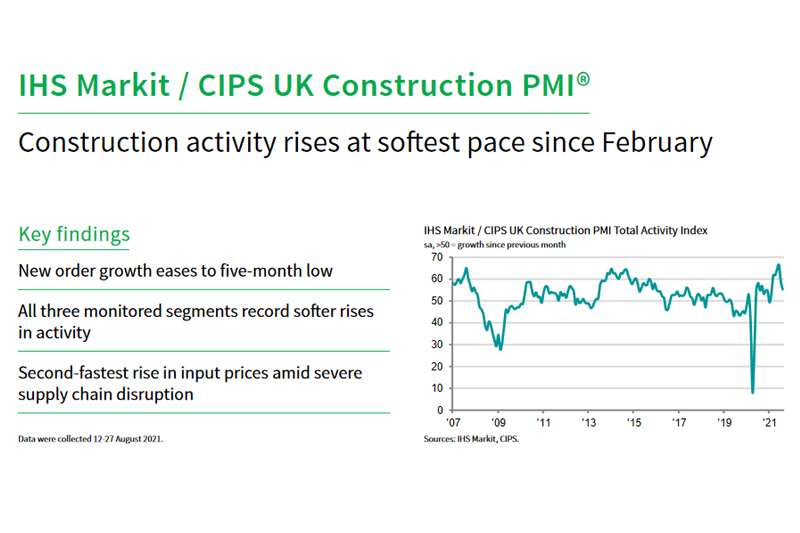

The latest Construction PMI report for August 2021 shows that new order growth has easeed to a five-month low with all three monitored segments recording softer rises in activity compounded by the second-fastest recorded rise in input prices amid severe supply chain disruption.

UK construction companies signalled a further increase in output volumes during August, however the pace of growth eased notably from the previous survey period. There were softer expansions across housebuilding, commercial work and civil engineering activity, as well as in new order growth. Moreover, companies widely noted sustained – and severe – supply chain disruption in August, which contributed to an accelerated rise in input prices – and one that was the second sharpest in the history of the survey.

The headline seasonally adjusted IHS Markit/CIPS UK Construction PMI Total Activity Index posted 55.2 in August, down from 58.7 in July, indicating activity has expanded in each of the last seven months. That said, the rate of increase eased to the softest since February as restricted supply of materials and transport began to weigh on overall construction activity.

Commercial work (index at 56.0) was the best performing broad category of construction output in August, though the rate of expansion eased to the slowest for six months. This was followed closely by housebuilding (55.0), while civil engineering remained the slowest growing subsector (54.8) for the fourth month in a row.

Total new work increased for the fifteenth consecutive month in August. While the latest improvement in order books was marked overall, the rate of growth softened to the weakest since March. Businesses noted a continued resumption of projects that had been delayed due to Brexit and the COVID-19 pandemic, though client confidence was dampened by volatility in raw material supplies and increased cost burdens.

Amid softer growth in new orders, the rate of job creation eased to a four-month low in the latest survey period. Firms continued to note that strong market conditions had sustained demand for new employees, though additional cost burdens and a lack of skilled workers began to weigh on the rate of hiring.

Input buying expanded at the slowest pace since January. Strong rises in demand for construction materials continued to stretch supply chains however, as some firms noted difficulty in sourcing and receiving purchased inputs. This occurred as supplier delivery times continued to lengthen at a substantial rate, though one that was slightly improved from June’s record deterioration.

Anecdotal evidence suggested that ongoing material shortages were exacerbated by a lack of transport and freight availability, compounding existing issues related to the supply of materials due to port congestions and demand and supply imbalances.

As a result, input cost inflation accelerated to the second-fastest rate in the 24-year history of the survey, surpassed only by the record rise two months prior. Among those materials reported as up in price, the most common were concrete, fuel steel and timber.

Looking ahead, construction companies remained highly upbeat about their growth prospects over the coming 12 months. Positive sentiment was underpinned by hopes of an expected rise in new contract awards across all subsectors of construction.

Data were collected 12-27 August 2021.

Usamah Bhatti, Economist at IHS Markit, which compiles the survey said:

“Evidence that the UK construction sector began to feel the impact of ongoing supply chain disruption was widespread midway through the third quarter of 2021. Growth rates for overall activity as well as the three monitored subsectors eased further from the recent highs earlier in the summer. Similarly, new business inflows have continued to increase at a marked pace, yet even here the rate of growth has eased to a five-month low.

“Supply chain disruption continued to disrupt activity across the UK construction sector, as demand for materials and logistics capacity outstripped supply. Average vendor performance continued to deteriorate at a near-survey record rate, as firms noted severe shortages of building materials, a lack of available transport capacity and long wait times for items from abroad due to port congestion.

“As a result, the rate of input cost inflation faced by construction companies accelerated to the second-fastest on record, while the increase in subcontractor rates hit a fresh series high, fuelled by supply shortfalls in the sector. Despite this, businesses noted a stronger degree of optimism regarding the year-ahead outlook, as more than half of survey respondents predicted a rise in activity. This was underpinned by expectations that new contracts would be brought to tender across the construction sector as markets continued to recover from the economic disruption caused by the pandemic.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, said:

“Formidable supply chain pressures restrained purchasing activity and building projects across the board in August as 68% of construction companies reported even longer delivery times for materials compared to July. A combination of ongoing covid restrictions, Brexit delays and shipping hold-ups were responsible as builders were unable to complete some of the pipelines of work knocking on their door.

“Material and staff costs went through the roof as job hiring accelerated to fill the gaps in capacity left behind by employee moves, overseas worker availability and brought on by skills shortages. Paying higher wages for experienced staff along with low stocks of materials at suppliers meant inflationary pressure rose at a rate almost on a par with June’s survey record. 84% of supply chain managers reported paying more for their purchases.

“These obstacles to construction’s progress are set to continue and are now affecting last year’s strongest performer – house building, which will exacerbate the problem of housing supply. However optimism improved on last month as more than half of building firms believe that output will continue to rise in the year ahead.

Response from the Federation of Master Builders

The FMB warns that builders’ recovery from the pandemic is being curtailed by a long-lasting crisis in the price and availability of vital building materials.

Brian Berry, FMB Chief Executive, said: “Builders throughout the UK, particularly smaller firms, are struggling to recover from the pandemic as a result of the continued materials crisis. For some time now, demand for building materials has been outstripping supply, with this month’s data representing the second-fastest rate for input cost inflation since recording began.

“The FMB’s latest membership survey revealed the prevalence of this crisis within the sector, with 98% of FMB members experiencing price increases for building materials. It’s vital that transparent allocation and pricing policies are implemented to help enable SMEs to have continued and stable access to materials. The Government should also re-evaluate its position with regard to issuing temporary visas for EU HGV drivers, to better enable the delivery of materials.”

Brian continued: “Notwithstanding the wider economic impact risked by consumers choosing not to undertake building projects as a result of delays, there is also a real risk that the current environment is exploitable by cowboy builders. Builders are working hard to stick to agreed timelines, but consumers must be cautious about promises to complete jobs quickly and cheaply. All too often these will be too good to be true, and could well leave households at the mercy of unscrupulous cowboy builders.”

Related news

UK Construction PMI for July 2021

UK Construction PMI for June 2021

UK Construction PMI for May 2021

UK Construction PMI for April 2021

UK Construction PMI for March 2021

UK Construction PMI for February 2021