the next 12 months, led by infrastructure spending and a potential rebound in new commercial work from the depressed levels seen during the pandemic.

“Transport delays and a lack of stock among suppliers were the main difficulties reported by UK construction firms at the end of 2020, which contributed to the fastest rise in purchasing prices for nearly two years.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, added:

“Some positive news for the construction sector in December as the uplift from summer’s close continued through to the end of 2020 and new order levels increased for the seventh successive month. Long-term prospects came to fruition and halted projects started again as clients became more optimistic after the covid hiatus. To meet this demand head-on, builders opted for job creation for the first time in 21 months to increase previously pared-back capacity.

“Further down the line, with purchasing growth close to its highest for six years, supply chains were groaning at the seams and delivery times increased to the most dramatic extent for six months. Low availability for finished products and raw materials as a result of port disruptions added to builders’ woes as suppliers named their price for goods in acutely short supply and input price inflation increased to its highest level since April 2019.

“Once again residential building was the strongest sector and construction companies focussed on this segment seem resilient for now. As the appetite for building resources grows in the first quarter of the year however, suppliers will find it difficult to ramp up production quickly to pre-pandemic levels, so we could see even longer delivery times potentially delaying some building projects as post-Brexit disruption also remains an ever-present threat.”

Related News:

UK Construction PMI for November 2020

UK Construction PMI for October 2020