Offering a broad perspective on the evolving nature of the market in the UK and Europe, the results from L.E.K. Consulting’s 2021 European Building and Construction Survey reveal the changing habits of tradespeople in terms of how they research and source the tools, products and materials they need. PBM reports.

Canvassing the opinions of 900 contractors across four key European markets — the UK, France, Spain and Germany — L.E.K. targeted firms of less than €100m turnover and covered all trades and market segments. Its findings point to a number of key issues that can help building product manufacturers, merchants and distributors to understand changes in their market, and to develop strategies to make the most of the new opportunities they present.

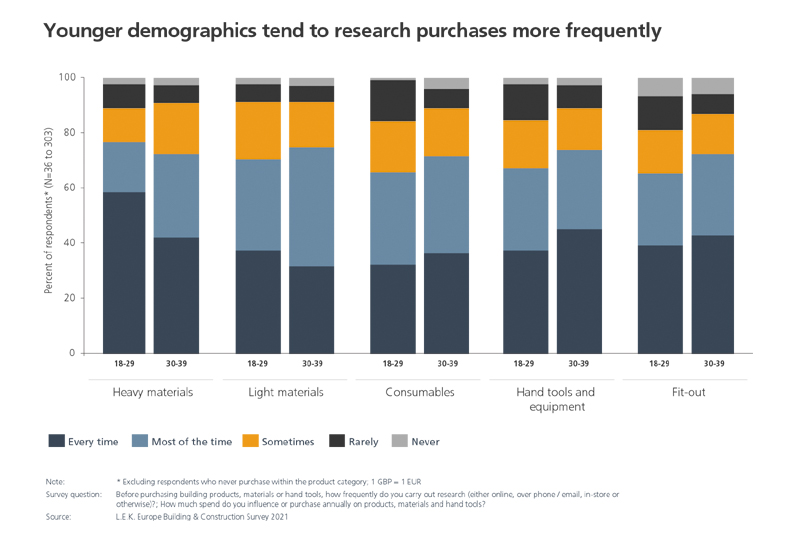

Several important key insights were uncovered within the survey results, for example with the data showing that building contractors undertake especially extensive research before making most of their purchases, particularly for heavy materials, hand tools and fit-out.

This research can be conducted online or in-store, however the most common research tasks conducted are comparing prices and gathering additional product information — and this is increasingly likely to be done online. Furthermore, the data shows that research frequency increases with spend influence, so those high-ticket supplies needed by a company’s big purchasers will require lots of information:

Survey question: Before purchasing building products, materials or hand tools, how frequently do you carry out research (either online, over phone/email, in-store or otherwise)?

As shown in Graph 1, the key stats for the average percentage of those with £1m+ spend influence aged 18-39 who responded either “every time” or “most of the time” are:

Heavy materials: 74%

Light materials: 72%

Consumables: 69%

Hand tools and equipment: 71%

Fit out: 69%

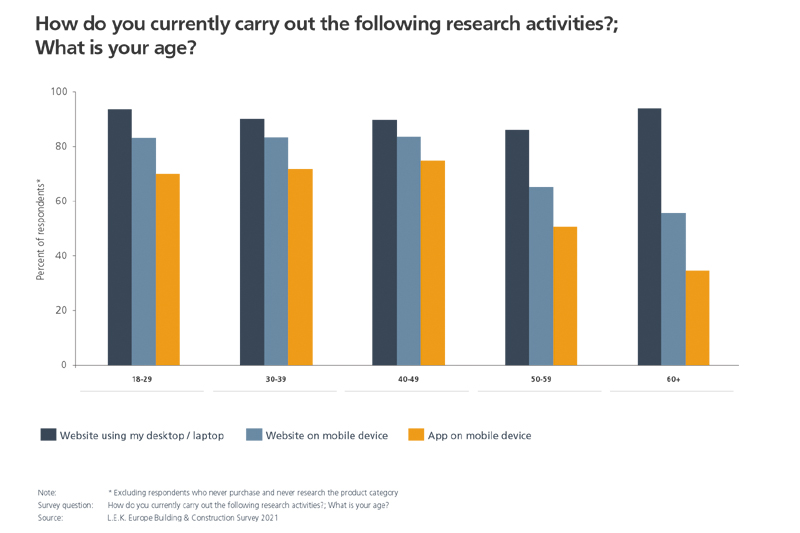

Currently, websites on desktop (or laptop) are the most commonly used research source across research activities. Perhaps as one might expect, younger demographics are more likely to use mobile websites and apps for research — indicating that the prevalence of these sources will increase over time:

Survey question: How do you currently carry out the following research activities? What is your age?

Graph 2 outlines those who responded that they carry out research activities via a website on their desktop or laptop are:

94% of 18-29 year olds

90% of 30-39 year olds

90% of 40-49 year olds

86% of 50-59 year olds

94% of 60+ year olds

When it comes to using mobile devices and apps for research purpose, the statistics vary further between age groups with a significant reduction among the over 50s. In the 18-29, 30-39 and 40-49 age groups, 84% in each bracket responded that they visited a website on a mobile device and between 70-75% used apps.

