UK construction companies experienced a solid return to growth in February after a setback at the start of 2021, according to the latest PMI data compiled by IHS Markit.

New orders also regained momentum as project starts increased in anticipation of improving UK economic conditions over the course of the year.

Extended supplier lead times persisted in February as vendors struggled with transport delays and stronger demand conditions. Stretched global supply chains, greater shipping charges and rising commodity prices all contributed to the sharpest increase in average cost burdens across the construction sector since August 2008.

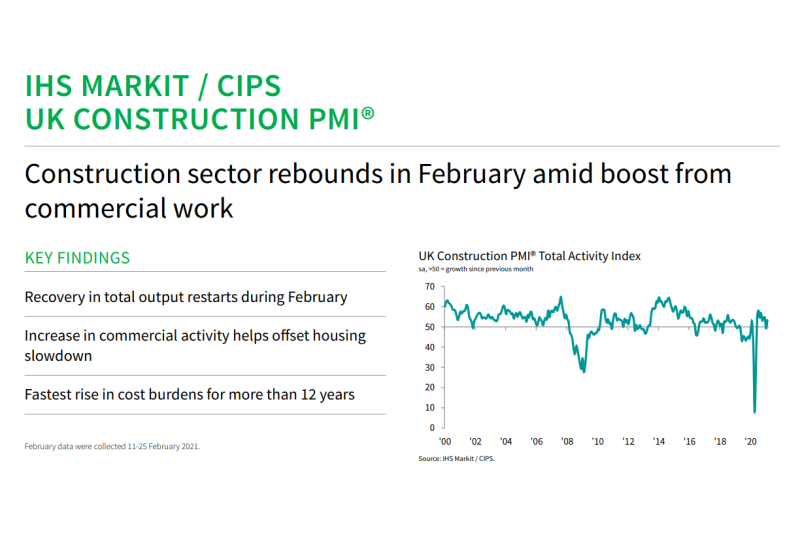

The headline seasonally adjusted IHS Markit/CIPS UK Construction Total Activity Index posted 53.3 in February, up from 49.2 in January, to signal a solid increase on overall construction output. The index has registered above the 50.0 no-change mark in eight of the past nine months.

Residential work remained the strongest area of growth in February, although the speed of recovery eased slightly since January. There were some reports citing temporary delays on site arising from adverse weather and supply chain issues (especially for timber).

The slowdown in house building was more than offset by the sharpest rise in commercial work since last September and a slower fall in civil engineering activity. Survey respondents commented on contract awards for commercial building that had been delayed earlier in the pandemic and some reported a boost from infrastructure work related to major transport projects.

New order volumes increased for the ninth consecutive month in February and the rate of expansion accelerated from the subdued pace seen at the start of the year. Construction companies cited improving demand across a range of sources, including residential development, new opportunities in the commercial segment and public sector infrastructure spending.

Greater workloads encouraged additional staff recruitment. Although only modest, the rate of job creation was the fastest since March 2019. Similarly, input buying picked up as construction firms prepared for new project starts. Improving order books and early signs that the vaccine rollout will release pent up demand also led to the strongest degree of construction sector optimism for over five years.

Meanwhile, purchasing prices increased at a rapid pace in February. Survey respondents cited an imbalance of demand and supply, alongside inflationary pressures from the pass through of higher transportation costs.

Tim Moore, Economics Director at IHS Markit, which compiles the survey, said:

“Construction work regained its position as the fastestgrowing major category of UK private sector output in February. The rebound was supported by the largest rise in commercial development activity since last September as the successful vaccine rollout spurred contract awards on projects that had been delayed at an earlier stage of the pandemic.

“House building is still the engine of recovery for the construction sector, although there was a loss of momentum since January as adverse weather and longer wait times for materials contributed to some temporary delays on site.

“Civil engineering activity has been somewhat subdued in recent months, but survey respondents continued to cite the positive outlook for infrastructure work on major transport projects as a factor helping to boost confidence in the construction sector.

“Stretched supply chains and sharply rising transport costs were the main areas of concern for construction companies in February. Reports of delivery delays remain more widespread than at any time in the 20 years prior to the pandemic, reflecting a mixture of strong global demand for raw materials and shortages of international shipping availability. Subsequently, an imbalance of demand and supply contributed to the fastest increase in purchasing costs across the construction sector since August 2008.”

Duncan Brock, Group Director at the Chartered Institute of Procurement & Supply, added:

“On the one hand, February saw a welcome rise in overall output in the construction sector as commercial projects in particular were woken from their slumber and purchasing levels rose across the board for the ninth month in a row.

“On the other hand, strong demand for products added pressure to already impaired supply chains as sellers battled with raw material shortages, and the costs of business rose at the fastest rate since August 2008. Though delivery times were still deteriorating as port disruptions made their mark, it was to a lesser degree compared to January suggesting the worst of the squeeze due to Brexit may have eased. Supply chain managers found themselves spinning a number of plates with creative ways to get stock including sourcing more local supply for some.

“These ongoing issues did nothing to dampen builder enthusiasm as optimism for the future rose to its highest since October 2015 and this return to confidence lead to job hiring at the fastest rate for almost two years. With part-time furlough options now in place, some constructors will be mixing and matching their approaches to meet the ebb and flow of projects and capacity in the coming months.”

Related News:#

UK Construction PMI for January 2021

UK Construction PMI for December 2020