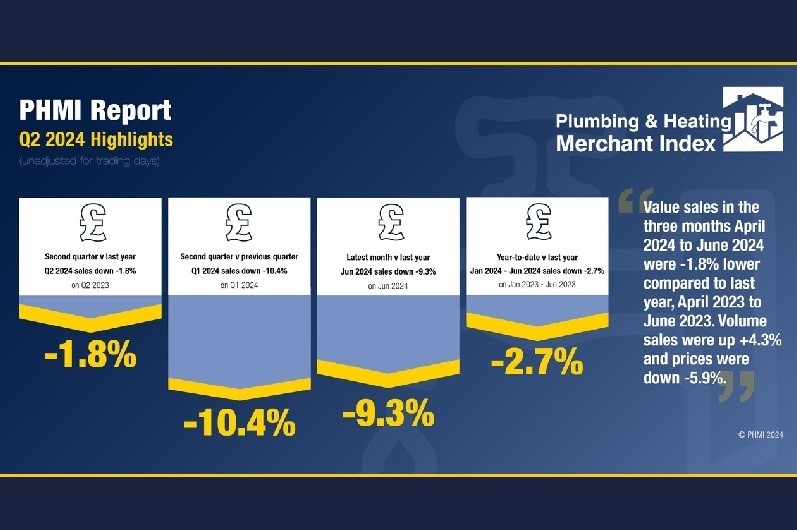

Figures released by the Builders Merchants Federation in the Plumbing & Heating Merchant Index (PHMI) for the second quarter of 2024 show the impact of price deflation on the sector.

Quarter 2 2024 v Quarter 2 2023

Total value sales in Q2 2024 were -1.8% lower compared with the same period last year. Volume sales were up by +4.3%, while prices fell by -5.9%. There were two more trading days Q2 2024, which means like-for-like value sales were down by -5.0%.

Quarter 2 2024 v Quarter 1 2024

Total value sales in Q1 2024 were -10.4% lower compared with the first three months of the year. Once again, this was driven by falling prices. Volume sales increased by +1.4%, but prices were down by -11.7%. With one less trading day in the most recent period, like-for-like value sales were -9.0% lower.

Half 1 2024 v Half 1 2023 (January – June 2024 v January – June 2023)

Total value sales in the first half of 2024 were -2.7% lower than the first six months of 2023. Volume sales were down by -1.2%, with prices down by -1.5%. Once again there was a trading day difference, with one more in 2024, meaning like-for-like sales were -3.5% lower.

Latest 12 months v previous period (July 2023 – June 2024 v July 2022 – June 2023)

Total value sales over the last 12 months were slightly lower at -0.5% than the preceding 12 month period. Volume sales were down by -.2.4%, with prices increasing by +2.0%. There were two more trading days in the latest period, making like-for-like sales -1.3% lower.

The data for the PHMI is taken solely from P&H specialists, including City Plumbing Supplies, James Hargreaves Plumbing Depot, Plumbfix, PTS, Williams & Co, and Wolseley, who form part of GfK’s Plumbing & Heating Merchants Panel, and there is no overlap or double counting between the PHMI and the BMF’s established Builders Merchants Building Index which analyses sales at generalist merchants.