However, only 65% of 50-59 year olds said they visited a website on a mobile device with 51% using apps. Just 56% of respondents aged 60+ visited a website on a mobile device whilst the number who used apps had dropped significantly to 35%.

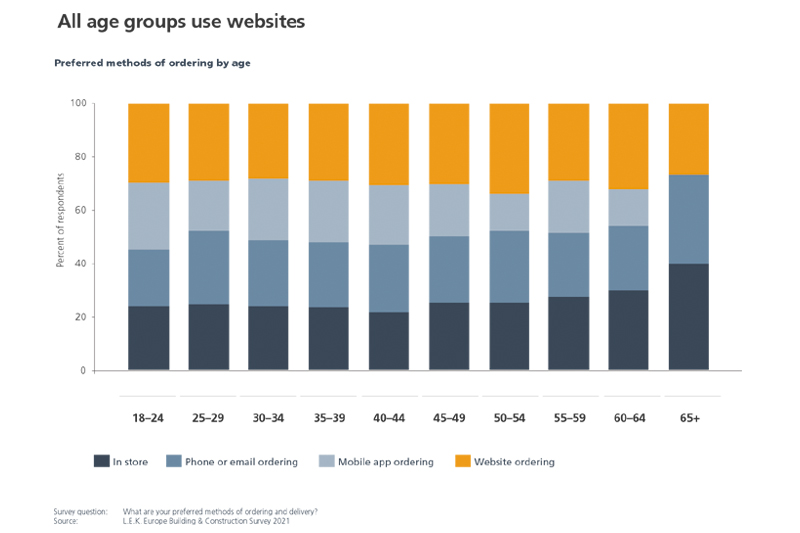

Perhaps mirroring the previous point, the survey data also shows that the number of people who favour in-store ordering decreases by (older) age group. The number of people who prefer mobile or app ordering stays much the same across age groups, except for the 50-54 and 60-64 year old sets.

This goes to show that behaviours like online and mobile shopping — that would have been accelerated by the response to Covid — are not unwinding, but “are here to stay”:

Survey question: What are your preferred methods of ordering and delivery?

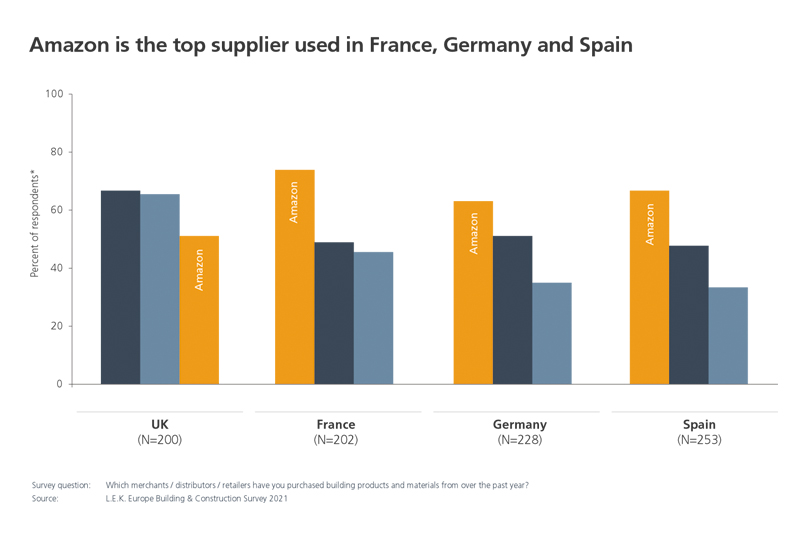

For smaller contractors looking for super-convenience, the findings from L.E.K. indicate that Amazon’s presence is rapidly accelerating in the building and construction markets across Europe. With respondents citing a digital platform that’s easy to search and access reviews and product information, Amazon was most frequently cited by French (73%), German (62%) and Spanish (65%) respondents. According to those surveyed by L.E.K., B&Q and Screwfix were the most common answers, however Amazon is in the top three as well (50%):

Survey question: Which merchants/distributors/retailers have you purchased building products and materials from over the past year?

Commenting, Tom Diplock, L.E.K. Senior Partner for Industrials, said: “Off the back of the destruction of Covid, we’ve seen a pretty rapid bounceback in demand. However, with the added context of fairly significant constraints and challenges around materials and labour shortages and rampant price inflation, it has made supplying that demand and managing margins incredibly difficult.

“Our outlook for 2022 is a continuation of a number of the key themes we’ve seen over the past 12-18 months — continued demand across the majority of sectors of the market, the ongoing resolution of supply chain challenges plus the continued acceleration of both digital adoption and the importance of sustainability for the sector. The recovery and ongoing growth of the sector will continue to be slightly uneven but overall we see a positive trajectory.”

For more detail on L.E.K. Consulting’s 2021 European Building and Construction Survey and further business insight, visit www.lek.com

And click the following link to see L.E.K. Consulting’s fascinating report from 2020: How Digital-Savvy Customers Are Transforming the Builder’s Merchant Landscape