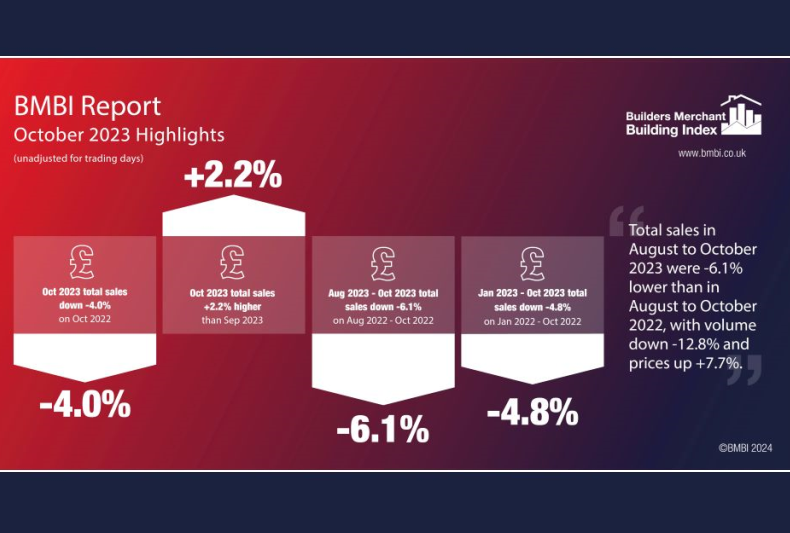

The latest Builders Merchant Building Index (BMBI) report – and the first to feature an expanded dataset to cover 92% of the market – shows builders’ merchants’ value sales were down -4.0% in October 2023 compared to the same month in 2022, with volume sales dropping -11.5% and prices rising +8.4%. With one more trading day in October 2023, like-for-like sales were -8.4% lower.

Eight of the twelve categories sold more in October 2023 compared to the previous year, with Miscellaneous (+16.5%) topping the list. Decorating (+10.8%), Workwear & Safetywear (+10.4%), Ironmongery (+7.0%) and Kitchens & Bathrooms (+4.7%) also did better than the merchants overall. Landscaping (-6.4%) and Timber & Joinery Products (-9.7%) were the weakest categories.

Month-on-month, total merchant sales were up +2.2% in October compared to September 2023. Volume sales were flat, and prices registered a moderate increase (+2.3%). With one additional trading day in October, like-for-like sales were -2.4% lower.

Ten of the twelve categories sold more with Workwear & Safetywear (+19.3%) considerably ahead of the rest. Plumbing, Heating & Electrical (+11.6%) also performed well month-on-month. Landscaping (-6.5%) was weakest.

Total merchant sales in the year to date were -4.8% down on the same period (January to October) the year before. Volume sales were -13.9% lower, and prices rose +10.6%. With two more trading days this period, like-for-like sales were -5.7% lower.

Nine of the twelve categories sold more with Renewables & Water Saving (+35.5%) growing the most, followed by Decorating (+9.7%), Workwear & Safetywear and Plumbing, Heating & Electrical (+6.0%). The three largest categories – Heavy Building Materials (-2.4%), Landscaping (-12.5%) and Timber & Joinery Products (-15.0%) – all sold less.

Now tracking 92% of builders’ merchant sales to builders and tradespeople

BMBI uses data from GfK’s Builders Merchants Panel which captures generalist builders’ merchants’ sales throughout Great Britain to builders and tradespeople who are directly involved in repairing, maintaining, and improving Britain’s 27.7 million homes. The recent addition to the panel of Huws Gray, JT Dove and CMO Stores means the October 2023 dataset tracks the sales of 92% of builders’ merchant branches – up from around 80% – making it the most accurate, comprehensive monitor of market performance available.

Mike Rigby, Managing Director of MRA Research which produces the BMBI report, said: “Once you track over 90% of builders’ merchants’ sales of building materials to builders and tradespeople the numbers are, practically speaking, the market itself, not an estimate or scaled up approximation of it. That’s a crucial distinction. It’s not like a survey or poll which takes a small slice of the market, which is intended to represent the market, and then scales up.

“However sound your sampling and rigorous your methodology, there’s a world of difference between scaling up from a small sample and reporting on 92% of actual sales to the market.”

BMF Chief Executive John Newcomb added: “The relaunch in the October BMBI report is a significant step forward in establishing reliable statistics across construction. The BMF’s Builders Merchant Building Index (BMBI) is the closest measure there is of Britain’s small builder and trades market, and the best proxy we have to the important residential RMI (Repair, Maintain, and Improve) market.

“BMBI is as accurate a measure of the market as it’s possible to get.”

October’s BMBI report is available to download at www.bmbi.co.uk along with expert comment and Round Table videos.

Set up and run by MRA Research, the BMBI – a brand of the Builders Merchants Federation – is a monthly index of builders’ merchant sales, and the most reliable, up-to-date measure of Repair, Maintenance, and Improvement (RMI) activity in the UK.

The index is based on actual sales from GfK’s Builders’ Merchant Point of Sale Tracking Data, which captures value sales out to builders from generalist builders’ merchants, accounting for 92% of total sales from builders’ merchants throughout Great Britain.

The businesses are defined as those selling a mix of heavyside and lightside products through more than three branches or with an annual turnover of more than £3m. The panel includes national, multi-regional and regional merchants such as Buildbase, Jewson, Travis Perkins, EH Smith, IBMG, Howarth, Alsford, Selco, Gibbs & Dandy, MKM, Bradfords, Covers and Sydenhams.

The recent addition of Huws Gray, JT Dove and CMO Stores means the October 2023 dataset data now tracks the sales of 92% of builders’ merchant branches – up from just over 80% – making it the most accurate, comprehensive monitor of market performance available.

Live data confirms total annual sales for the Multiple Generalist Builders Merchants Channel to be in excess of £6bn.

An in-depth review, which includes commentary by sector experts, is provided by BMBI each quarter.